Does the anxiety of getting paid the wrong amount haunt you?

If so, you are not alone. Incorrect invoices cannot only cause unnecessary payment delays but significant financial disruptions if not validated correctly.

A compelling testament to efficient invoice verification suggested that 61% of the payment delays occur due to incorrect invoices.

Along with this, a real-life incident that took place with Shark Tank investor Barbara Corcoran, caused $400,000 of financial devastation! In fact, as more businesses move online, the risk of getting an incorrect invoice has only skyrockted.

But hey, savvy entrepreneurs, fear not!

We are here with this comprehensive guide on how to verify an invoice. This guide will present to you foolproof invoice verification tactics, transforming you from a payment delay victim to a fraud-fighting champion.

So, buckle up; we're going teach you to scrutinize invoices like a pro, ensuring smooth payments and financial peace of mind.

What You'll Learn

- 01Understanding the invoice verification process and why it matters for your business

- 02Step-by-step procedures for checking invoice accuracy and preventing fraud

- 03Three different types of invoice verification methods used by businesses

- 04Essential documents needed to verify invoice details properly

- 05A complete checklist to ensure no payment errors slip through

What is the Invoice Verification Process?

Invoice verification is making sure that the payment process has accurately been carried out. It also ensures that the vendor accurately bills the customers for the specific services or products they have utilized.

The invoice validation process is carried out by cross-checking the incoming invoices received against the purchase order and delivery receipt. An invoice is paid only if the invoice details match the supporting documents.

In case any essential invoice details are missing or if the invoice has any discrepancies, it is rejected and the vendor must be asked to generate a revised invoice.

Generally, companies have dedicated accounts payable managers who are authorized to verify and approve an invoice payment.

The main reason for invoice verification is to avoid any fraudulent payments. The invoice approval process varies. For small businesses, it may involve a simple review by the owner or manager. Larger companies often use automated systems or require multi-level approvals,

So, if you are wondering how to check invoice or which type of invoice verification you should practice, then let's talk about all the significant types of invoice verification.

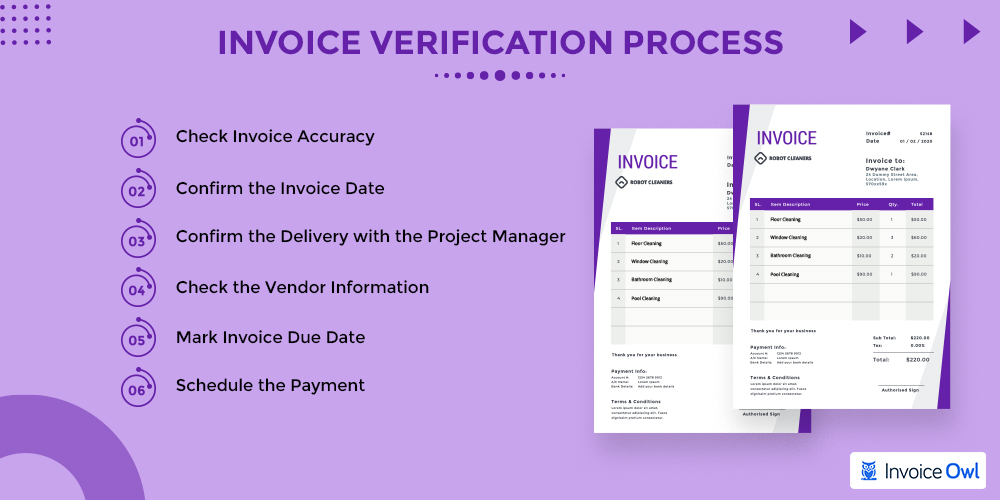

How Does Invoice Verification Process Work?

To verify an invoice, businesses must carefully review the document to ensure accuracy and prevent making payments on erroneous charges. Key information contained in invoices like quantities, prices, and payment terms must match data from other sources such as purchase orders and delivery receipts.

Check invoice accuracy

Checking invoices accurately is the most vital step of invoice verification. Here is what you need to do to make sure that the invoice check process gets accurately conducted:

Confirm the invoice date

Checking the invoice dates has a massive significance in invoicing because it has many benefits, such as:

- It can make you lose or win legal battles about the transactions.

- It helps you avoid double payments.

- You can find invoices much easier if you want them later for auditing.

- You can calculate taxes more accurately with correctly dated invoices.

Confirm the delivery with the project manager

Confirming the delivery with the project manager keeps you away from fraudulent payments. Ensuring that you have received the services/products you are paying for is one of the best invoicing practices.

Before greenlighting the delivery, the manager has to check the described quantity and quality of the line items in the invoice with those of the actual delivery.

Sometimes, if the delivery is not made on time, the customer can pay less to the vendor and save the company money. This could only be possible by confirming the delivery with authority.

Check the vendor information

Checking vendor information is another easiest method to avoid fraudulent payments. You should cross-check the vendor details on the invoice with the past invoices in your accounts payable process. Check:

- Business name

- Logo

- Contact number

- Mailing address

- Email ID

- Bank details

This cross-checking not only warns you about fraud but also helps you keep your system data updated. And if it is a new vendor, you must verify the contact details before proceeding.

Moreover, if you want to save time and avoid payment failures, you should also check invoice payment terms like:

- Account number

- Tax ID number

- Preferred payment method mentioned on the invoice

Mark invoice due date

Making a note of the invoice due date helps you sort out the invoice payment priority and improve cash flow. Other than that, noting the payment deadline has economic benefits for your organization too.

It saves you from paying late payment fees and helps you avail of the early bird discounts as mentioned in the payment terms.

Schedule the payment

Once all the above essential invoice data are checked, the payment must be approved and scheduled by the accounting manager at least a couple of days prior. This gives you a window to stop the payment if there are any issues with the payment.

Moving ahead, in case if you are wondering about which type of invoice verification you should practice, then let's talk about all the significant types of invoice verification.

Alright then, let's jump right in.

Different Types of Invoice Verification

The invoice checking process depends on the nature of the trade. Also, the company size, company structure, and the process being followed affect the invoice validation process.

However, widely adopted business practices involve these three common invoice checking methods mentioned here.

Let's have a look at the three of them.

Invoice Verification Methods

| Method | Description | Best Used When |

|---|---|---|

| Purchase Order Based | The invoice is matched with the purchase order placed by the client's accounting department. This method counts only vital invoice details like total quantity and invoice amount, not partial deliveries. | You have a formal purchase order system and want to verify total amounts quickly |

| Goods Receipt Based | Individual goods are invoiced separately as they are delivered. Each delivery is verified against its corresponding receipt. | Goods delivery is done in parts and you need to track each partial shipment separately |

| Without Order Reference | Invoice is verified directly by the accounts payable authority, accountant, or G/L accountant when no purchase order number is available. | Purchase order numbers are not available or for non-standard purchases |

Now that you know the benefits of invoice approval, you must be eager to see the process. So let us continue!

Invoice Verification Checklist

As discussed above, invoice verification is a crucial process, and it demands strict attention to detail.

Thus, a wise thing would be to run the approved invoices through a final invoice verification checklist before submitting invoices to make the transaction. Here is a quick but essential invoice verification checklist for invoice reconciliation.

Make sure the invoice is unpaid

Before you submit invoices making the payment, you should confirm that the invoice is unpaid. The most accurate way to find that out is to run an invoice number check in your "paid invoices" logs.

Clarify discrepancies

Invoicing mishaps are not a rare phenomenon. And suppose you find any discrepancies in the invoice is verified. In that case, you should never neglect it and clarify it with the accounts payable & accounts receivable clerk, project manager, or the appropriate authority. Still, if you are facing any issues, you should contact the vendor to resolve them.

Verify the invoice with documentation

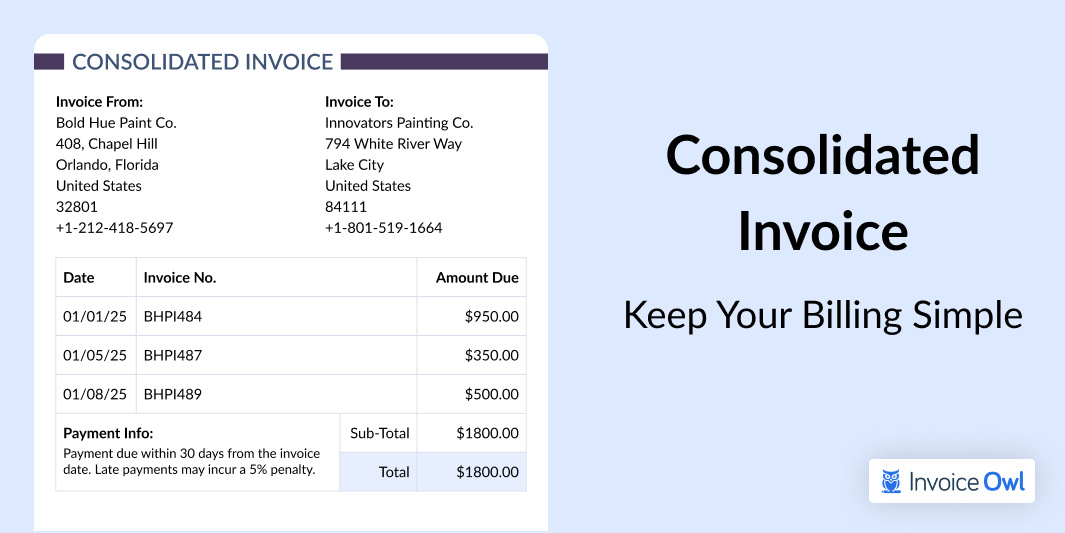

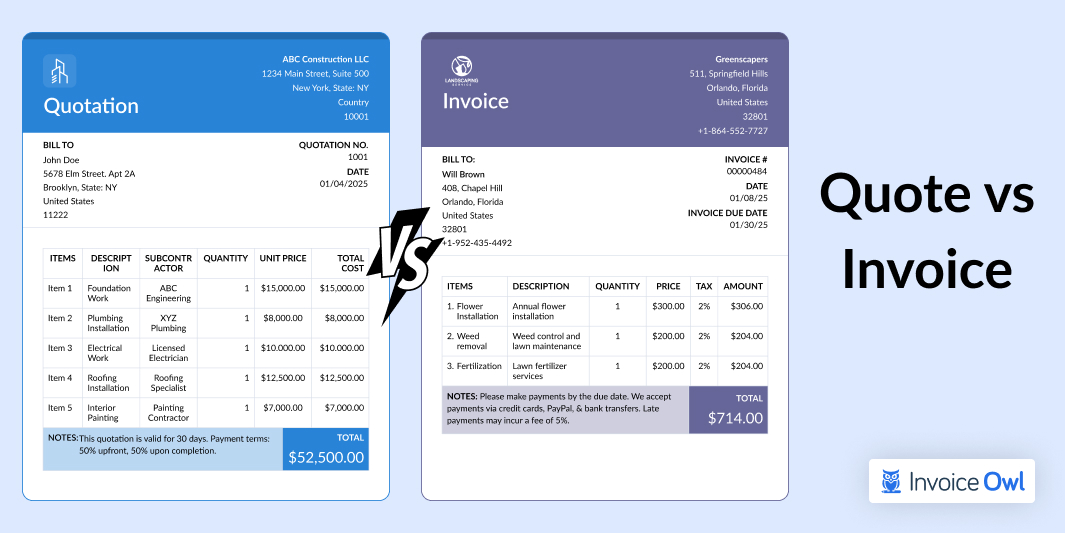

Once you know the invoice is yet unpaid. You should cross-verify it with all the supporting documents and invoice data available relevant to the purchase. For example, it includes the PO, quotation, and delivery receipts. Additionally, learning how to check invoice number also comes in handy when it comes to documentation.

Now that you have gone through the invoice verification checklist, its time to talk about the documentation. Do you know what documents you need to verify an invoice?

Don't worry; we have listed all the documents here.

Essential documents you need to verify invoice details

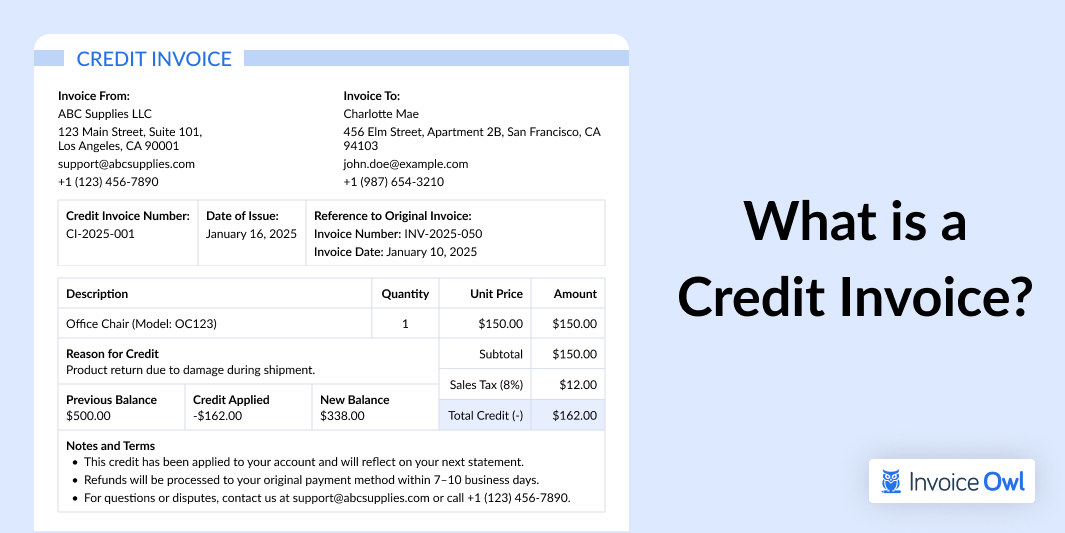

Credit memos are the best solution to retrieve a mistaken payment.

Voila!

You are done! If you have followed the above steps, you have verified an invoice successfully.

Now,

How long did it take?

Did it take longer than you imagined?

Generally, the time taken to process an invoice for a small business with limited resources is roughly 17 days on average.

So, if you want to hit top gear, download the InvoiceOwl app now!

Ready to Streamline Your Invoice Verification?

Join 100,000+ contractors using InvoiceOwl to create accurate, professional invoices and get paid faster with built-in verification features.

Try Free for 3 DaysFrequently Asked Questions

The invoice verification process work includes checking the supporting documents, such as PO, order delivery receipt, and quotation. This verification is done to avoid fraudulent transactions and repayments.

To verify an invoice, you need to match the invoice with the purchase order, delivery receipt, the standard sales tax, and the discounts agreed upon. This may take an hour, especially if the invoice has been stacked for a while. Therefore, the most efficient way to verify an invoice is by using invoicing software.

The head accountant of the company has the authority to approve an invoice for payment. Before approving an invoice make sure to verify the invoice against the purchase order and check the invoice for discrepancies.

To verify if an invoice is real, check for accurate company details such as the name, address, and contact information. Ensure the invoice includes a unique invoice number, itemized list of goods or services, payment terms, and correct amounts. Cross-reference the invoice details with prior agreements or purchase orders and contact the issuer directly if anything seems suspicious.

A valid invoice typically contains essential elements such as the seller's and buyer's details, invoice date, due date, unique invoice number, itemized charges, taxes, and total amount due. Additionally, it should align with the agreed terms and include clear payment instructions.

Businesses verify invoices through methods like three-way matching (comparing the invoice, purchase order, and receiving report) and two-way matching (comparing the invoice with the purchase order). Digital verification tools like InvoiceOwl may also be used to cross-check invoices against contracts to maintain accuracy and prevent errors.

Conclusion

Alright!

Wasn't that simple?

In this blog, we talked about the simplest steps to avoid making invoice payment mistakes. And the benefits of invoice verification must have encouraged you to practice it already.

But, if you want to avoid all the manual invoicing tasks, generate an invoice now and eliminate the room for human errors from the entire invoicing process.