There is a general question "When to Invoice a Customer? An invoice should be sent immediately after a customer's order has been met successfully.

- Product-based organization: The invoice is sent when the client receives all the goods.

- Service-based organization: An invoice is sent immediately after the full service has been rendered.

Here, we have highlighted some of the best strategies that you can apply for sending an invoice to the clients. Moreover, this guide will help you to understand:

What You'll Learn

- 01What an invoice is and what information it should contain

- 02Three main strategies for timing your invoices (before, after, or interim)

- 03Best practices for sending invoices immediately, within 48 hours, or monthly

- 04Different methods for delivering invoices to your customers

- 05How to follow up on overdue invoices effectively

What Is an Invoice?

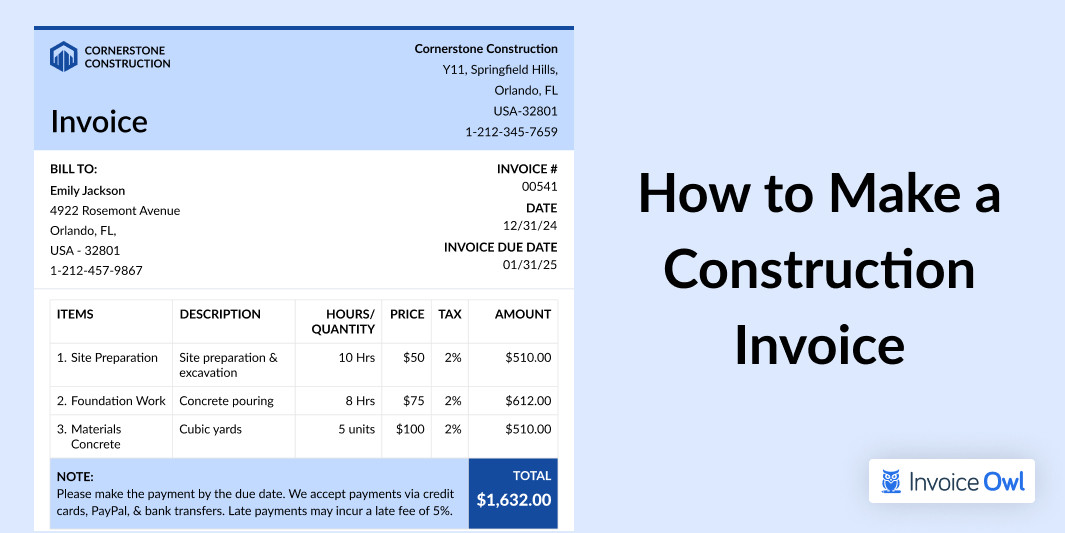

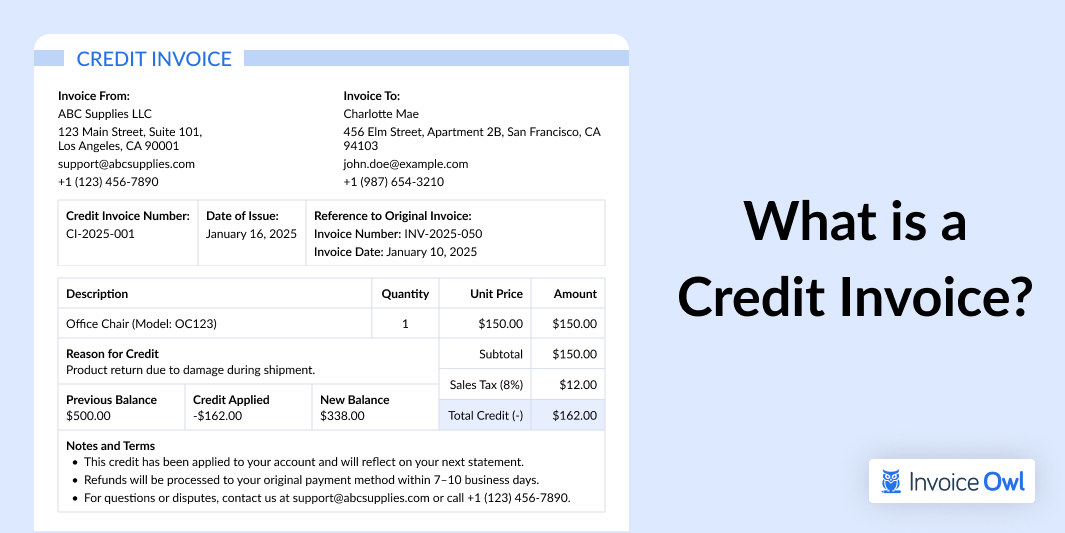

An invoice is a document prepared by the merchant to receive payment for the service and goods supplied. It can also be called a list of a product or service the merchant provides to the client and the prices for every quantity. The commencement of payment begins when a client first receives the invoice. An invoice contains the following information:

When to Send an Invoice?

The most essential factor that you, as a business owner, need to take care of is when to send invoices to your clients. Generally, there are three main strategies that you can apply for sending an invoice to your customers.

- Before the job completion

- After the job completion

- Interim invoices

Let's see how such strategies help you in getting paid faster from your client.

Before the Job Completion

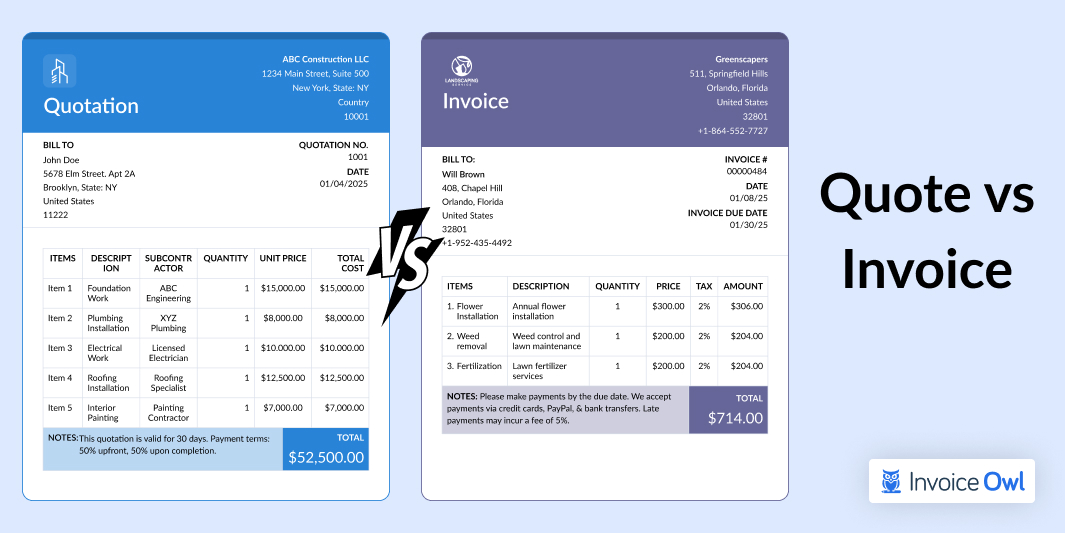

One of the best strategies that you can apply for sending invoices to the clients is billing them before you have actually started the work. In simple words, it is just like requesting a deposit or prepayment from your client. Before a service is completed, you have an option to send invoices to your client in terms of the following metrics.

Pre-Work Invoice Types

| Invoice Type | Description | Best Used For |

|---|---|---|

| Advance payments | Take payment (most preferable, half payment) in advance from your client | Purchasing equipment or material |

| Large-scale projects | Request payment after installation or after a certain period | Long-term projects with multiple phases |

| Deposits | Ask for a deposit from clients by assuring them of the work to be done | New clients or custom work |

Requesting a deposit upfront helps protect your business from non-payment and demonstrates the client's commitment to the project.

After Job Completion

One of the most common methods that many businesses follow is sending invoices after the job is completed. Nowadays, customers usually prefer to pay after the job is completed. On the job completion, there are three standard methods that you can apply to send an invoice to your customers.

Invoice immediately

If you have just started your new business or you are dealing with small-scale jobs, the best option is to send an invoice to your client as soon as possible. But how is that possible? It is made possible if you follow the below-mentioned strategies:

- You must discuss the payment terms of use with the customers to make them know exactly what they are paying for.

- You need to include the charges of late payments from your clients.

- Keep your professional invoices ready and available to you. The best option is to adopt online invoicing software solutions that make it easy for you to create and send invoices quickly.

- Credit card payment is the most efficient way that allows your clients to pay faster, making it easy for you to improve the business cash flow.

Sending invoices within 48 hours

This option is well-suited for large-scale jobs and will help to build a strong client relationship. The best way to send an invoice to the client is by sending a follow-up email or making a direct phone call to your client. It will help you know whether your customer is happy with your service or not. Some of the best practices that you can apply to send an invoice after the job is completed are:

- Send a regular follow-up email to your client to notify them that job is done from your end and verify whether they are satisfied or not.

- Once you receive the confirmation that your customers are happy, send a professional invoice to your client by text or email along with a payment due date.

- You must provide an online payment option to your customer so that they can directly pay by text or email.

Waiting 24-48 hours before sending an invoice gives you time to ensure client satisfaction and address any concerns before requesting payment.

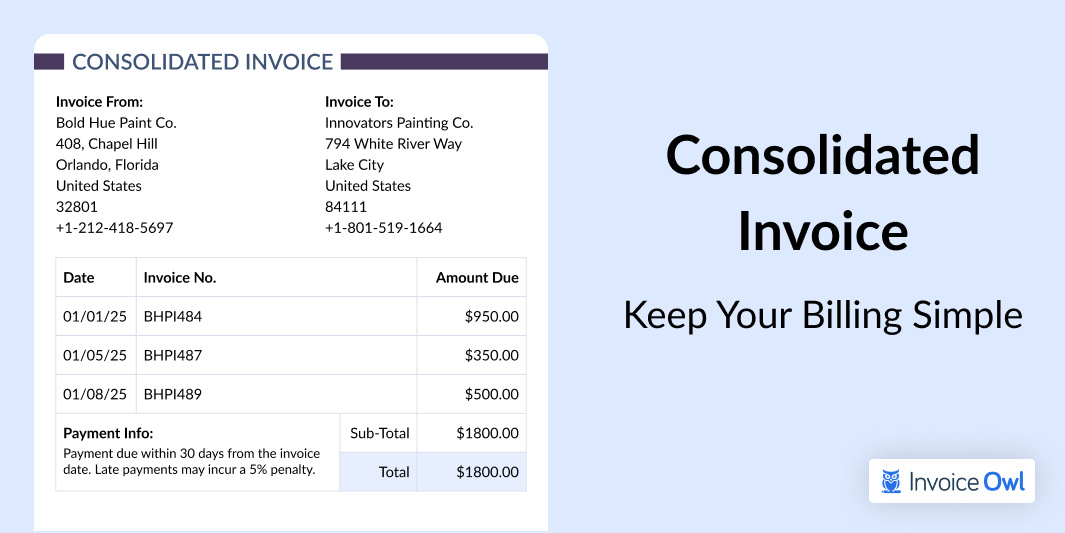

Sending monthly customer invoice

Monthly customer invoices are designed explicitly for commercial contracts or recurring services. In fact, it's an ideal choice for businesses that don't want to process multiple payments every month. There are two standard methods that can help you to send an invoice to your clients using a monthly invoice.

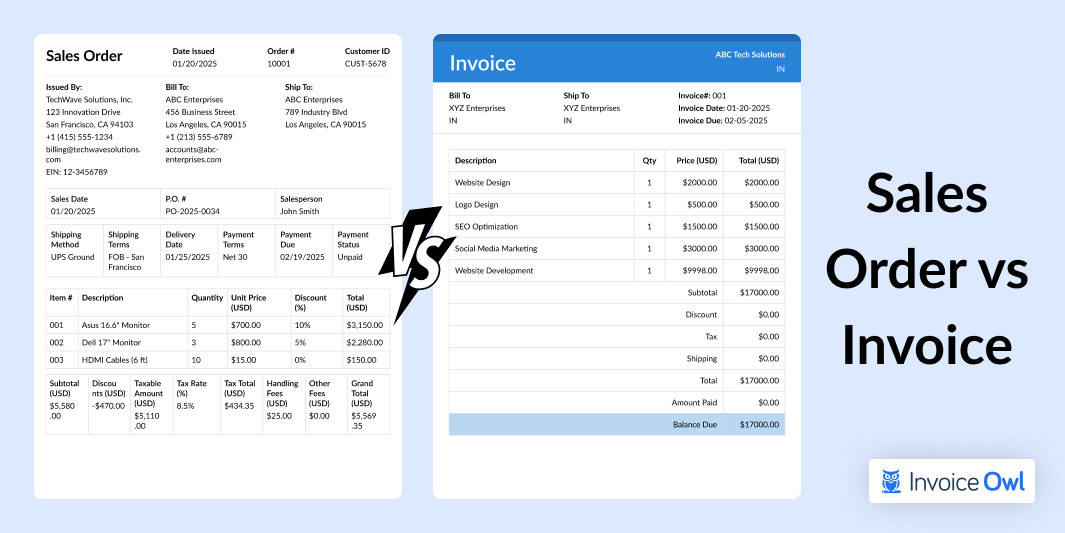

- Uses of sales invoice: You can easily mention all the essential transaction details like due date, amount of products, seller, buyer, and also total price in the invoice. It will make it easier for you to collect money from your client.

- Contract termination: Contract termination is a drastic step and should be avoided, if possible. Termination might occur when the terms of the contract or the law allow for termination and it would also be the best way to mitigate damages. Remember, the contract should be terminated with caution and with good legal advice.

Monthly invoices help you deal with monthly recurring services, commercial contracts, get more loyal customers, and most importantly, minimize paperwork and admin work.

Interim Invoices

An interim invoice is usually assigned to the client, just before starting your project or service. With interim invoices, you can easily get paid on time once the job is completed from your end. However, there are two main options that you can opt for:

- Monthly Payments: You can send an invoice to your client on a monthly basis depending on your requirements. Let's say, if you find that you are going to complete your entire job in six months, the best option will be to charge one-sixth of the total estimate of every invoice.

- Partial Payments: Depending on your project requirements, you can send an invoice to your client to pay you partially. It means that your client has an option to pay half of the amount or some percentage of the total amount before you start your project.

How to Send an Invoice?

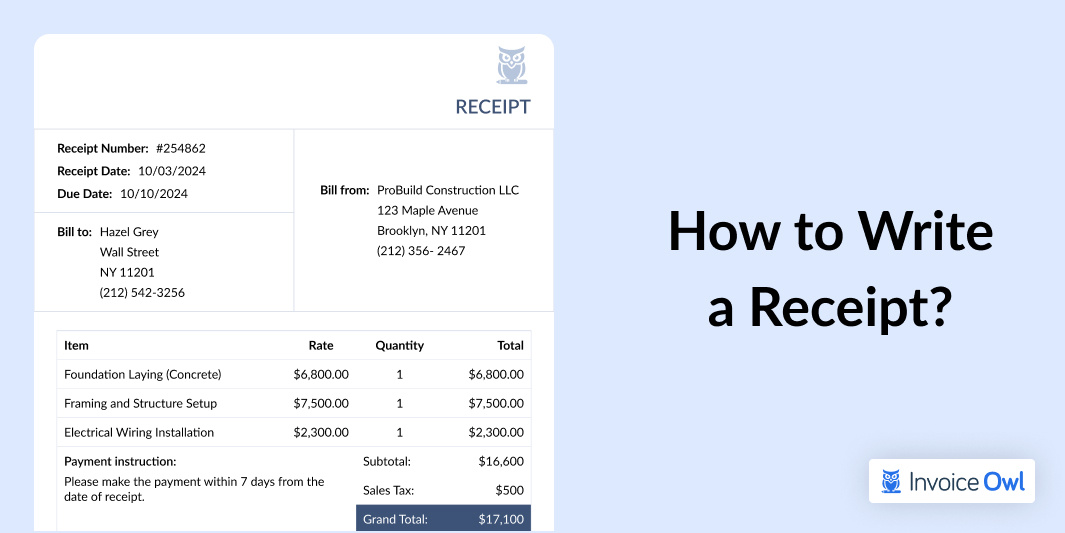

An invoice can be delivered to the customer in different ways:

Invoice Delivery Methods

| Method | Speed | Pros | Cons |

|---|---|---|---|

| By Mail | Slow | Traditional, physical record | Unreliable, may not reach customer, slow delivery |

| By Email | Fast | Quick delivery, secure, trusted, trackable | Requires valid email address |

| By Accounting Software | Instant | One-click sending, automatic follow-up, overdue notifications | Requires software subscription |

Using accounting software with an internal email system is the most efficient method for sending and tracking invoices. It allows you to send invoices with just a click and automatically notifies you when invoices are overdue.

Ready to Streamline Your Invoicing?

Create professional invoices in seconds and get paid faster with InvoiceOwl's easy-to-use invoicing software.

Try Free for 3 DaysWhen to Follow Up for Invoices?

Sending a late payment reminder schedule to your client either:

Free Invoice Templates for Small Business

An invoicing template is a layout that simply includes the necessary fields to make it easier to fill in details, such as your company name, company address, customer details, contact details, information about the product or service you're selling, prices, and extra charges. If you're unable to create your own invoice template, you can always download and personalize invoice templates in Microsoft Word, Excel, and even PDF format. This process is easy with InvoiceOwl invoicing software, which provides you with several templates and also a sample consultant invoice.

Related Resources

Frequently Asked Questions

For product-based businesses, send the invoice when the client receives all the goods. For service-based businesses, send it immediately after the full service has been rendered. The key is to invoice as soon as the value has been delivered to the customer.

This depends on your business type and project scope. For small jobs, invoicing immediately after completion works best. For large-scale projects, consider requesting deposits upfront or using interim invoices. For recurring services, monthly invoicing is most efficient.

An invoice must include your company name, the client's company name, an invoice number, purchase order number (if applicable), itemized list of products or services, prices, payment terms, payment methods, and due date.

Send a friendly reminder 7 days before the due date. If the invoice becomes overdue, follow up immediately. Continue following up regularly (every 7-30 days) until payment is received, up to 120 days after the due date.

An interim invoice is sent during a long-term project to request partial payment before the work is fully completed. It helps maintain cash flow on large projects and can be sent monthly or at specific project milestones.

Email is the recommended method for sending invoices. It's faster, more reliable, trackable, and secure. Using accounting software with built-in email functionality is even better, as it allows for automatic follow-ups and overdue notifications.