A sales invoice is the foundation of financial clarity in business, as trying to track payments or manage sales without one is like navigating without a map—complete chaos!

But why is it needed?

Sales invoices help solopreneurs to stay organized by keeping their cash flow in check, ensuring what is owed and when payments are due. Additionally, for small businesses, this invoice plays an important role in meeting legal requirements, serving as official records of transactions that can be referred to in case of disputes or audits.

Want to know how it works?

Read our detailed guide on sales invoices that consists of various information like what a sales invoice is, its key components, importance, types, and template.

What You'll Learn

- 01What a sales invoice is and why it's essential for small business accounting

- 02Key components that make up a professional sales invoice

- 03Step-by-step process for creating, issuing, and managing sales invoices

- 04Different types of sales invoices and when to use them

- 05Best practices for managing invoices to improve cash flow and client relationships

What is a Sales Invoice?

A sales invoice is an accounting document issued by a seller to a buyer comprising details relating to goods or services provided, their quantities, transaction date, payment terms, and the amount owed.

This legal accounting document helps businesses ensure that payment has been received and shows a clear transaction between a business and its customer. Sales invoices also facilitate accurate financial reporting, auditing, and accounting processes.

Furthermore, this helps businesses ensure adherence to Generally Accepted Accounting Principles (GAAP) standards.

Organizations choose different ways to create and deliver sales invoices:

- Printed documents delivered by mail or in person

- Digital documents like PDFs or other files sent via email

- Automated digital documents sent from accounting software

Purpose

The main purpose of a sales invoice is to clearly document the details of every transaction. It serves as both a legal proof of sale and a financial record for business owners. Specifically, if you are running your business or a freelancer in the United States, sales invoices are an important aspect to understand. As it helps to stay compliant with tax laws and meet the standards of Generally Accepted Accounting Principles (GAAP). Once understood, you get an end number of benefits from it. Starting from simplifying tax reporting to various other financial details, which is especially important for meeting state and federal tax requirements in the US.

Difference between a sales invoice and a sales receipt

While both documents are crucial for businesses, they serve different purposes in the sales process.

Scroll down for a quick snapshot!

| Aspect | Sales Invoice | Sales Receipt |

|---|---|---|

| Purpose | Notifies the buyer of payment owed and terms, commonly used for tracking revenue. | Confirms payment has been received and finalizes the transaction. |

| Timing | Issued before payment is made, typically for B2B or service-based transactions. | Issued immediately after payment is received, ideal for retail and e-commerce. |

| Key Details | Includes itemized products/services list, payment terms, due date, sales tax, and total amount owed. | Includes itemized list of products/services, date of purchase, payment method, and total amount paid. |

| Legal Use | Acts as a legal record of what is owed and helps enforce payment terms if needed. | Acts as proof of payment and is used for record-keeping and tax reporting. |

| Example | A freelance graphic designer invoices a client $300 for a project due in 15 days. | A New York cafe provides a receipt for a $10 cash purchase. |

| Significance in the U.S. | Crucial for service providers, contractors, and businesses tracking receivables. | Essential for retailers and small businesses to confirm transactions and returns. |

Now that we understand sales invoices, it's important to know their importance in businesses.

Why are Sales Invoices Important for Small Business Accounting?

Sales invoices are crucial for accurate bookkeeping and business planning with respect to legal and financial compliance.

Here, we are going to discuss the top 5 significances in detail:

Maintains accurate financial bookkeeping for detailed records

Sales invoices are an important document, specifically for small businesses as they help create sales records. This invoice is considered to be the foundation of any business's bookkeeping system. With sales invoices, you can track sales and customer payments, and create accurate financial reports.

Facilitates tax returns to meet regulatory requirements

Sales invoices are considered to be one of the most important documents for confirming claims on tax returns. As per the Internal Revenue Service (IRS), small businesses must keep supporting documents like invoices for situations like tax audits.

Supports effective inventory management

Retailers, wholesalers, and e-commerce businesses in the US selling physical products use sales invoices for effective inventory management. Thus, it helps you know the amount of stock you have on hand to complete the orders. With such information, you can create marketing strategies for holiday sales and seasonal promotions.

Offers insights on business plans for informed decisions

Sales invoices provide all the essential data, such as sales trends, inventory levels, pricing, and discounts, which are crucial for future business planning. They provide insights into revenue and earnings fluctuations over a specific period, making them valuable for budget forecasting.

Helps with legal considerations and tax compliance

Sales invoices act as legal proof of a specific transaction between the buyer and seller. They document everything, like what was sold, to whom, and on what terms. With sales invoices, businesses can resolve disputes, and comply with tax laws and regulations by providing an official record of sales and income.

Automate your invoicing process with software like InvoiceOwl to reduce errors, save time, and get paid faster. Track when invoices are viewed and receive automatic payment reminders.

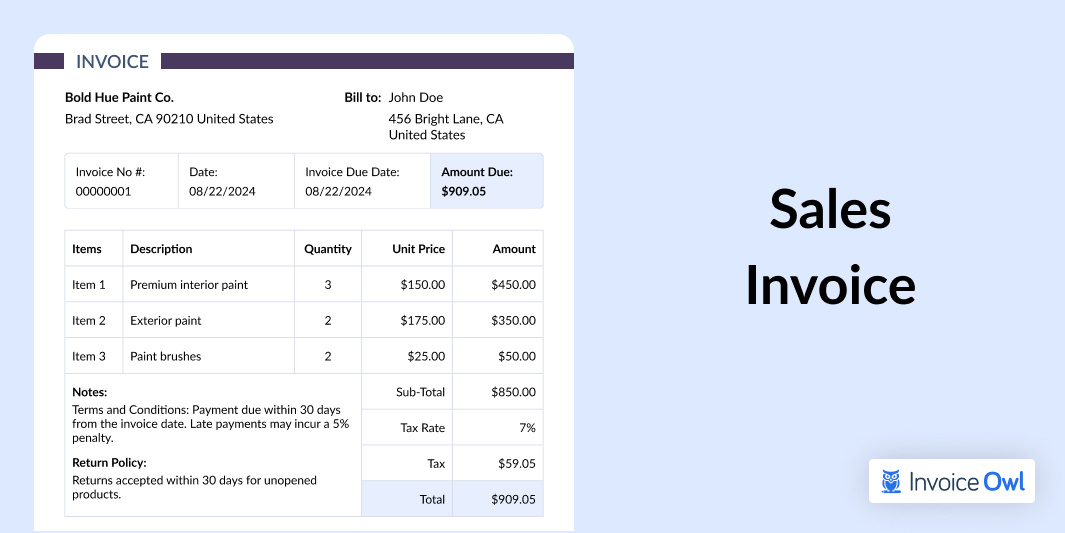

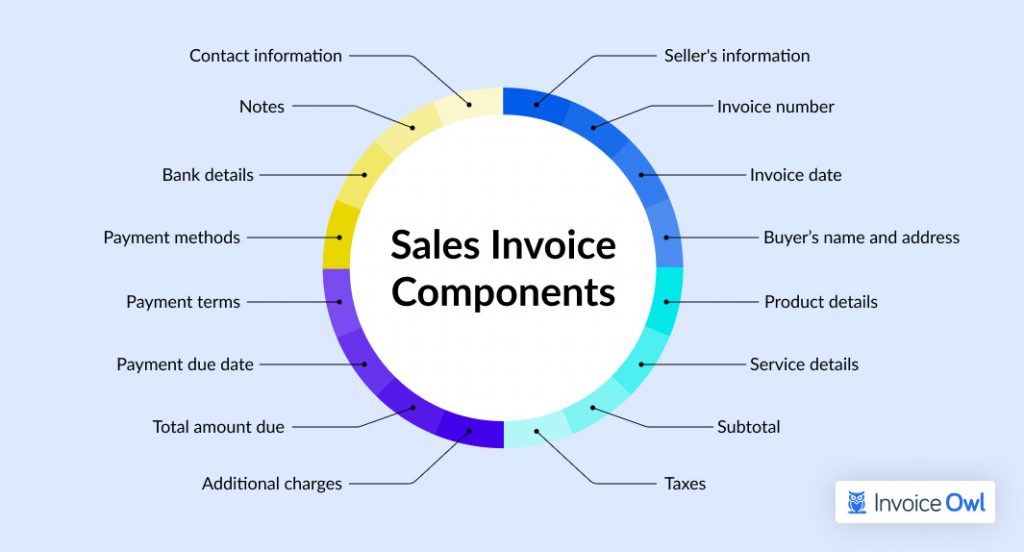

Key Components of a Sales Invoice Explained

These below-referred components are essential to understand for any business owners, and also reviewing a sales invoice example can make it easier to see how they all work together.

For now, here's a quick look at the main elements.

Detailed analysis of sales invoice components

Here are the essential components of a sales invoice:

Now that we know the essential components of a sales invoice, it's important to navigate the process of issuing and managing them.

How to Create a Sales Invoice?

In the United States, a sales invoice is more than just a piece of paper—it's your official handshake with your esteemed customers.

Here's a breakdown of how to make sales invoice if you are still wondering where to start:

Manual methods

If you prefer traditional methods, tools like Word or Excel are common options:

Using Microsoft Word:

- Step 1: Open a new document and use a pre-made invoice template or design one manually.

- Step 2: Include essential details like your business name, contact information, client details, and an itemized list of products or services.

- Step 3: Add payment terms, total amount due, and due date.

- Step 4: Save and send the invoice as a PDF for professional presentation.

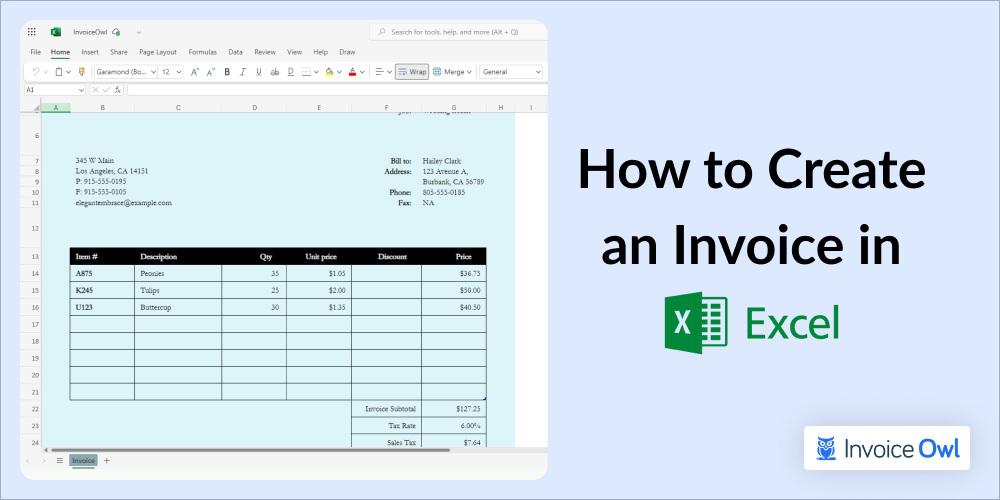

Using Microsoft Excel:

- Step 1: Choose a blank sheet or use built-in invoice templates.

- Step 2: Utilize Excel's table functionality for an organized breakdown of items, quantities, and prices.

- Step 3: Insert formulas to calculate totals, taxes, or discounts automatically.

- Step 4: Save and share as a PDF.

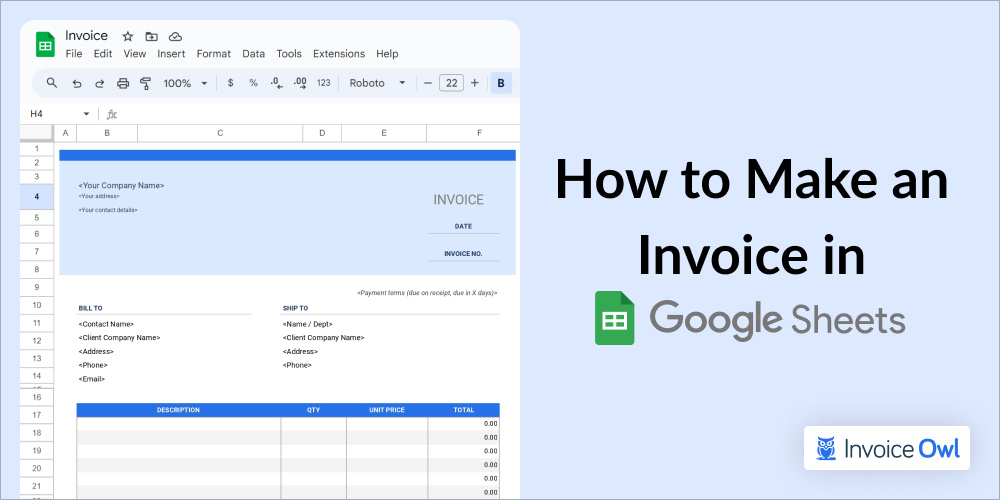

Using online tools

Get an online invoicing tool like InvoiceOwl to automate your complete invoicing process in just 5 steps:

- Step 1: Sign up for an InvoiceOwl account (free or paid plans available).

- Step 2: Use pre-designed templates to quickly fill in your business and client details.

- Step 3: Automatically calculate totals, taxes, and discounts, reducing errors.

- Step 4: Send the invoice directly to your client via email or a shareable link.

- Step 5: Track payment statuses and get notified when invoices are paid or overdue.

Free templates

If you are a small business owner—whether you run a retail shop, provide professional services, operate a freelance business, or manage an e-commerce store—and are looking forward to creating sales invoices instantly, we offer free sales invoice templates.

This template is ready to send to your clients after you edit the product or service details, add contact information, and customize it with your brand name and logo.

Download our professional sales invoice template and customize it with your business details. The template is ready to use and includes all essential components for professional invoicing.

Step-by-Step Process for Issuing and Managing Sales Invoices

Here is a detailed explanation of the process of issuing and managing sales invoices in 6 important steps:

Step - 1: Create an invoice

The process of issuing and managing sales invoices begins with the creation of the invoice. The seller generates the sales invoice using accounting software, an invoicing system, or manually.

Step - 2: Send the invoice

Once the invoice is created and reviewed, send it to the buyer. An invoice can be sent through an email or an online invoicing system. To ensure timely payment, invoices should reach the buyers promptly. Some small businesses have also started using invoicing software that enables them to track when an invoice is viewed.

Step - 3: Record the invoice

After sending the invoices, a seller documents them in the accounting system for bookkeeping purposes. Recording invoices is an important step for maintaining the accuracy of financial records. It comes in handy while monitoring outstanding invoices and managing cash flow effectively.

Step - 4: Follow-up payment

When payment is not received by the due date, a seller might have to follow up with the buyer through emails or phone calls. Invoicing software is a great option for businesses looking to automate reminders to streamline their business processes and minimize administrative burdens.

Step - 5: Receive payment

When the payment has been made, the seller records the payment in their accounting system. Issuing a receipt to the buyers acts as proof of payment, which helps in maintaining transparency and trust in the business relationship.

Step - 6: Reconcile the accounts

Last but not least, the seller will reconcile the accounts to ensure all invoices have been paid and recorded correctly. This step is essential for ensuring the accuracy of financial records and for identifying any unpaid invoices that may need further follow-up.

Types of Sales Invoices and Their Uses

There are several types of sales invoices available. A seller needs to pick the one that meets their business requirements. Here are the following:

Standard invoice

This is the most commonly used professional invoice issued by a seller or business and sent to the client. Generally, small businesses in construction and contracting use standard invoices, but they are also capable enough to fit most industries and billing cycles.

Pro-forma invoice

A pro-forma invoice, also known as an estimate, is sent by the seller to the customer before providing goods or services. This invoice showcases the expected amount a customer will have to pay after the goods or services are rendered. Sometimes, this invoice might need to be adjusted after the project's completion to accurately reflect the invoice for hours worked.

Credit invoice

A credit invoice is sent when a business offers a refund or any sort of discount. This invoice showcases a negative total representing a lessening of the amount owed by the customer. It is often used to correct billing errors or provide compensation for returned goods or services.

Debit invoice

A debit invoice is issued by a business to increase the amount a customer owes to the business. Debit invoices are of great help to small businesses and freelancers for making small adjustments to existing bills. These small adjustments comprise adding charges for additional services or correcting previous undercharges.

Credit Invoice vs Debit Invoice

| Aspect | Credit Invoice | Debit Invoice |

|---|---|---|

| Definition | A document issued to decrease the amount a customer owes | A document issued to increase the amount a customer owes |

| Purpose | Used for refunds, discounts, returns, or billing error corrections | Used for additional charges, late fees, or correcting undercharges |

| Amount Display | Shows a negative total representing a reduction | Shows a positive total representing an increase |

| Common Use Cases | Customer returns a $50 item or receives a discount | Client requests extra feature for $200 or late payment fee added |

| Impact on Accounts | Decreases accounts receivable | Increases accounts receivable |

Recurring invoice

Recurring invoices are meant for regular customers with memberships or subscriptions who purchase goods or services at set intervals. Generally, software providers use recurring invoice systems to manage these transactions, while long-term customers can use invoice software to automate payments. As businesses increasingly adopt this approach, the invoice processing software market is estimated to reach US$25.3 billion by 2033, reflecting the rising demand for automated systems.

Interim invoice

An interim invoice (also called progress invoice) is used for large billing projects where both business and customer have agreed to terms with multiple payments. An organization or a freelancer submits interim invoices after reaching a certain milestone of a larger project. With interim invoices, small businesses can manage their cash flows effortlessly while working on larger projects over a long time.

Commercial invoice

A commercial invoice is used for international trade documentation. When compared to other documents, commercial invoices are more complex as they consist of custom valuations for products crossing international borders. These sales documents comprise several important information like country of origin, product weight, and freight cost.

What is the Difference Between Sales Invoice and Sales Order?

Here are the key differences between sales invoice and sales order:

| Aspect | Sales Invoice | Sales Order |

|---|---|---|

| Definition | A document issued by the seller to request payment from the buyer for goods or services delivered | A document created by the buyer to confirm their intention to purchase goods or services |

| Purpose | To request payment and provide a detailed account of the sale | To confirm the purchase details and initiate the sales process |

| Issued by | Issued by the seller after goods or services have been delivered | Issued by the buyer before goods or services are delivered |

| Timing | Created after the sale or delivery of goods/services | Created before the sale or delivery of goods/services |

| Content | Includes details like items sold, quantities, prices, total amount due, payment terms, and due date | Includes details like items ordered, quantities, prices, delivery date, and terms of sale |

| Role in accounting | Acts as a financial document that records revenue and accounts receivable | Acts as a contractual document that records the buyer's commitment to purchase |

| Legal standing | Serves as proof of transaction and is often used for accounting and tax purposes | Serves as a confirmation of the buyer's intent but does not typically include payment terms |

| Impact on cash flow | Directly affects cash flow by generating an outstanding payment that needs to be collected | Does not directly impact cash flow but impacts inventory and order fulfillment processes |

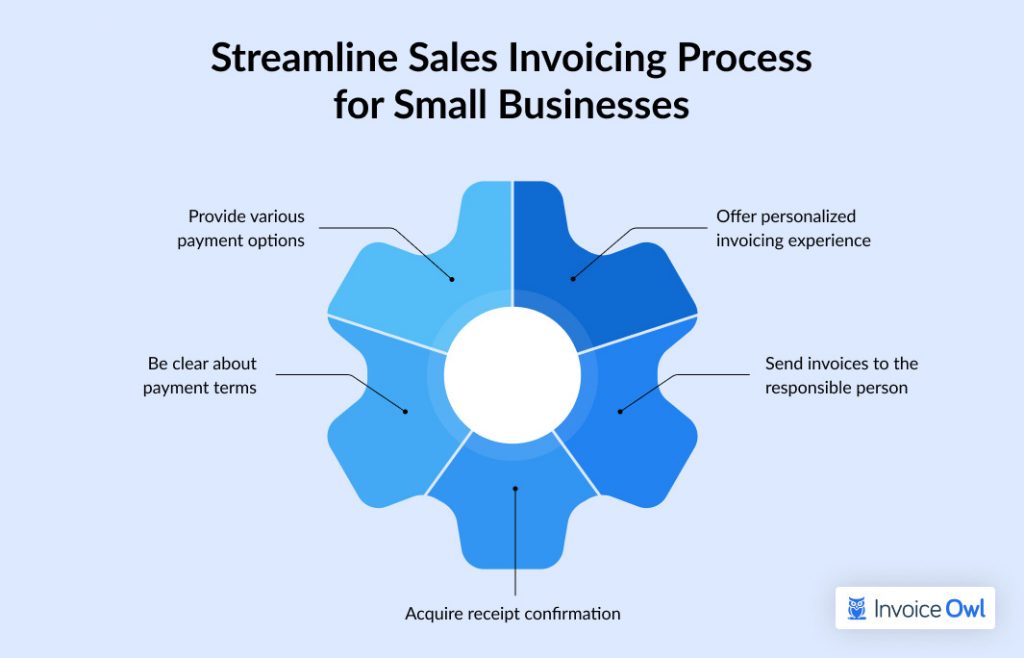

Best Practices for Managing Sales Invoice

For small businesses in the United States—whether you're designing logos as a freelancer, managing landscaping projects, or running your own boutique shop—keeping your sales invoices is must. It's all about making sure your cash flow stays steady.

Ready to level up your invoicing game? Here are some tips to help business owners like you handle invoices like an expert:

1. Offer personalized invoicing experience

Small business owners, such as home contractors and SaaS providers are always looking for ways to offer the best possible services to their customers. One of the best ways to do so is by adding a personal touch to the invoice. All you have to do is add a message while issuing the invoice through email or by your invoicing software's interface.

Tips for personalizing invoices

- When sending the invoice, ensure to address your recipient by name and use a similar tone that you use with your customer.

- Add the branding elements and a personalized message if you can. This helps with making your customers feel valued.

2. Send invoices to the responsible person

Ensure to spot the person responsible for processing invoices in the early stages of customer relationships. Start by sending the invoice for sales to the person who is responsible for processing the invoice. It might not always be possible to do so but is a great way to minimize the chances of losing invoices and getting paid faster.

3. Acquire receipt confirmation

Once the invoice is sent, make sure to check if it is received by the customer or not. This will help you solve potential issues early rather than solving the issue after the payment deadline.

Using invoicing tracking software will notify you when a customer has received and opened an estimate or an invoice. With this, you will not have to worry about sending long follow-up emails.

4. Be clear about payment terms

At some point, there comes a moment when you have to follow up with your customer for payments. Most invoicing errors occur because of a lack of clarity in payment terms.

Examples of common invoice errors

- Missing due date or payment information

- Not including late fees

- Incomplete payment methods

Missing payment terms is one of the most common invoicing mistakes. Always include a clear due date, accepted payment methods, and late payment penalties to avoid confusion and delays.

5. Have effective strategies for prompt payments

The best strategy to get your customers to pay faster is to offer different payment methods. It will offer customers the ability to pick the one that fits their processes.

You will have to create a customized infrastructure for accepting every payment method you offer.

Payment methods to consider:

- Debit and credit cards

- Bank transfers

- Online payments (platforms like PayPal, Google Pay, and Stripe)

Ready to Streamline Your Sales Invoicing?

Join 100,000+ contractors and small businesses using InvoiceOwl to create professional invoices and get paid faster.

Start Free TrialEnhancing Customer Relationships through Invoicing

Sales invoices are the most important accounting documents to request payments for goods or services provided. A well-documented invoice is capable of boosting cash flow and strengthening customer relationships. In federal accounting, it acts as a legal accounting document with information relating to the business transaction and terms under which sales occur.

There is a lot of work to be done before sending in the invoice. Well, it can be performed easily with invoicing software like InvoiceOwl. The sales invoice templates comprise the transaction, track the receivables, and ensure accurate record-keeping.

Maintaining accurate sales invoices helps businesses streamline their operations, improve cash flow, and contribute to overall business success.

Frequently Asked Questions

When a sales invoice is issued, it is recorded as a debit in accounts receivable and a credit in sales revenue. When the customer pays a sales invoice, it is recorded as a debit of cash and a credit of accounts receivable.

If a client refuses to pay, start by politely following up to address any concerns or misunderstandings. If the issue persists, send a formal payment reminder, and if needed, offer a payment plan to maintain the relationship. Unfortunately, if it is still unresolved, consider legal action or involve a collection agency. To prevent future issues, ensure your invoices are clear, detailed, and outline late payment terms and conditions.

Sales invoicing is important for many industries, including freelancers like writers and graphic designers, contractors in construction, and e-commerce retailers who are constantly managing transactions. In addition, it is significant for subscription-based businesses like gyms or SaaS providers. Even professional services such as lawyers and consultants in the U.S. use sales invoices to ensure timely payments.

A seller or supplier is required to prepare a sale invoice. Any business owner, solo entrepreneur, or administrative assistant is accountable for billing and invoicing. After the goods or services are delivered, it is time to issue an invoice to the buyer.

Yes, sales invoices act as a formal request for payment and can be used as evidence in legal disputes over payment terms and amounts.

While working on international sales invoices, you should add all important information, such as currency, taxes, and shipping terms. In addition, ensure compliance with both local and international trade regulations to ensure accuracy and legality.

Yes, sales invoices impose a great impact on taxes as they document taxable transactions, provide important records for tax reporting, and help in calculating the total sales tax owed.

A sales invoice is issued by the seller after delivery to request payment for goods or services. A purchase order, issued by the buyer, initiates the transaction by requesting goods or services.

To handle a disputed sales invoice, start by acknowledging the dispute and reviewing the invoice for any errors. Next, communicate clearly with the customer to understand their concerns. Finally, a solution that resolves the issue amicably must be provided.

In such situations, it is essential to stay professional and communicate clearly. Start by recording the partial payment and issuing a receipt. After issuing the receipt, send a revised invoice with the outstanding balance. Last but not least, perform customer follow-up and consider adjusting payment terms.