Key Takeaways

- 01Receipts serve as proof of payment and record of business transactions

- 02There are 4 main types of receipts: cash register, carbon copies, handwritten, and packing slips

- 03Businesses must keep receipts for at least 3 years for audit purposes

- 04Receipts are essential for tracking expenses, tax compliance, and return policies

- 05Digital receipts help prevent manual errors like lost or damaged paper receipts

For any business, keeping a record of transactions is crucial. But why? It's because receipts serve as records and proof of payment, indicating that products and services were exchanged for money. Without receipts, you run the risk of the buyer, the seller, or your company being unable to show proof of payment or a business transaction that took place. This blog will explain in great detail what a receipt is, its many types, and why they are issued. Additionally, we will also provide an example to help you generate better receipts. Let's dive in!

Table of Content

- Definition of Receipt

- Types of Receipts

- Why Are Receipts Important?

- Why Are Receipts Issued?

- Receipt Examples

- Frequently Asked Questions

- Final Words

Definition of Receipt

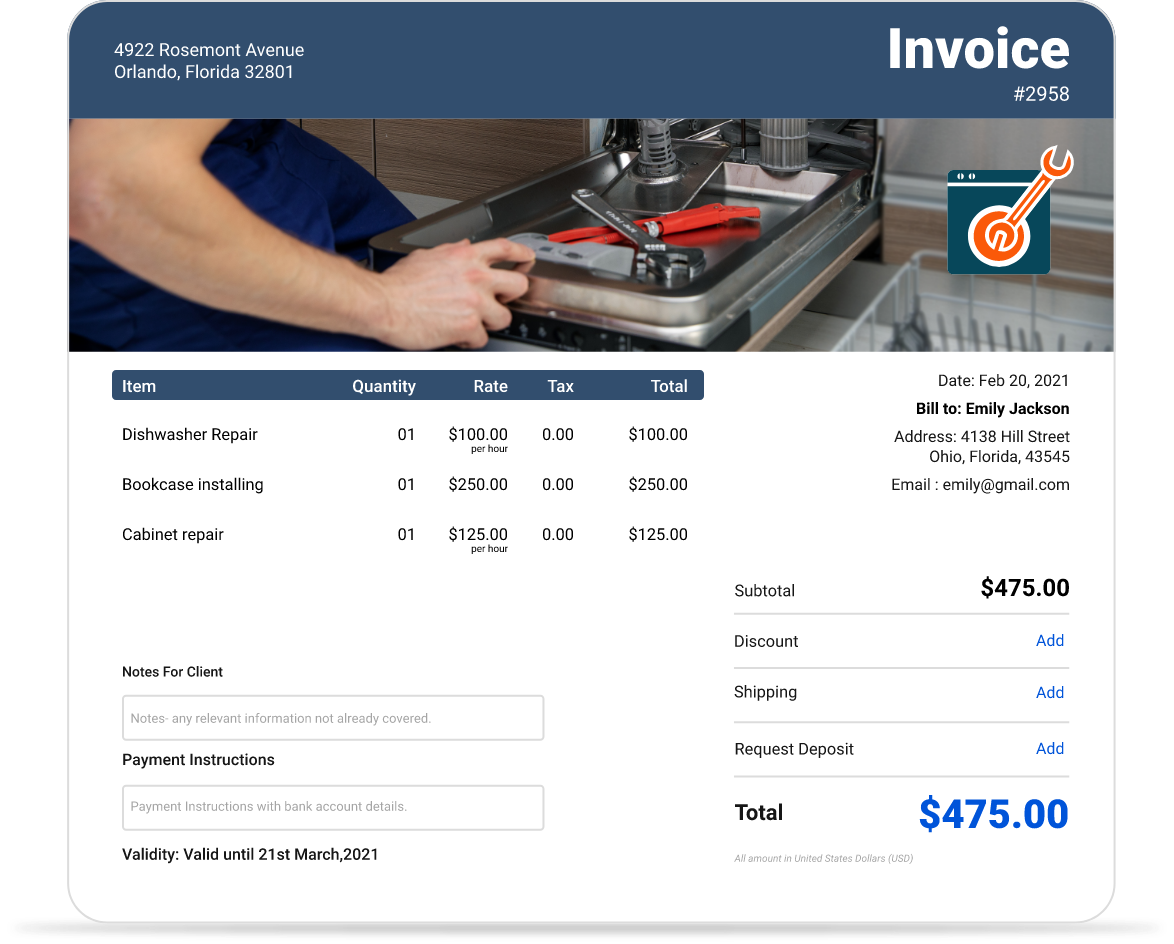

In essence, a receipt serves as proof of a transaction. After a customer has paid for the good or service they purchased from you, you offer them a receipt. Receipts contain details about the products or services that were sold, such as the cost, the quantity, any discounts, and sales tax. Additionally, they include information about the amount paid, the payment method, and details about the vendor.

In many instances, clients need receipts if they want to return or exchange a product. Since the receipt contains information about the products and their costs, you can confirm that the customer bought the item(s) from your business. To ensure accuracy, it's essential to know how to fill out a receipt properly, including all key details like the date, item description, and total amount paid.

Many companies have a return policy that states that clients must show a valid receipt to return an item. You must determine the sort of return policy you prefer:

- No returns are accepted without receipts

- For returns without receipts, offer store credit

- There is no need for receipts for returns

As a small business owner, you must save copies of customer receipts since they serve as records. Likewise, save every receipt you get from a vendor. Your accounting books' accuracy is ensured by such supporting documentation. Additionally, if you are audited, you require records and keep business receipts for a minimum of three years.

Keep business receipts for a minimum of three years. This protects your business during audits and ensures accurate accounting records.

Types of Receipts

For many different types of payments, individuals, businesses, and other organizations may provide a receipt. For instance, they might issue a receipt for a check, cash in hand, or an online bank transfer. The receipt serves as evidence of payment, not just for the seller but also for the customer. They are essential in the eyes of the tax authorities since they mandate that vendors pay the taxes on such sales.

The following are the various receipt types:

Cash Register Receipts

When a customer makes a purchase, they typically receive a printed slip of paper called a cash register receipt. You might be accustomed to this kind of slip from your regular grocery shop purchases.

Carbon Copies

This type of receipt is produced while the handwritten receipt is being written. Every receipt page in a receipt notebook has a carbon layer behind it. As a result, the vendor may trace the receipt onto the layer beneath and keep it.

Handwritten Receipts

This kind of receipt may be issued to customers by service providers outside of the retail setting. For instance, an electrician may give a client a handwritten receipt after repairing their home's plug outlets or wiring.

Packing Slips

Online sellers send out both an electronic receipt and packing slips, which are included in the product packages that customers order. Additional information, such as the return policy, can also be found on the packing slip.

Why are Receipts Important?

Receipts are essential so that businesses have proof of certain payments. Small businesses might generate receipts so that they can track their business operations.

Purchase receipts should include the payee's name, the amount paid, any canceled checks, and proof of payment through electronic fund transfers, among other things. These records help verify that purchases were essential for conducting business as well as the costs associated with them.

Why are Receipts Issued?

The following are some reasons why receipts are issued after purchases:

- To prove that the purchaser now owns the product or received a service

- It provides the purchaser with proof of their complete or partial payment

- It acts as ownership proof for insurance purposes

- It gives proof that if sales tax was already paid as part of the transaction, the purchaser is not required to pay it

- It can be used as the basis for an accounting entry to document an underlying transaction

- If the products are returned under warranty, purchasers may use the supplier's receipts as proof of delivery

The receipt is automatically generated by the seller using a cash register. However, there are also situations where the seller manually creates the receipt.

Imagine a customer purchases a laptop from your electronics store. When they provide the receipt, you can verify the purchase date, warranty coverage, and original payment amount. If the laptop malfunctions within the warranty period, the receipt serves as proof of purchase and enables the return or exchange process.

Receipt Examples

[This section would typically contain visual examples of receipts]

Automate Your Receipt Generation Today

Stop creating receipts manually and risking errors. InvoiceOwl helps you generate professional digital receipts in seconds, ensuring accuracy and easy record-keeping.

Start Your FREE TrialFrequently Asked Questions

Receipts are absolutely essential for all businesses. This is so that comprehensive and accurate documentation can be established. Receipts give businesses the ability to keep track of every expense they incur and serve as crucial supporting evidence for tax audits. You can easily create financial statements, track your deductible business expenses, and complete tax returns with accurate recordkeeping, which will help you monitor your company's financial performance.

A receipt frequently contains the following information:

- The date of the transfer

- A description of the good or service delivered

- The price of the items sold

- The amount of sales tax levied during the transfer (if any)

- The chosen mode of payment, such as cash or a credit card

An invoice serves as a payment request. After the client receives their product or service, you provide an invoice. A receipt, however, serves as proof of payment. After the client has paid for an item or service, you hand them a receipt. When a customer pays an invoice, they will also get a receipt. Clients who pay at the point of sale, on the other hand, will not receive an invoice.

Final Words

We hope this blog article helped you understand everything important about a receipt and why, as a business owner, you should keep track of receipts in your accounting records. Many businesses offer written acknowledgment as a customer receipt for money received. However, this can result in manual errors, leading to bad business since a written statement can get lost, smudged, or torn. The best way to prevent these situations is to opt for digital receipts. You can use a digital receipt maker and get your job done conveniently with automation.