Recurring invoice scheduling has become quite common in the modern industry due to its functionality to charge clients at fixed intervals regularly.

They have simplified the billing and payment procedures in organizations of all sizes.

Recurring invoices, payments, and billing are frequently confused. As the three of these terms differ significantly from one another. You can design your invoice following your brand's rules and deliver it elegantly packaged in consumable formats with the aid of recurring invoices.

This post here will briefly introduce recurring invoices and explain how to use them in your business.

So, let's get into it straight!

What You'll Learn

- 01What recurring invoices are and how they work for subscription-based businesses

- 02Key benefits and potential drawbacks of implementing recurring invoicing

- 03Which types of businesses benefit most from recurring invoice systems

- 04Step-by-step guide to setting up automated recurring invoices

- 05Critical differences between recurring payments and recurring invoices

What are Recurring Invoices?

Recurring invoices enable a business to routinely bill a customer's credit card for products or services. It acquires a one-time authorization from the cardholder to continuously charge the registered credit card until the cardholder withdraws approval.

For instance, recurring invoicing is most frequently utilized by cable providers, cell phone providers, utilities, gym membership providers, and online software companies. In the U.S., the best recurring invoice example is Netflix, the widely used streaming platform.

Benefits of using recurring invoices

Modern firms frequently use recurring invoices because they want to automatically bill clients for agreed-upon goods and services. They are particularly beneficial for small businesses with monthly billing cycles or those charging recurring fees.

Furthermore, to implement recurring invoicing, a company must first obtain the customer's consent to charge them regularly for a consistent amount. The charges will carry on until a mutually agreed-upon termination date or when the consumer withdraws consent.

While recurring invoices offer numerous advantages for businesses, it's equally important to consider their potential drawbacks to make an informed decision.

Pros and Cons of Recurring Invoice

The process of setting up recurring invoicing has benefits and drawbacks. Before producing them for your clients, assessing the advantages against the disadvantages is worthwhile.

- Less human error - Automating the invoice process eliminates the risk of forgetting to charge customers

- Develops cash flow - Consistent monthly income ensures you have enough to pay bills and run operations

- Automatic payment processes - Set up once and invoices are sent on time for fast, automatic transactions

- Better relationship with customers - Clients view you as a permanent team member rather than an ad hoc provider

- Save time and avoid unanticipated expenses - Eliminate manual work of creating, tracking, and processing each invoice

- Transaction failure - Dealing with failed transactions can be challenging and disrupt cash flow

- Incorrect pricing - Must exercise caution to avoid billing errors with outdated pricing

- Price adjustments - Need to ensure prices haven't changed before issuing recurring bills, especially with contractual price adjustments

You can use a template of invoices to make the invoicing task easier and maintain consistency across all your recurring bills.

Who Should Use Recurring Invoices?

Any business that provides the same type of invoices to its customers regularly for a service or product should consider implementing recurring invoices. Some of the businesses that issue recurring invoices to their clients include:

Setting Up Recurring Invoices with Step-by-Step Guide

Understanding the recurring invoice meaning is crucial for businesses that regularly bill clients for the same products or services. As a freelancer or small business owner, you can plan and ensure on-time payment with recurring billing.

Here is how you can set up recurring invoices and plan your cash flow far in advance.

A recurring invoice has the following workflow:

- Step 1 – Pick a custom template: Make sure to select a custom template of your liking with a professional outlook and custom design for your invoice sheet.

- Step 2 – Update the payment details: Add the required payment details to the template like the total amount, due date, and accepted payment methods, and make sure to double-check the accuracy to avoid delays.

- Step 3 – Set the invoice frequency: Decide the rate at which invoices must be sent like weekly, monthly, or yearly, and set this frequency in your system to match your agreement with the client

- Step 4 – Automated invoice generation: Once the frequency is set up, the system will automatically generate and send the next invoice after the interval which decreases manual work and ensures timely billing.

- Step 5 – Record payment information: Safely store the customer's bank account information or payment details which makes it easier for clients to pay on time.

- Step 6 – Remove the recurring invoices: Once the approved service period ends or the customer decides to cancel the subscription, stop the recurring invoices and make sure to properly communicate before stopping the process.

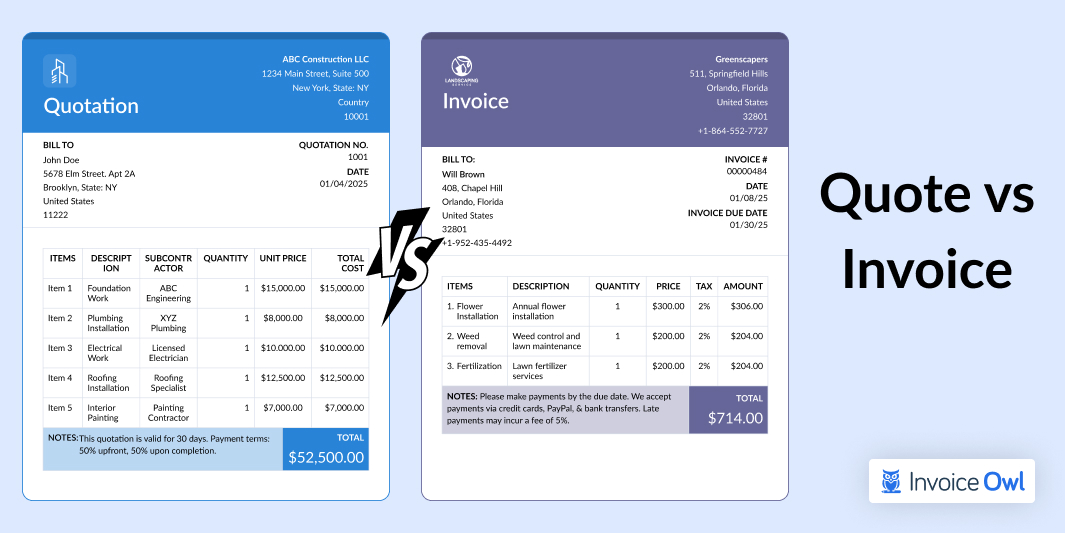

Difference Between Recurring Payment and Invoice

Here's the difference between recurring payments and recurring invoices for a more ideal comparison:

Recurring Payments vs Recurring Invoices

| Aspect | Recurring Payments | Recurring Invoices |

|---|---|---|

| Payment process | Automatic payment charged at pre-defined intervals | Manual payment is charged once the client receives an invoice |

| Ideal for | Businesses charging upfront for fixed deliverables or subscriptions | Businesses charging hourly or providing constant service fees |

| Payment method | Recurring payments need saved payment information like credit card or bank details | Recurring invoices can be paid through many methods, such as credit cards, checks, and ACH transfers |

| Frequency | Fixed schedule, for example, weekly, monthly, and annually | As required based on finished work or approved milestones |

| Compliance | Must align with U.S. laws like NACHA for ACH payments and card network rules | Must align with the U.S. invoicing standards, like detailed payment terms & conditions |

Must align with U.S. laws like NACHA for ACH payments and ensure compliance with U.S. invoicing standards for detailed payment terms and conditions.

Simplify your Recurring Invoicing Process

As a business owners, all of your workflows should be compatible with your billing system. It must be scalable to your constantly changing business demands, enabling you to support numerous plans, add-ons, and coupons without always requiring manual involvement.

To learn how to set up recurring payments for customers, businesses can use secure payment platforms with the help of InvoiceOwl.

The invoicing software helps you create estimates and invoices with a professional appearance in just a few minutes! It is a paid, user-friendly, mobile estimating and invoicing program. You can make expert estimates that awe prospective customers. From the mobile app, create and send estimates to clients immediately.

Automate Your Invoices with InvoiceOwl

InvoiceOwl lets you automate creating and sending digital invoices to your clients and track them in real-time. Get a free trial today to test it out for yourself.

Start Your FREE TrialFrequently Asked Questions

Yes, recurring invoices are legal if they include all required details, such as payment amount, terms, and contact information. Compliance with U.S. invoicing standards and tax regulations (e.g., sales tax) is essential.

Popular options include InvoiceOwl, QuickBooks, FreshBooks, and Wave. They offer features like automation, client management, and integration with payment gateways.

The payment methods that are most accepted for recurring invoices in the U.S includes payment methods like credit cards, debit cards, ACH (Automated Clearing House), transfers, and digital payment such as PayPal or Stripe.

Yes, invoicing platforms must comply with U.S. data protection laws. The Gramm-Leach-Bliley Act (GLBA) is for financial data, and the California Consumer Privacy Act (CCPA) is for handling California residents' personal information. These mentioned laws ensure data security and customer privacy.

To charge clients recurring payments, use a payment gateway or invoicing platform that supports automated billing. In that platform, set up the client's payment details, define the billing amount and frequency, and ensure they consent to the recurring payment terms. Platforms like InvoiceOwl, Stripe, or PayPal are helpful for small businesses for these transactions securely.

The difference between recurring billing and recurring invoices is that recurring billing automates the payment process by charging a customer's account at regular intervals, commonly used for subscriptions and memberships. On the other hand, recurring invoicing automates sending invoices on a schedule, requiring the customer to review and pay manually. This is ideal for project-based or flexible services.