A commercial invoice isn't just a piece of paper!

It is one of the most important components of hassle-free international trade.

Whether you're shipping products overseas or managing customs requirements, this document meets both your business and regulatory needs. A commercial invoice differs from a regular sales invoice. Why? It includes additional information for border crossings, such as the country of origin, the HS code, the freight terms, and other important details.

Want to know more about commercial invoices?

Here is our detailed blog on the essential elements of commercial invoices, their purpose, and their importance in businesses.

What You'll Learn

- 01What a commercial invoice is and how it differs from regular invoices

- 02Essential information required in a commercial invoice for customs clearance

- 03Step-by-step guide to preparing accurate commercial invoices

- 04Common mistakes to avoid and potential risks of incorrect invoices

- 05Difference between commercial invoices and proforma invoices

- 06Why commercial invoices are critical for international trade

What is a Commercial Invoice?

The commercial invoices is crucial for businesses that are operating in the U.S., especially in international trade. In the next section, you'll learn why it's so important, its role in seamless international transactions, and other details.

Definition and purpose

Commercial invoices are the special export document that facilitates the passage of your package through customs. To help the customs authority calculate the right amount of taxes and import duties that should be applied to your shipment, you should prepare your commercial invoice for export properly and accurately. In this way, delays can be avoided.

The main purpose of commercial invoices is to request payment and record the sale of goods, particularly in international trade. This document consists of various important information like buyer and seller information, product descriptions, pricing, and payment terms.

- Legal considerations

As already discussed, it is different than a usual sales invoice. A commercial invoice is a legally binding document that is required for compliance with tax regulations, trade agreements, and export laws. Therefore, this document has to be accurate with all the important declarations to avoid any legal penalties.

- Role in international trade

A commercial invoice serves as an important document for customs authorities to evaluate duties and taxes. This document supports effortless logistics by providing important information like shipping terms, product codes, and final amount.

Information Included in a Commercial Invoice

When creating or filling in a commercial invoice template, whether from scratch or using a premade template, make sure that the document contains all of the following elements:

Buyer and seller details

Every invoice begins with a header containing information about the buyer (importer) and the seller (exporter), whose contact information can be found at the top of the invoice.

The buyer's details comprise the business or customer's full name, address, contact information, postal code, city, and country.

Product information

Having an itemized list of the products you're shipping on your commercial invoice is essential. With the help of this information, the customs department can get a good idea of what the package contains, along with its purchase price.

- Comprehensive details

Add the important details of the product along with a brief description like the code of the item (SKU number), quantity, quality, price per unit, and final amount.

- Classification codes

Including a harmonized system (HS) code on every product you ship is mandatory. According to the HS code, merchandise is categorized by type, function, and nature. It allows customs tax authorities to quickly determine which taxes, tariffs, excise, and customs duties should be applied to every product line.

Every product shipped internationally must include a Harmonized System (HS) code. This classification code helps customs authorities determine applicable taxes, tariffs, and duties for your shipment.

Financial aspects

The monetary components and any involvement in transactions within a business process are key elements that highlight financial aspects businesses need to understand in advance. Some related and important aspects are discussed further.

- Payment terms

An international contract, also known as an Incoterm, is a set of rules that facilitate the trade of goods internationally. Clearly define the agreed payment terms, such as net 30 or net 60, to set expectations and ensure timely payments. It is common in business to use net-30 payment terms, meaning payment is due within 30 days of issuance of the commercial invoice.

- Currency used

Mention the currency of the transaction specifically in international trade. Having such clarity eliminates the exchange rate complications and ensures accurate financial planning for both parties.

Preparing a Commercial Invoice

Here is a step-by-step guide to creating a professional-looking commercial invoice for your respective businesses.

Step-by-step guide

- Step 1: Seller and buyer information: Add the business and client's name, address, contact number, and email address. This information ensures clear communication among both parties and prevents potential errors.

- Step 2: Itemized products or services: Itemize every product or service with specific descriptions, quantity, unit prices, and final cost. Additionally, mention important information like invoice numbers, and item codes for easy tracking.

- Step 3: Payment terms: Mention the payment methods, due dates, and late fee penalties. Specify the agreed currency to avoid potential disputes.

- Step 4: Shipping details: Mention the shipping method, port of origin, expected delivery date, and destination. If required, do include tracking numbers.

- Step 5: Taxes, duties, and discounts: Add the applicable taxes and duties, discounts, and exemptions, if any. Additionally, ensure compliance with important tax laws.

- Step 6: Signatures and date: Last but not least, validate the invoice with a signature and date. This addition makes the document valid for official use.

Common mistakes to avoid

- Incomplete or incorrect details: Missing important information like a buyer's address or incorrect tax calculation might result in unwanted delays and legal issues.

- Unclear payment or shipping terms: Abstain from giving vague descriptions of shipping methods and deadlines to avoid potential misunderstandings.

- Noncompliance with regulations: Failure to meet international trade standards and documentation rules (HS codes) might lead to heavy fines.

- Errors in formatting: Using an inconsistent layout and missing out on important elements results in complications and reduces invoice credibility.

Risks of Not Using a Commercial Invoice Correctly

Commercial invoices are one of the most important documents for international trade. Not using it correctly can lead to several risks that could impact businesses financially and operationally. Let's discuss these risks in detail below:

Financial implications

Incorrect commercial invoices lead to unexpected costs like:

- Overpayment of duties and taxes due to misclassified goods.

- Fines or penalties for non-compliance with customs regulations.

- Increased operational costs caused by errors requiring corrections.

Legal repercussions

Failing to Use a proper commercial invoice can result in:

- Breaches of trade compliance laws may lead to audits or sanctions.

- Non-adherence to international trade agreements, exposing businesses to lawsuits.

- Confiscation of goods if customs authorities suspect fraudulent declarations.

Delays in shipping

Incorrect commercial invoices can severely impact shipping timelines due to:

- Customs clearance delays are caused by missing or inaccurate information.

- Additional inspections, slow down the shipping process.

- The need for re-documentation, which disrupts supply chain efficiency.

Here are a few more potential risks, discussed with examples.

Risks of Incorrect Commercial Invoices

| Risk | Potential Impact | Example |

|---|---|---|

| Financial implications | Overpayment of taxes, penalties, increased costs | A U.S.-based electronics company misclassified goods as luxury items, leading to a $50,000 overpayment in customs duties. |

| Legal repercussions | Breaches of laws, potential lawsuits, confiscation of goods | A European textile exporter failed to comply with U.S. trade compliance laws, resulting in a $250,000 fine and shipment seizure. |

| Delays in shipping | Customs delays, additional inspections, supply chain disruptions | An auto parts supplier listed incorrect HS codes on invoices, causing a two-week customs clearance delay in Mexico. |

So far, we've explored commercial invoices and the essential details that can help your business succeed. But did you know there are other types of invoices too? One of them is the proforma invoice. Let's take a closer look at what it is and how it's different.

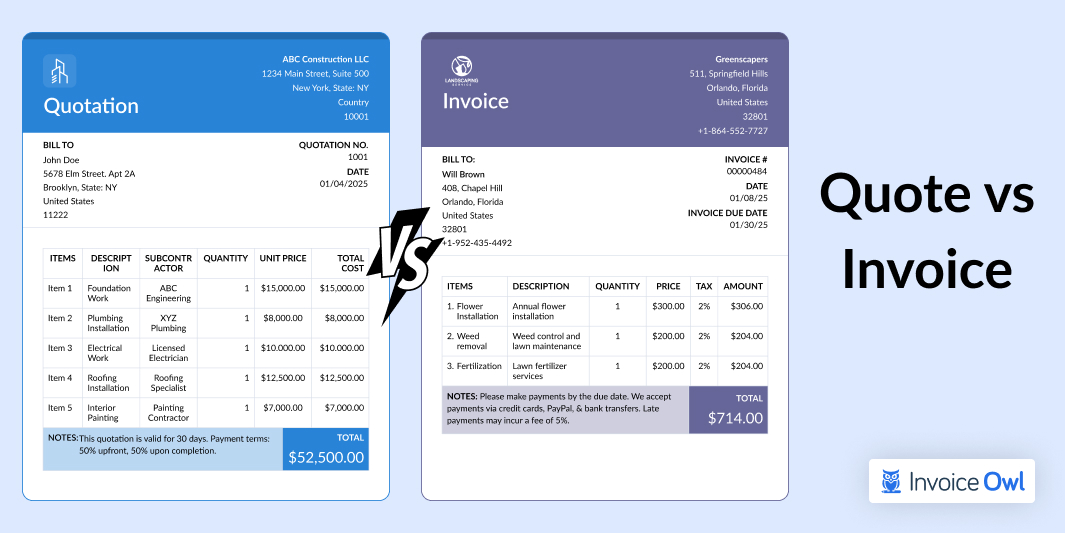

Commercial Invoices vs. Proforma Invoices

Commercial and proforma invoices are essential for trade. Here, we bring a detailed comparison between the two in the table below:

Key differences

Commercial Invoice vs. Proforma Invoice

| Aspect | Commercial Invoice | Proforma Invoice |

|---|---|---|

| Definition | A legal document for completed sales, used for payment and customs. | A preliminary document outlining terms before the final agreement. |

| Purpose | Facilitates customs clearance, tax calculation, and payment. | Acts as a quotation to negotiate pricing and terms. |

| Timing | Issued after a sale or shipment confirmation. | Provided before the sale or agreement is finalized. |

| Key details included | Full item description, pricing, payment terms, and tax information. | Estimated prices, potential terms, and basic details of the transaction. |

| Examples of use | Used for export/import, customs, and official billing. | Used for price quotation or purchase approval by the buyer. |

Here are a few more details to keep in mind.

- Legal implications

Proforma invoices are non-binding and act as preliminary quotes for goods and services. However, commercial invoices are legally binding documents that are required for clearance from customs and ensure compliance with import/export regulations.

- Timing in business processes

Proforma invoices are issued before finalizing sales and are meant for quotation purposes. Commercial invoices are issued after the sale agreement mentions the payment and shipping terms, and customs processes.

The Importance of a Commercial Invoice in Business

Commercial invoices ensure smooth international trade by fulfilling customs requirements and facilitating accurate payments. In addition to collecting payment, commercial invoices are also used by customs agencies to identify applicable duties, taxes, and other import fees.

Here are some of the most important aspects of commercial invoices, as stated below:

Facilitation of trade

A commercial invoice is an important document in international trade. It provides important details relating to the goods shipped, their respective value, and sales terms. Additionally, it also facilitates effortless transactions by offering transparency and reducing the chances of potential misunderstandings or disputes.

Documentation for customs

Commercial invoices also an essential role in customs clearance. Generally, customs authorities use this document to calculate the duties and taxes to confirm compliance with import/export regulations. A well-prepared commercial invoice prevents shipment delays and additional fines.

Create Professional Looking Invoices and Get Paid Faster!

InvoiceOwl is here to help you with creating professional looking invoices in just a tap so that you get paid faster for your services!

Start Your FREE TrialExamples and Templates of Commercial Invoices

Commercial invoices play a critical role in international trade. With the right commercial invoice format, you can streamline customs clearance and ensure compliance.

Here, we bring you some standard formats that can also be customized to meet your specific business needs.

Standard formats

The standard commercial invoice formats follow international trade requirements like seller and buyer details (name, address, and contact information), and description of goods (quantity, value, weight, and HS code). Additionally, it also includes the terms of sale (Incoterms), payment terms, and shipping details.

A small construction firm exporting prefabricated building materials comprises standard details like item descriptions, quantities, unit prices, and total costs. The commercial invoice complies with customs requirements with no additional customization.

Template download: Download the standard commercial invoice template

Customized solutions

Businesses with unique requirements need customized commercial invoices that enable them to include additional details or fields. These details comprise product serial numbers, tax exemptions, and multi-language invoices for shipments to non-English-speaking countries.

A landscaping business exports specialized soil and fertilizers. They customize commercial invoices to include batch numbers, soil composition data, and compliance certifications for agricultural standards, meeting specific import regulations.

Template download: Download a customized commercial invoice template

Conclusion

The commercial invoice is a fundamental part of international trade or shipping to a country with a different customs policy.

With a clear understanding of what it is, how it looks, and what fields it must include, it should be easy to create the correct commercial invoice for export every time.

Even if you would like to create a proforma invoice or any invoice quickly, the InvoiceOwl can help.

At InvoiceOwl, you get a list of template that helps you create different types of invoice. Wondering how to try? Go for the FREE trial and get started with premium features.

Frequently Asked Questions

The purpose of the commercial invoice is that it is required for international shipments. It provides U.S. Customs and Border Protection (CBP) with details to determine duties, taxes, and clearance.

An invoice details the sale and requests payment after a business delivers a product or service. Commercial invoices, on the other hand, are invoices used in international deliveries.

The shipper or exporter is responsible for issuing a commercial invoice. It is one of the most important documents in international trade that provides details about the goods, their value, and payment terms. Additionally, it also offers compliance with customs regulations and facilitates smooth transactions.

Yes, a commercial invoice is mandatory for most international shipments to ensure smooth customs processing.