![What is Invoice Discounting? [Implementation Steps + Advantages]](/images/2021/11/what-is-invoice-discounting.jpg)

Do you know which is the best way to monetize your business's unpaid invoices?

It's invoice financing.

It helps you get paid immediately, especially in need of a short-term cash injection. So, you do not have to wait for days/weeks to collect payment from the customer. You need to pay a 5 percentage (standard value) of your total invoice value to a third-party (finance company).

Generally, invoice factoring and invoice discounting are the two essential types of invoice financing however, both the terms are somewhat similar and distinct too.

Let's get started with the basic information of invoice discounting, its advantages, and the steps to implement it.

Key Points

- 01Invoice discounting allows you to access up to 85% of unpaid invoice value immediately

- 02You maintain control of your sales ledger and customer relationships, unlike invoice factoring

- 03The process helps improve cash flow and working capital without waiting for payment terms

- 04Implementation involves choosing between whole turnover or selective invoice discounting

- 05Typical fees range from 1% to 3% of the total invoice amount plus interest charges

What is Invoice Discounting?

Invoice discounting is an operational process to conduct simplified calculations. Till the time you can take all the action.

Invoicing discount is a financial term that allows you to gain access to money in your customer's unpaid invoices (Know more about strategies for dealing with unpaid invoices)

In simple terms, a process where you sell your invoice to a third party (often a finance company) is known as invoice discounting.

An invoice discounting is a form of short-term borrowing against your unpaid customer invoices.

The discounting company will lend your business a certain percentage of the face value of the invoice in the accounts receivable ledger. In effect, it's like having an overdraft invoice finance facility that's secured against your accounts receivables.

Once you sell your invoice:

- You will get a small percentage of the invoice value billed to your customer.

- The financing company will take over the total amount.

An invoice discounting help your business in

- Getting quick access to cash.

- Improving the business's cash flow and working capital.

- Maintaining the responsibility of sales ledger, payment chasing, and even payment processing.

Example of Invoice Discounting:

A white-label service provider company takes bulk orders of manufacturing TV sets. The receiver company has proposed crediting the amount 2-months after receiving orders. The white-label service provider company agrees to the terms and conditions.

Post-completion and delivery orders, the company has received another bulk order of manufacturing washing machines. Now the cache is this white-label service provider company is short of funds since the payment of the first order is yet to receive.

In this case, invoice discounting comes to the rescue. The white-label service provider company applies invoice discounting to a third-party financer. Financier would then offer 80% of the outstanding receivables to the white-label company. The remaining 20% would be returned by the financier to the white-label company upon receiving the full amount from the TV set buyer.

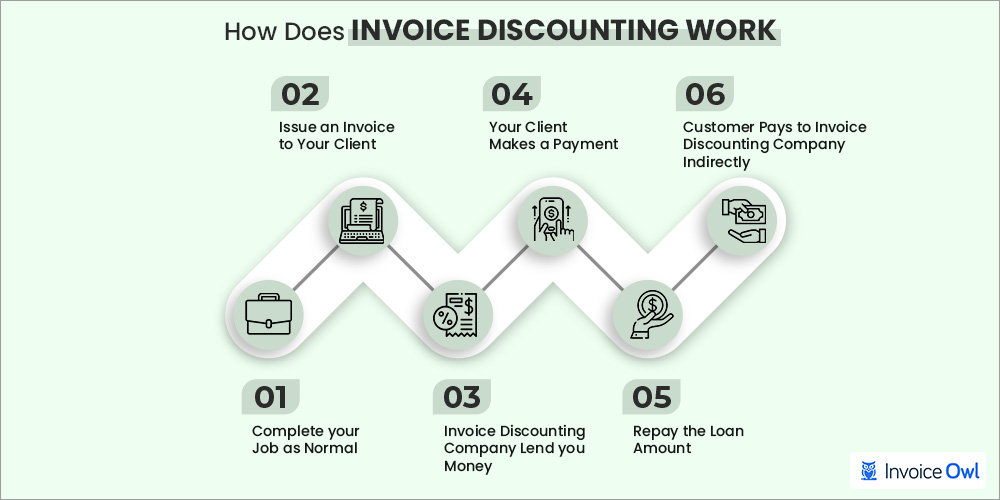

How Does Invoice Discounting Work?

The process of invoice discounting is very simple as it is related to the normal invoicing process. Here's how invoice discounting works:

-

Complete your job as normal

The invoice discounting process usually starts when you sell goods and services to your client. First, you need to create an invoice for all such goods and services offered to your client.

-

Issue an invoice to your client

Once the job is completed, the first step you should take is to raise an invoice for the goods and services offered and send an invoice to your client.

-

Invoice discounting company lend you money

Once the invoice check is completed, business invoice discounting companies provide you with the money as a loan of the raised invoices, minus a small percentage.

-

Your client makes a payment

Just as per your normal payment terms defined in the invoice, your client makes a full payment. You are the sole person, or we can say credit controller, to deal with chasing late invoice payments.

-

Repay the loan amount

Once you receive invoice payments, it's time to repay the loan to the invoice discounting service, including an agreed service fee (between 1% and 3% of the total invoice amount) to cover costs, risk, and interest.

-

Customer pays to invoice discounting company indirectly

In some cases, your customers pay into a trust bank account in your business name but are actually controlled by the invoice discounting company. This reduces the risk of non-payment by you to the lender yet maintains confidentiality.

Steps to Implement Invoice Discounting

Below is a step-by-step guide that will help you to implement invoice discounting in your business.

Step 1: Select either whole turnover invoice discounting or selective invoice discounting

First, you need to understand the two important terms of invoicing discount:

- Whole turnover invoice discounting: To discount your entire accounts receivable ledger.

- Selective invoice discounting: To discount only a few particular invoices.

It's almost impossible for small businesses to use a selective method as many invoice discounting companies prefer to spread their risk as widely as possible.

So, large companies prefer to use the whole turnover discounting method.

Step 2: Contact your invoice discounting provider

The next step is to select your best provider from multiple invoice discounting providers. It is made possible by comparing the services and fees of different providers.

You can even contact their customers to know about the provider's feedback. So, it plays a vital role in deciding the perfect company.

Consult your accountant first before making your final decision as they might have the correct advice on choosing the right invoice discounting provider.

Step 3: Finally, grab the best guidance from your provider

Once you've signed up with your chosen invoice discounting company, they will guide you through the process.

This includes

- Setting up payments to you.

- Arranging a trust account for customer payments (if required).

- Linking into your invoicing process so that you get paid as quickly as possible.

The good part is that all of this can be done online. And it's by using online invoicing software.

Invoice Discounting vs Invoice Factoring

While the concepts are relatively similar, there are a couple of key differences to getting your head around.

Invoice Discounting vs Invoice Factoring Comparison

| Aspect | Invoice Discounting | Invoice Factoring |

|---|---|---|

| Definition | Loan secured against your outstanding invoices | Invoice factoring companies buy unpaid invoices, which in turn help them with credit control |

| Control | You get to manage your own sales ledger and collect payments yourself | The finance company takes over the management of your sales ledger and credit control process |

| Obligation | It's a loan and not a sale. So, your money must always be repaid | If you sell the invoice to a factoring company and your customer is not ready to pay, you won't be obligated to repay the money yourself |

| Credit Checks | Discounting companies will not run credit checks on your customers before agreeing to purchase your invoices | The factoring company will run credit checks on your customers before agreeing to purchase your invoices |

What are the Advantages of Invoice Discounting?

Invoice discounting helps you in many ways:

1. Improving cash flow

You can effectively convert up to 85% of the total amount if not full value into instant cash with the help of invoice discounting. Moreover, it helps you to deal with shorter working capital cycles.

It's obvious that you'll receive your cash from invoice discounting providers much quicker than banks. Also, they are actively responsible for assessing the lender's viability.

Invoice discounting has significant speed advantages over traditional finance as it allows lenders to generate cash in no less than 48 hours.

2. Getting quick cash

As compared to taking loans from banks which is a time-consuming activity, Invoice discounting is a faster method to procure cash and get your invoice payments back.

Once an invoice is issued, invoice discounting provides you with liquid cash ASAP. Such cash injection helps you in many ways like increasing sales, pursuing growth, capital investment, and repaying critical debts.

3. Releasing locked cash

Invoice discounting helps you in releasing locked cash of customer invoices.

The primary role of invoice discounting is just to convert your account receivable (debtors) into liquid cash. Such cash can even be used for emergencies.

4. Maintaining confidentiality

In the case of invoice discounting, confidentiality can be maintained by the discounting houses.

Remember that neither suppliers nor customers are aware of the company's borrowing against sales invoices. In fact, the agreement between the financier and you/your business is not disclosed to your customers.

5. Dealing with win-win situation for businesses

The invoice discounting takes care of both the borrowing company and customers.

- The borrowing company obtains the cash advance quickly.

- Customers are directly provided with the credit period.

This creates a win-win situation for the company and the company's customers, which helps build a healthy relationship with customers.

6. Short Turnaround Time

Invoice discounting is one of the fastest ways that you can opt to get a business loan.

Once you become a trusted partner of an invoice financing NBFC (Nonbank Financial Companies), you can permanently reduce the collection period of your invoices.

7. No-risk to assets

Invoice discounting offers unsecured business loans instead of your invoices and hence does not pose any risk to your company's movable assets. It is basically a non asset based lending.

8. No effect on business relations

Invoice discounting helps you maintain the business relations between the seller and buyer.

Discounting companies have no contact or correspondence with the buyer.

Hence, the buyer is sure that he would be liable to the seller, not to other parties.

9. Boosts credit sales

Since invoice discounting can help convert credit sales into cash, it helps in quick growth and exploitation of new opportunities for a SME.

After going through detailed information on invoice discounting, we've answered a few questions in the next section.

Disadvantages of Invoice Discounting

While invoice discounting offers many benefits, it's important to understand the potential drawbacks before implementing this financing method in your business.

1. Low-profit levels

Profit margins tend to decrease with implementing invoice discounting at a place. Though it helps manage cash at the time of financial crunches, it also impacts a company's revenue levels. The loss, you as a borrower, have to bear is the discounting charges that the financial company levies on the borrowing company.

2. Productivity at risk

When the credit terms are liberal, there are high chances of uneven cash flow. Such uneven cash flow arises a fund shortage situation, eventually, leading to invoice discounting if any payment is yet to be received. Depending on invoice discounting, the company loses focus on productivity and tightening credit terms.

3. Affects new businesses

Since new businesses have just stepped into the industry, discounting on invoice is not a recommended method for such startups. Invoice discounting not only attracts interest and maintenance costs but also lower profit margins. In the inception itself, no business would wish to have negative profit levels.

4. Cash flow dependency

Despite levying hefty interest, Invoice discounting makes any company depend on it. The only reason is the quick generation of cash flow. The company's receivable department becomes slightly irresponsible about the payments yet to receive since they have already received the majority part of their receivables. Considering this as a fact, it puts a major dent in the company's revenue roadmap.

5. Load on administrative department

In the Invoice Discounting method, the entire load to acquire cash from the finance company is on the administrative department of the lender's company. The company demands various documents from the department, which they need to furnish to the financing company.

Ready to Streamline Your Invoicing?

InvoiceOwl helps small businesses, freelancers and contractors create professional invoices on-the-go and get paid quicker.

Start Your Free TrialFrequently Asked Questions

A process that allows you to continue dealing with customers yourself as usual — your customers won't know you're using a finance provider is called confidential invoice discounting. The downside to this is that you'll still have to chase invoices yourself if you face late payments, unlike invoice factoring.

If you finance an invoice for $10,000 with an invoice factoring company, they will usually advance you 80% of the invoice amount that is $8,000 when the invoice is allocated to them. You will then get the remaining balance of $2,000 (minus the fee charged by the finance company) back when the customer pays the invoice. In this complete invoice discounting process, the $2,000 can be seen as a discount.

Yes. Invoice discounting is a good idea as it provides you with a great investment option while protecting yourself against market volatility while reaping high returns. It's particularly useful for businesses that need quick access to cash without waiting for payment terms to expire.

Invoice discounting allows you to maintain control of your sales ledger and customer relationships, while invoice factoring involves selling your invoices to a third party who then manages collections. With discounting, you're responsible for collecting payments yourself, whereas factoring companies handle the entire collection process.

Invoice discounting fees typically range from 1% to 3% of the total invoice amount, plus interest charges on the advance. The exact rate depends on factors like your business creditworthiness, invoice volume, and the terms of your agreement with the financing company.

Conclusion

Invoice discounting and invoice factoring are two significant types of invoice finance.

Invoice discounting helps you receive a percentage of the total from the lender when you invoice a customer or client, providing your business with a cash flow boost.

To deal with invoice discounting in your business, the best option is to adopt online invoicing software like InvoiceOwl. InvoiceOwl provides you with the perfect solution in creating and sending invoices to your client quickly.

Moreover, it helps you to make your business finance management easier than ever. Sign up for InvoiceOwl now to create your first invoice and share your experience with your friends and colleagues.