Key Takeaways

- 01Credit memos are issued by sellers to show positive balances in customer accounts after transactions

- 02There are 6 main types: Price Dispute, Refund, Marketing Allowance, Internal, Bank, and Overstated Credit memos

- 03Price disputes and refunds are the most common reasons for issuing credit memos

- 04Internal credit memos are used for inventory tracking and remain with the seller only

- 05Bank credit memos are issued exclusively by financial institutions, not businesses

- 06Using credit memo software helps manage and track outstanding receivables efficiently

You own a credit note and you went to use it but found that it is invalid and got rejected; how frustrating that would be, right? It is not just a hypothetical example, even companies as large as American Airlines sometimes have a hard time.

"Once travel to the US reopened, we made plans to revive our trip in May 2022 – but AA would not accept our credit note... can you help?"

Read Gill Charlton's advice here https://t.co/wNpAZY33G9 — The Telegraph (@Telegraph) April 6, 2022

Thus, in this blog, we will discuss the types of credit memos and credit memo features. But, first, let's understand what is credit memo is in detail.

What is a Credit Memo?

The credit memo is an abbreviation of a credit memorandum. It is a form of a document issued by the seller of goods or services to the buyer to show a positive balance in the customer's account.

A credit memo is a formal document that reduces or eliminates the amount a customer owes. It's essentially an IOU from the seller to the buyer, representing money that can be used for future purchases or refunds.

Types of Credit Memos

There are multiple credit memos issued for diverse circumstances, let's see what are the types of credit memos.

Price Dispute Credit Memo

One of the most used and common reasons for issuing credit memos is price disputes. Several times, prices are changed after the transaction is done; for such a situation, the seller issues a credit note to the buyer.

For instance, the buyer company has purchased a good of $8000 from the seller company, before delivering of good the price of the good got reduced and now its price is $6000. Now the deal is done, the seller company will issue a credit memo of $2000 as a price dispute.

Refund Credit Memo

Not all days in business are successful and happy, right? Some days you have to deal with defective or damaged products and thus, you have to refund your customers. Now, once the transaction is sealed you cannot return it completely, so in this situation, a credit memo is issued. The reason for a refund could be also different like the wrong supplies or inappropriate goods.

Marketing Allowance Credit Memo

As a business owner, you may or may not be aware of the 4Ps (Price, Promotion, Place, and People) of marketing. But do you know there is a link between a marketing allowance and a credit memo? Yes, a credit memo can be issued by providing a marketing allowance to the buyer/ customer. In marketing allowance, you get a certain amount of discount and offer.

Internal Credit Memo

Internal credit memo is an alien term to many because not all business owners are aware of it. So, what is an internal credit memo? It is a form of document that is created to write off an outstanding receivable balance. The sole purpose of an internal credit memo is to keep track of inventory and that's the reason the copy remains with the seller and is not sent to the buyer.

Bank Credit Memo

A bank credit memo is a little different from other credit memos as it is issued by a bank only. A bank credit memo is a document sent by the bank after a customer deposits funds, earns interest, or receives a loan credit to their account.

Overstated Credit

An overstated credit memo is an accounting document issued when the price written in the invoice is incorrect or the reported amount is more than or less than the actual amount. This type of memo corrects billing errors and ensures accurate financial records.

Review your open credit memos at the end of each reporting period. This helps you see if customers owe money that can be linked to open accounts receivable, making future payment management more efficient.

Example of a Credit Memo

To understand it better, let's understand with credit memo assume. Company A is a seller and company B is a buyer. B has decided to purchase 50 units of goods for $5000. A few days later, B received the goods but founds out that some of them are defective. Some of them are wrong in size and some of them are damaged.

Now, following companies policies A cannot take goods back completely so A, being the seller issues the credit note with reduced payments of the actual money. The positive balance is the amount seller owes to the buyers.

Scenario: Company B ordered 50 units for $5000 but received some defective items.

Solution: Company A (seller) issues a credit memo for the defective items. If 10 units worth $1000 were damaged, Company B receives a $1000 credit memo. This credit can be:

- Applied to future purchases

- Used to offset the current invoice

- Refunded if requested

This maintains the business relationship while correcting the transaction error.

Moreover, the seller should review the open credit memos at the end of each reporting period. It will help them to see if the customer owes money that can be linked to open accounts receivable. The accounting software decreases the aggregate dollar amount of invoices outstanding and helps to manage future payments more efficiently.

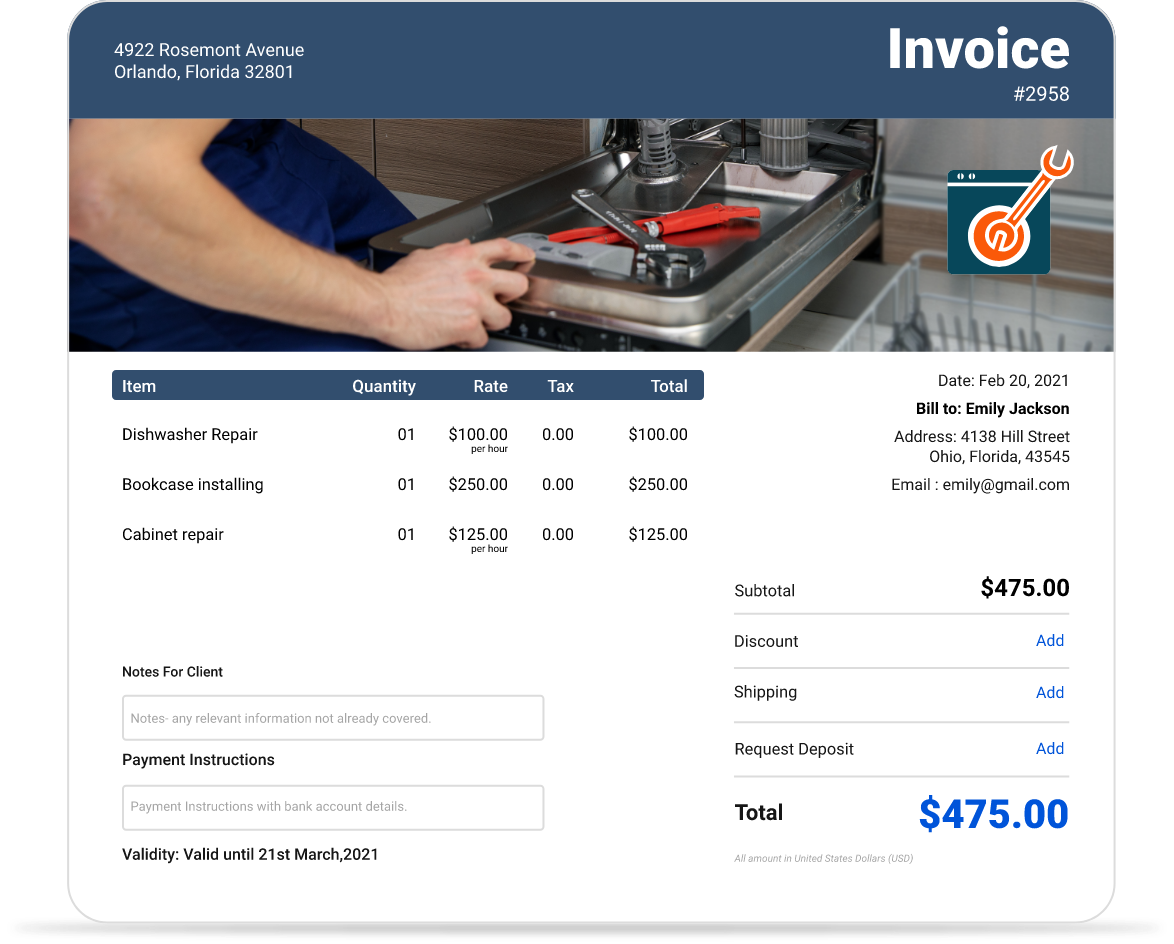

For a quicker process, try the word doc of credit memo template or download it directly:

Create Professional Credit Memos Online Easily

InvoiceOwl is feature-rich software that helps small businesses, freelancers, and contractors create credit memorandums and notes on the go and get paid quicker!

Get Started for FREEFrequently Asked Questions about Credit Memos

A credit memo reduces the amount a customer owes and represents money the seller owes to the buyer. A debit memo increases the amount a customer owes, typically used when there's an undercharge or additional fees need to be added to an invoice.

The validity period of a credit memo varies by company policy. Some businesses set expiration dates (commonly 30-90 days), while others allow credit memos to remain valid indefinitely. Always check the terms stated on the credit memo or your agreement with the seller.

No, a credit memo cannot be used as cash. It's a document that represents a reduction in what you owe or credit toward future purchases with that specific seller. However, in some cases, you may request a refund which would convert the credit into actual cash returned to you.

Yes, businesses should keep credit memo records for tax and accounting purposes. Credit memos affect your revenue and accounts receivable, which are important for accurate financial reporting and tax calculations. Retention periods typically follow standard business document guidelines of 3-7 years.

A complete credit memo should include: credit memo number, date of issue, seller and buyer information, original invoice number and date, reason for credit, itemized list of products/services being credited, amounts being credited, and any terms or conditions for using the credit.

Word

Word Excel

Excel PDF

PDF