Download Free Accounting Invoice Templates

Access professional accounting invoice templates for CPAs, bookkeepers, and financial advisors. Download ready-to-use templates in Word, Excel, and PDF formats designed specifically for accounting services.

InvoiceOwl vs Free Accounting Invoice Template

See why professionals choose InvoiceOwl

Professional Accounting Invoice Templates - Download Free

You help clients streamline their financial processes every day. Now it's time to streamline your own invoicing. Our free accounting invoice templates deliver the precision, transparency, and professionalism your practice demands.

Specialized Templates for Every Accounting Service

Our comprehensive collection includes templates specifically designed for various accounting professionals:

Accountant - General accounting service invoices for comprehensive financial management, monthly accounting services, and business advisory work.

Bookkeeper - Monthly bookkeeping billing templates designed for recurring services, transaction recording, and financial record maintenance.

Tax Preparation - Season-ready tax service invoices optimized for individual tax returns, business tax preparation, and tax planning consultations.

Financial Advisor - Advisory service billing formats for investment consulting, retirement planning, and wealth management services.

Auditing - Professional audit engagement invoices for internal audits, external audit services, and compliance reviews.

Format Options for Your Practice

Microsoft Excel - Perfect for accountants who love spreadsheets. Built-in formulas automatically calculate totals, taxes, and service fees with precision.

Microsoft Word - Easy editing and customization to match your firm's branding and communication style.

Adobe PDF - Professional, client-ready documents that maintain formatting consistency across all platforms and devices.

Why Accounting Professionals Choose These Templates

Precision Billing Without Manual Errors

Manual invoice creation increases error risk. Pre-designed templates ensure every detail is captured accurately, reducing disputes and maintaining your professional reputation. As an accounting professional, accuracy is your brand - your invoices should reflect that same attention to detail.

Improve Cash Flow with Faster Payments

Clear, professional invoices communicate value and encourage prompt payment. Transparent billing with itemized services leads to faster collections and improved cash flow. When clients understand exactly what they're paying for, payment disputes decrease and collection rates improve.

Save Time on Administrative Tasks

As an accounting professional, your time is valuable. Templates eliminate repetitive invoice creation, letting you focus on serving clients and growing your practice. The hours saved on administrative work can be redirected to billable client services or business development activities.

InvoiceOwl Invoicing Software vs. Free Invoice Template

Ready to move beyond templates? Free invoice templates are helpful, but InvoiceOwl's invoicing software delivers advanced features and complete automation. Transform your entire invoicing workflow.

Advanced Features for Accounting Professionals

Unlimited Invoice Sending - Send unlimited invoices with real-time delivery tracking. Monitor when clients receive and open your invoices for better follow-up timing.

Automated Payment Reminders - Never chase overdue payments manually. The system automatically sends professional reminders based on your preferred schedule.

Instant Downloadable Invoices - Professional PDFs at your fingertips, ready to send immediately after completing client work.

Automatic Receipt Generation - Receipts issue when payments clear, providing immediate confirmation to clients and maintaining organized financial records.

Comprehensive Reporting - Track sales, taxes, and revenue streams with detailed financial reports. Perfect for your own business accounting and tax preparation.

Client Management System - Secure storage for all client data, including contact information, service history, payment records, and communication logs.

Get Over the Manual Invoicing Process & Leverage the Benefits of Automation

From creating customized accounting invoices from scratch to easily tracking them and getting paid promptly, everything happens in just a few clicks with InvoiceOwl. Stop spending valuable time on manual invoicing tasks and focus on what you do best - providing exceptional accounting services.

Frequently Asked Questions

An accounting invoice template is a premade document layout that is simple to create, and easily editable as per your business fit. This pre-designed document should include all the core details relating to your accounting or bookkeeping business services. It should have all the relevant fields that help a professional accountant as well as the client to stay on the same page.

Here are the few accounting invoice types: basic invoice, standard invoice, automatic invoice, pro forma invoice, credit invoice, debit invoice, and mixed invoice.

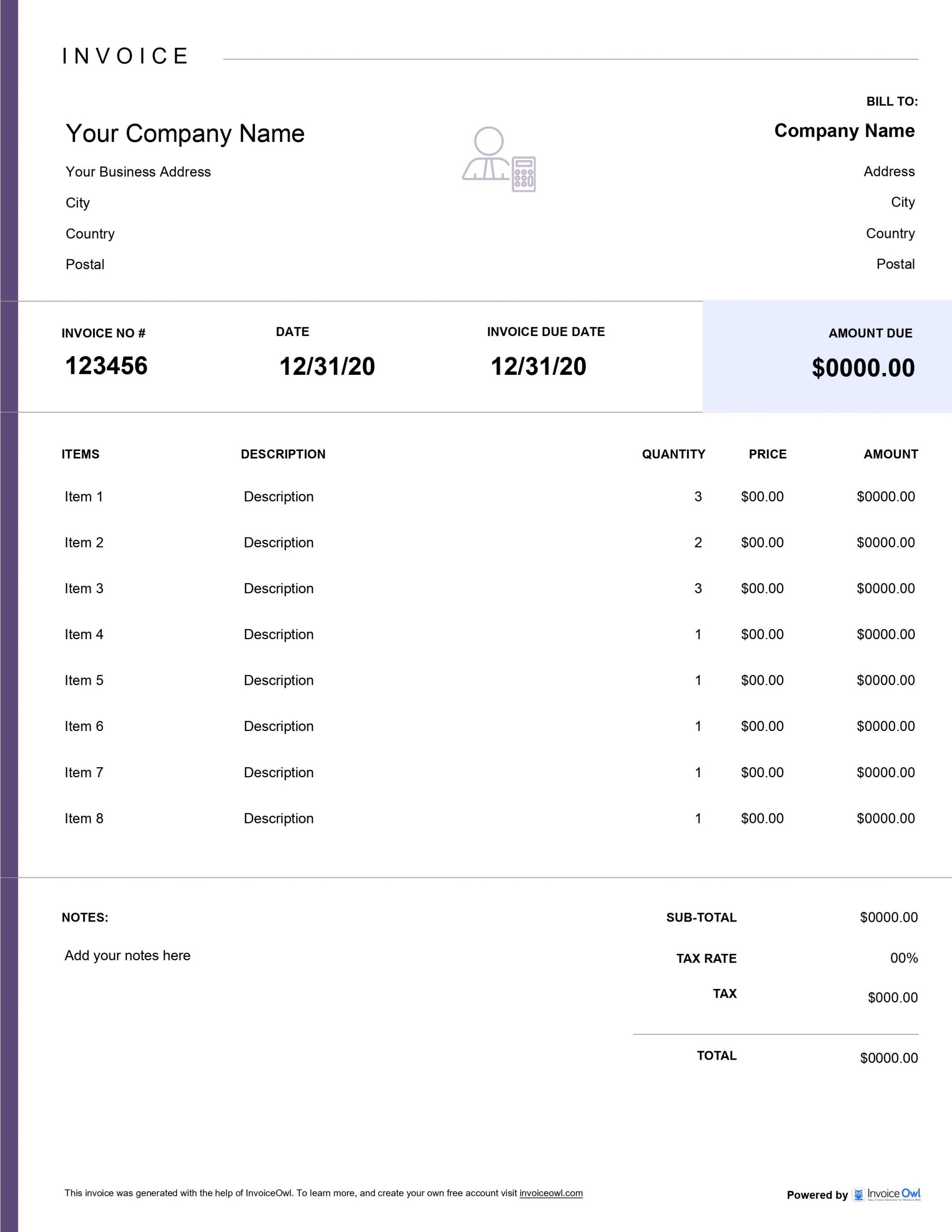

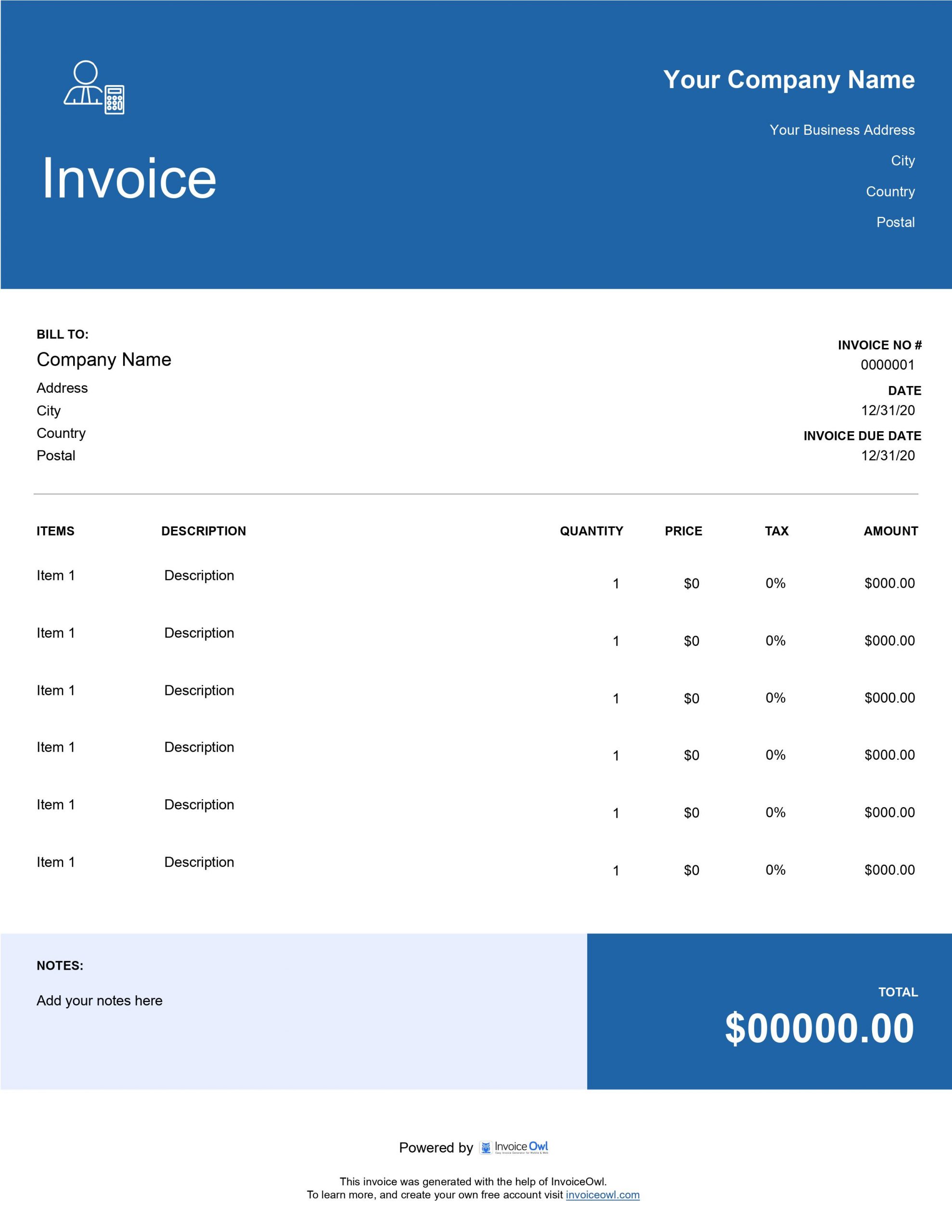

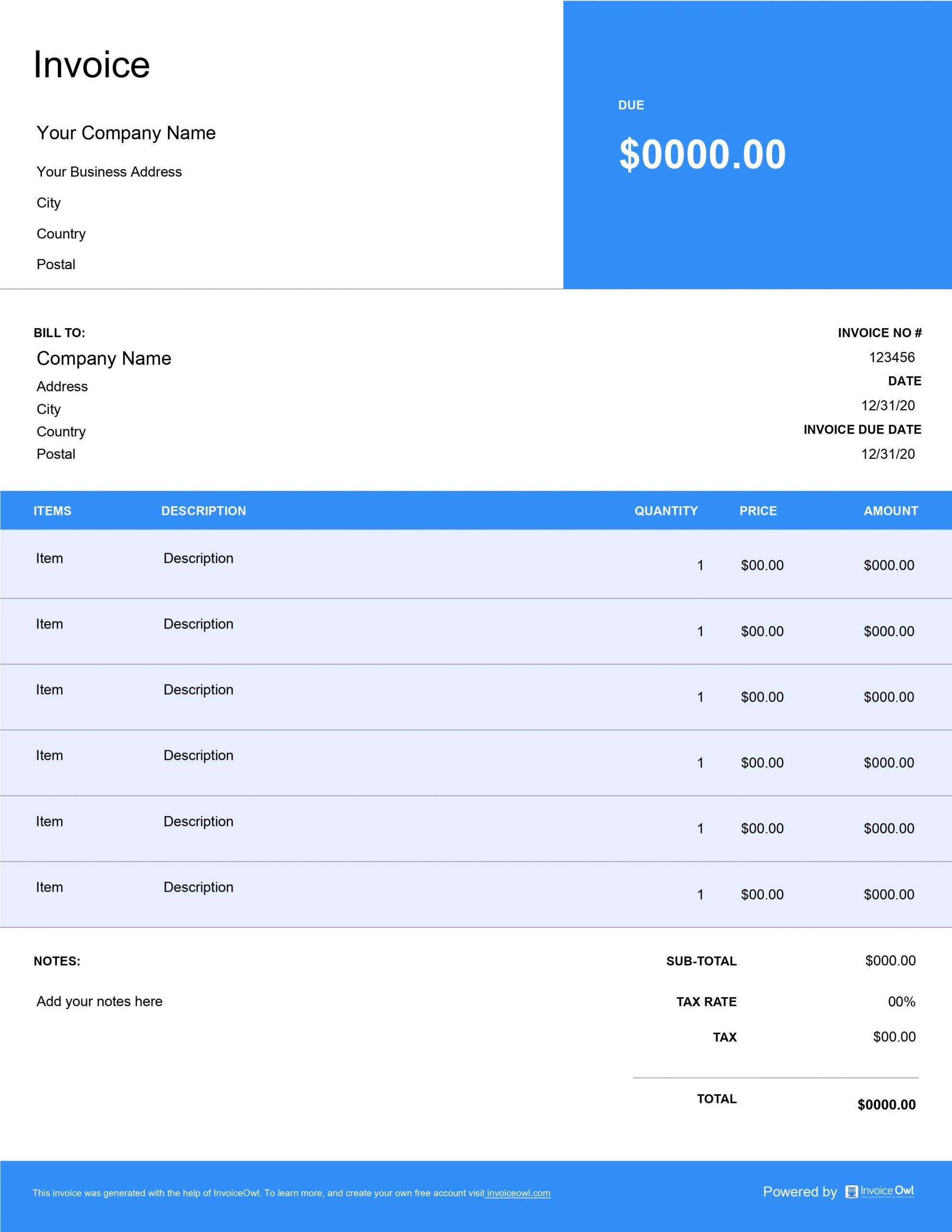

A professional invoice template for your rendered bookkeeping services can be customized as per your needs and preferences. First, select the preferred file format from the options available like Microsoft Excel, Microsoft Word, and Adobe PDF. Second, select the color that matches your brand. Finally, add, alter, or delete the fields as per your business specifications or the specialized services provided.

An accounting invoice template should include all the details relating to your accounting or bookkeeping business. This includes your company name, company logo, contact details, and email address. You should also include the client's name, address, contact information, and email address. The invoice should have an invoice number, invoice date, and invoice due date. Add a description of the accounting services provided, details of the pricing method either hourly pricing or fixed fee proposal, and detailed pricing structures of the services rendered. Finally, include specifications relating to payment terms or payment methods with any additional note on late fees or interest rates on delayed payments.

Word

Word Excel

Excel PDF

PDF All

All