Businesses often come across these typical export terms—proforma vs commercial invoices, which play a significant role across international trade and logistics.

As a solopreneur, you might get confused by both invoicing terms due to their interchangeable use. Both, however, are distinct from one another and serve different objectives.

In this blog, we will explore the "proforma invoice and commercial invoice" subject and uncover their differences. But before that, let's understand what exactly they are and their functions.

What You'll Learn

- 01The core differences between proforma and commercial invoices

- 02When to use each invoice type in your business transactions

- 03Legal and practical applications of both invoice types

- 04How to generate proforma and commercial invoices efficiently

- 05Common misconceptions and best practices for invoice management

Table of Content

- Introduction to Invoices

- In-depth Look at Proforma Invoices

- In-depth Look at Commercial Invoices

- Key Differences Between Proforma and Commercial Invoices

- How to Generate Your Invoices

- Final Words

- Frequently Asked Questions

Introduction to Invoices

In business transactions, the two commonly used types of invoices are proforma invoices and commercial invoices, which are discussed further.

What are proforma and commercial invoices?

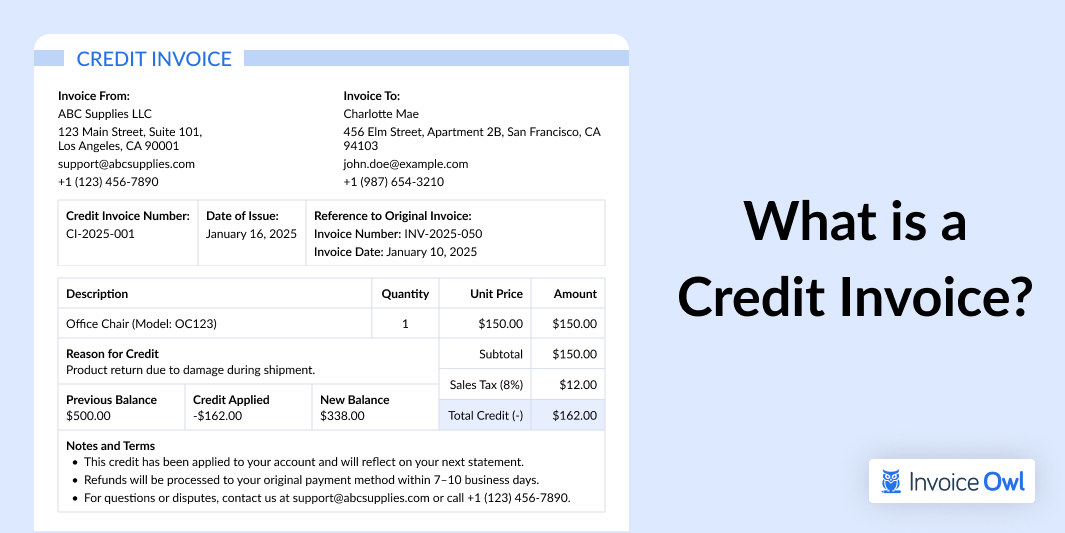

A proforma invoice is a draft bill of sale that a seller provides to the purchasers before shipping or providing the goods or services. It contains information about the cost, quality, quantity, and terms of delivery, among other essential details.

Whereas, a commercial invoice is sent to the purchaser after the products have been delivered or shipped. Additionally, the proforma invoice format and the format for commercial invoices are very similar.

Importance of understanding invoice types

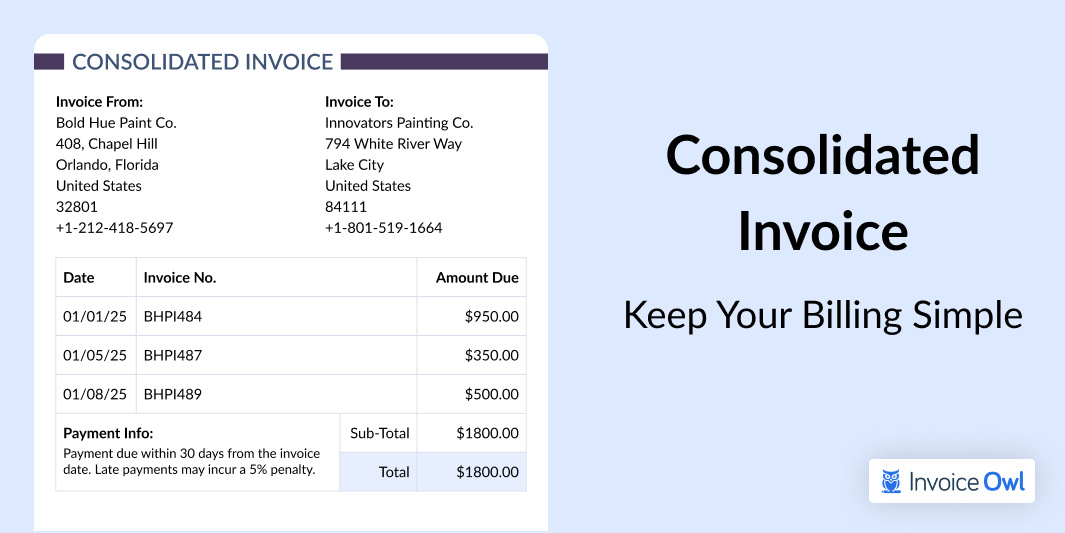

Understanding different invoice types is quite important for streamlining financial processes and proper documentation. Every invoice type is meant for different purposes, like initiating transactions, tracking progress, or recording completed sales.

With a proper understanding of different invoice types, businesses can communicate easily, comply with legal standards, and maintain accurate financial records.

In-depth Look at Proforma Invoices

For a more detailed analysis, let's find out how proforma invoices help you gather the necessary tasks, needed to initiate your business.

Meaning and purpose

For the final transaction, a proforma invoice is required as formal document. The purpose of the document is to provide a clear cost breakdown to the buyer before the finalization of payment and delivery. Furthermore, plays an important role across international trade for customs declarations, cost estimates, and negotiating terms with buyers.

- Mistaken for final invoices: Proforma invoices don't act as proof of sale or a legal document for collecting payments.

- Confusion with quotes: Compared to standard quotes, proforma invoices offer detailed pricing and transaction terms.

- Not a purchase order: Proforma invoices originate from the seller, while the buyer initiates purchase orders.

In-depth Look at Commercial Invoices

Now, it's time to discuss about the purpose and role elaborately:

Definition and purpose

A commercial invoice is a formal document issued by the seller to the buyer in an international sale. Based on the purpose of the document, a commercial invoice is generally required for businesses for customs clearance during the taxes and duties on imported goods.

Role in customs and trade

A commercial invoice acts as an official record of goods in transit, facilitating accurate customs declarations. Additionally, it also helps the authorities calculate tariffs and taxes, and ensure compliance with international trade laws.

Key Differences Between Proforma and Commercial Invoices

Element comparison table

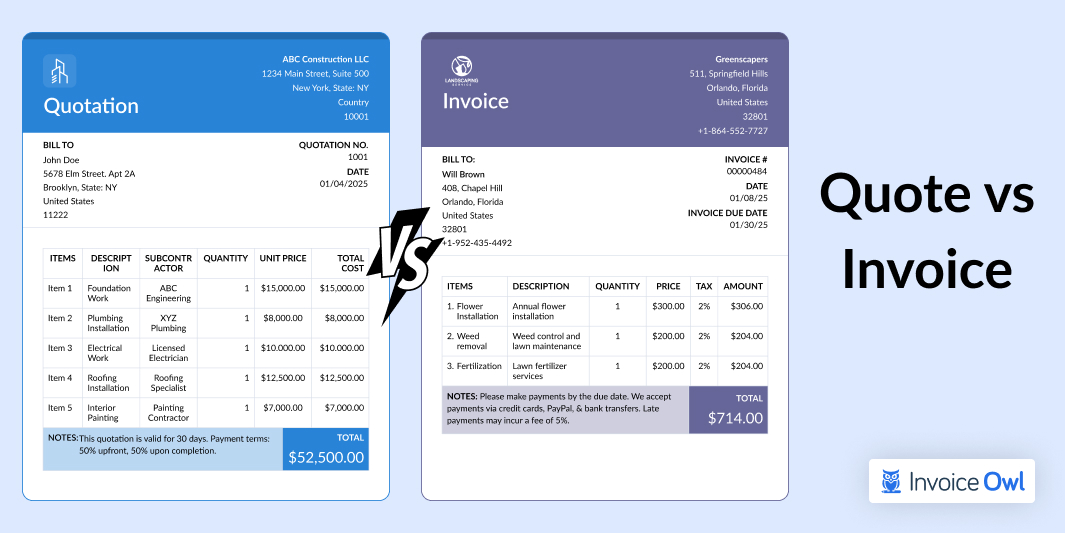

Proforma vs Commercial Invoice Comparison

| Element | Proforma Invoice | Commercial Invoice |

|---|---|---|

| Usage | Quoted prices for goods/services before agreement | Declaration for customs and payment collection |

| Legality | Not legally binding | Legally binding and enforceable |

| Information included | Estimated details (quantities, prices, terms) | Detailed, actual information on goods/services |

| Accounting | The proforma invoice does not require any accounting entries | Buyers and sellers are required to make entries in their respective accounting books |

| Payment amount | Gives a rough estimate of the total cost of the transaction | Shows the entire transaction amount that must be paid |

| Contents | Doesn't demand payment but offers information: the initial cost, quality, quantity, & payment terms | Includes the final agreed-upon specifications and the request for the final payment |

Situational usage examples

- Proforma invoice in freelancing: A graphic designer creates a proforma invoice to outline the estimated cost of logo designs. This invoice is sent before the client confirms the project.

- Commercial invoice in import/export: A manufacturer shipping the products abroad comprises commercial invoices with important details like product description, specific quantity, and costs related to customs clearance.

Industry: Construction

A contractor issues a proforma invoice to the client to provide an estimated cost of materials and labor during the bidding process. Once the project is initiated, a commercial invoice is issued detailing the expenses and milestones to ensure transparent billing for both parties.

Industry: Carpenter

A carpenter offers proforma invoices to clients for specific tasks like custom furniture or cabinets, offering an estimate for materials, labor, and time. As the work is completed, a commercial invoice is issued with detailed actual costs incurred and the final payment terms.

How to Generate Your Invoices

Here are the steps that are needed to follow for proforma and commercial invoice creation:

Step-by-step guide to proforma invoice generation

The below-given steps to generate a proforma invoice are:

- Select a template: Choose a proforma invoice template suitable for your business.

- Add business details: Add your organization name, logo, and contact information.

- Specify transaction information: Mention the customer details, description, estimated cost, and pricing.

- Include terms and conditions: Include the payment terms, validity, and other agreements.

- Review and send: Double-check all the important details and send the invoice to the client.

Fast and Professional Looking Invoices On-the-go With InvoiceOwl

Work smarter, not harder with InvoiceOwl. Create professional invoices in just a few taps!

Start Your FREE TrialStep-by-step guide to commercial invoice creation

The steps are referred further to generate commercial invoice creation:

- Choose a template: Select a pre-designed commercial invoice template customized for trade purposes.

- Input business and client details: Include the contact and legal information of both parties.

- List goods/services: Add the detailed description, unit price, quantities, and HS codes.

- Add shipping and customs information: Mention carrier details, destination, and essential trading terms.

- Calculate taxes and total costs: Add all the duties, taxes, and applicable shipping charges.

- Finalize and dispatch: Double-check for accuracy and provide copies to the buyer and customs.

Final Words

We hope this blog helped you understand the meaning of proforma invoices and commercial invoices, their key differences, and how you can generate them.

The differences between proforma and commercial invoices are minimal, and you can easily create them in Word or Excel.

But, as mentioned before, the quickest and simplest way to generate and send invoices is to use a professional online invoicing software.

Therefore, choosing the right online invoicing software is essential for creating and managing your proforma and commercial invoices.

It will automate your work processes, prevent human errors, and help you get paid faster!

Frequently Asked Questions

Yes, it is possible to convert a proforma invoice into a commercial invoice. Once the buyer agrees to the related terms, the transaction proceeds. After this, the proforma invoice can be updated and finalized into a commercial invoice.

No, the payments are not owed in response to a proforma invoice. However, the payments are processed via a standard invoice.

Once all the specifics have been made clear and a payment deadline established, a document known as an invoice is sent to the client. It is a legal record that lists the goods and services sold and the payment owed.

The final proforma invoice must be signed by the authorized purchaser and sent back to the exporter after it has been acknowledged.

A tax invoice serves as notice to the buyer that payment is required. The proforma invoice serves as a pre-sale review of the cost, type of products, and other terms of sale for the prospective customer.

The potential consumer can so decide whether or not to purchase the products based on the proforma invoice.

No, proforma invoices are not subject to GST. A Proforma invoice does not represent a transaction that has already occurred or that will soon occur.

As a result, it is not an invoice and does not require payment of GST in accordance with GST rules.