Key Takeaways

- 01Sole proprietors run their own business and are personally liable for all debts and obligations

- 02Independent contractors work on a project basis for clients without being employees

- 03Both classifications require filing Schedule C and paying self-employment taxes

- 04Independent contractors have fewer legal protections but more flexibility than employees

- 05You can operate as both a sole proprietor and independent contractor simultaneously

With the rapid expansion of the gig economy, an increasing number of individuals are choosing to become their own bosses by launching small businesses. The initial question to ask is whether you should register as a sole proprietor or independent contractor.

It's important to know the difference, as each classification has different implications for taxes, liability, and other legal matters. In this post, we'll examine these two alternatives, sole proprietor vs independent contractor, and explain which one may be best for you.

Table of Content

-

What is the Difference Between a Sole Proprietor and an Independent Contractor?

-

Should You Operate as a Sole Proprietor, or Do You Qualify as an Independent Contractor?

-

How Do You Become a Sole Proprietor or Independent Contractor?

Who is a Sole Proprietor?

In contrast to more formal business structures like corporations and limited liability companies (LLCs), a single proprietorship consists of only one person running the show. You are considered a lone proprietor if you run a business for profit.

One-person businesses occasionally recruit independent contractors to conduct work and then issue them a Form 1099 at the end of the year. Income from a sole proprietorship is considered personal income by the IRS. In addition, you will be held personally liable for the company's obligations.

As a sole proprietor, you have complete control over your business, but you're also personally responsible for all business debts and liabilities. Your personal assets could be at risk if the business fails.

Who is an Independent Contractor?

Depending on the project, an independent contractor may work for a single employer or multiple businesses. A client of an independent contractor can give direction on the work to be done, but not on the timing or method of completion.

IT consultants, graphic designers, and web designers are just some examples of the many types of freelancers out there. A Schedule C is filed by independent contractors in the same way as Schedule C is filed by sole proprietors if no separate business entity has been formed.

Since independent contractors are exempt from having their salary withheld for FICA, Medicare, or Social Security, they must typically make quarterly anticipated tax payments throughout the year to cover their self employment taxes.

What is the Difference Between a Sole Proprietor and an Independent Contractor?

As a sole proprietor, you are self-employed and operating as an individual rather than as part of a company. This means you run your own company, making decisions, setting prices, and taking responsibility for profits and losses. You are personally liable for all business duties and liabilities.

On the other hand, an independent contractor is a person who contracts with a firm or an individual to deliver services on a contractual basis. An independent contractor is neither an employee nor subject to the same laws and regulations as workers. They are usually paid by job or project.

Difference in taxes

There are a few key differences between sole proprietors and independent contractors when it comes to taxes.

Tax Comparison: Sole Proprietor vs Independent Contractor

| Tax Aspect | Sole Proprietor | Independent Contractor |

|---|---|---|

| Self-employment tax | May deduct half of self-employment tax from business income | Responsible for paying own Social Security and Medicare taxes |

| Quarterly estimated taxes | Not required to file quarterly estimated taxes | Required to file quarterly estimated taxes |

| Home office deduction | Can claim home office deduction if using part of home for business | Generally cannot claim home office deduction |

| Business expense deductions | Can deduct business expenses from taxes | Can deduct business expenses from taxes |

-

For one, independent contractors are typically considered self-employed, which means they are responsible for paying their own Social Security and Medicare taxes. Sole proprietors, on the other hand, may be able to deduct half of their self-employment tax from their business income taxes.

-

Another key difference is that sole proprietors are not required to file quarterly estimated taxes like independent contractors are. This means that they may end up owing more money at tax time if they haven't been withholding enough from their regular paychecks throughout the year.

-

Moreover, while both sole proprietors and independent contractors may deduct business expenditures from their taxes, only sole proprietors may claim the home office deduction. If they use part of their house for business, they can deduct some of their rent, mortgage interest, utilities, and other domestic expenditures.

Difference in legal rights

There are a few key differences in the legal rights of sole proprietors and independent contractors.

Independent contractors have fewer protections under the law than employees do. This means that if an independent contractor is not paid for their work, they may have a harder time getting the money they're owed through the legal system.

- For one, independent contractors have fewer protections under the law than employees do. This means that if an independent contractor is not paid for their work, they may have a harder time getting the money they're owed through the legal system.

- Additionally, independent contractors are not entitled to most employee benefits, such as health insurance or paid vacation days.

- Another key difference is that sole proprietors are typically liable for their business debts and obligations, while independent contractors are generally not responsible for the debts of the company they work for. This can be a significant risk for sole proprietors, as they may be on the hook financially if their business fails.

- Lastly, independent contractors often have less influence over their work than sole owners. Clients may demand independent contractors to conform to strict regulations and deadlines, but sole proprietors can typically create their own schedules and work as they see fit.

Difference in liabilities

There are several key differences between sole proprietors and independent contractors when it comes to liability.

- For starters, sole proprietors are personally liable for the debts and obligations of their business. This means that if their business is sued or incurs debt, the sole proprietor is responsible for paying it off.

- On the other hand, independent contractors are not personally liable for the debts or obligations of their business. This means that if their business is sued or incurs debt, the independent contractor is not responsible for paying it off.

- Additionally, sole proprietorships are not separate legal entities from their owners, whereas independent contractors are separate legal entities from their businesses. This means that if a sole proprietor is sued, their assets are at risk.

- However, if an independent contractor is sued, only their business assets are at risk. Lastly, sole proprietorships can be dissolved at any time by the owner, whereas independent contractors cannot be dissolved without going through a formal process.

Pros and Cons of each

If you're thinking about starting your own business, you'll need to decide whether you want to be a sole proprietor or an independent contractor. There are pros and cons to both options, so it's important to weigh your options carefully before making a decision.

Here are some of the pros and cons of each:

Sole proprietor:

Pros of Sole Proprietorship

Complete Control: You are your boss and have complete control over your business. This can be a big advantage if you're the type of person who likes to be in charge.

Flexible Schedule: You can set your hours and work as little or as much as you want.

Low Start-up Costs: There are relatively few start-up costs and paperwork involved in setting up a sole proprietorship.

Cons of Sole Proprietorship

Full Liability: You are solely responsible for all debts and liabilities incurred by the business.

Personal Asset Risk: If the business fails, you may lose personal assets such as your home or car.

Growth Limitations: Sole proprietorships can be more difficult to grow and scale than other business structures.

Independent contractor:

Pros of Independent Contracting

Maximum Flexibility: As an independent contractor, you have more flexibility than a sole proprietor. You have the flexibility to work with multiple clients on a variety of projects.

Remote Work Options: You can often set your hours and work from home.

Limited Liability: You are not responsible for the debts or liabilities of the businesses you contract with.

Cons of Independent Contracting

Job Security: If your client decides they no longer need your services, you could find yourself out of work with little notice.

Inconsistent Income: You may have difficulty finding consistent work, especially in slow periods.

No Employee Benefits: You are not eligible for certain employee benefits, such as health insurance or paid vacation days.

Higher Taxes: Independent contractors typically have higher taxes than employees of traditional businesses.

Should You Operate as a Sole Proprietor, or Do You Qualify as an Independent Contractor?

It depends on your circumstances and your desired business arrangement. If you desire total control over your job and profits, being a sole entrepreneur may be your best option. However, if you desire greater stability and less personal liability, working as a freelancer may be a better option.

You are not restricted to either label. Many persons who are self-employed fall under the categories of sole proprietors and independent contractors, respectively.

A musician, for instance, may make a living through live performances, music tuition, and merch sales. Even if they haven't formally established their company if they're taking in money from their business they are treated as a sole owner.

This musician is acting as an independent contractor when they accept payment to create original music for a corporate video.

Those who choose to work as independent contractors or as sole owners are required to :

How Do You Become a Sole Proprietor or Independent Contractor?

There are a few key differences between sole proprietors and independent contractors.

- For one, independent contractors are usually hired to work on a specific project or task, whereas sole proprietors typically have their businesses.

- Independent contractors also typically have more control over their work schedule and working conditions than sole proprietors.

- Finally, independent contractors usually have to pay their taxes and benefits, while sole proprietors may be able to deduct some of their business expenses from their taxes.

Sole proprietor:

In the United States, the simplest and most prevalent business structure is the sole proprietorship. To establish a sole proprietorship, you must simply file a DBA (Doing Business As) name with the local authorities. To become a single owner, you do not need to file any paperwork or pay any costs.

Most states allow sole proprietorships to operate without registering. However, some sole proprietors make similar efforts to avoid a competitor adopting the same name. Registration, licenses, and a business bank account will help you attract investors and lenders and legitimize your business.

Independent contractor:

Independent contractors, on the other hand, are usually hired by another company or individual to complete a specific project or task. They're typically not employees of the company they're working for, and they don't receive any benefits like health insurance or vacation days.

Independent contractors usually work on a 1099 basis, which means they receive a Form 1099-MISC from the company they worked for at the end of the year instead of a W-2 form.

Legal Implications

There are a few key legal implications to take into account when determining whether an individual is a sole proprietor or an independent contractor.

Independent contractors are not protected under most employment laws, which means they are not entitled to things like minimum wage, overtime pay, sick days, or vacation days. They are also not eligible for unemployment benefits if they lose their job, and not covered by the employer's workers' compensation insurance policy.

- Firstly, independent contractors are not protected under most employment laws, which means they are not entitled to things like minimum wage, overtime pay, sick days, or vacation days.

- Secondly, independent contractors are also not eligible for unemployment benefits if they lose their job.

- Finally, because independent contractors are not considered employees, they are also not covered by the employer's workers' compensation insurance policy.

Must I file paperwork to make my sole proprietor business official?

Most states allow sole proprietorships to operate without registering. If your business doesn't sell regulated goods or services, you don't need a business license or government agency registration. Freelance medical professionals, for instance, must be certified to practice in their discipline.

However, some sole proprietors make similar efforts to avoid a competitor adopting the same name. Registration, licenses, and a business bank account will help you attract investors and lenders and legitimize your business.

Must I file paperwork to be an official independent contractor?

Independent contractors and their clients should agree in writing on the work, rate, and duration. With the aid of a written independent contractor agreement, the hiring firm and the contractor can establish their relationship as that of an independent contractor as opposed to that of employer and employee.

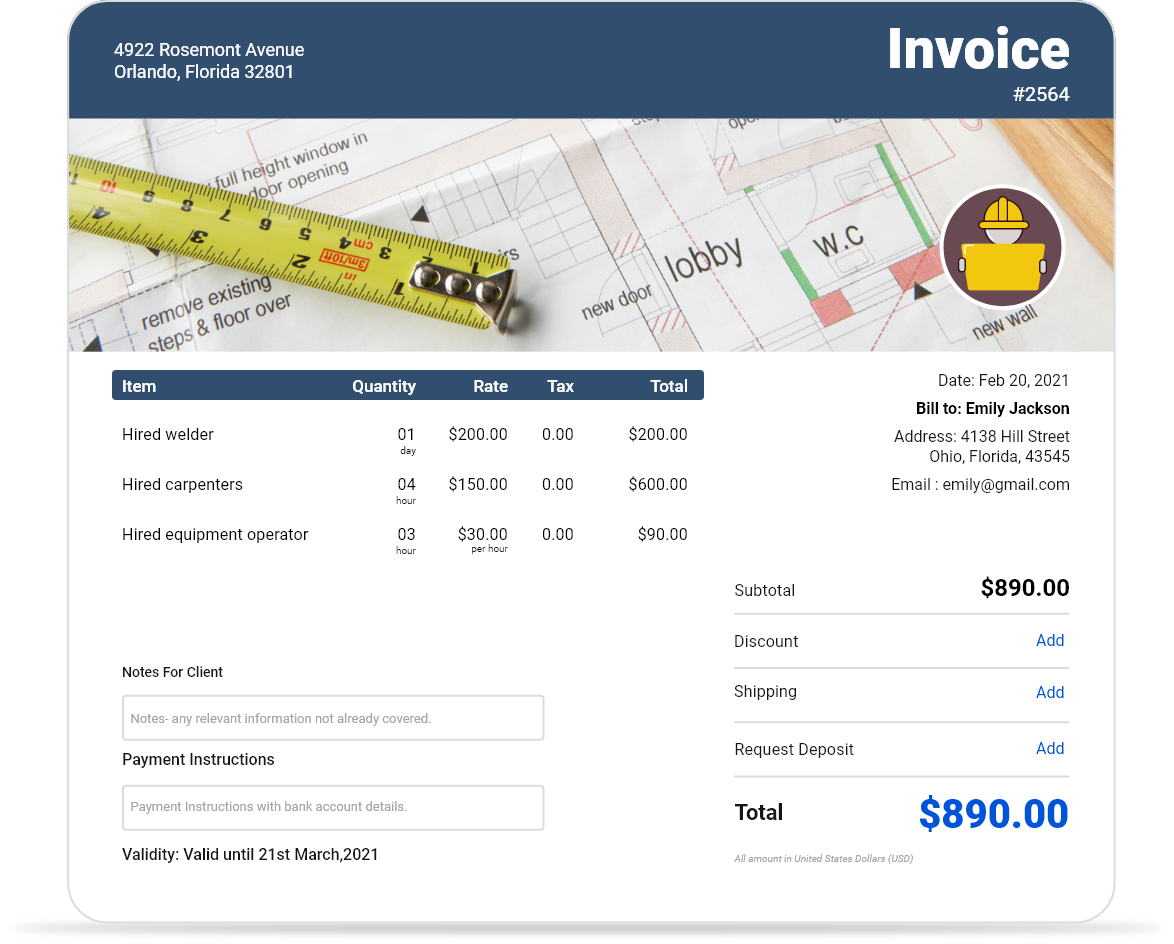

Streamline Your Invoicing and Accounting

Whether you're a sole proprietor or independent contractor, InvoiceOwl helps you create professional estimates and invoices, making your accounting as smooth as possible.

Start Your FREE TrialFrequently Asked Questions

Yes, an independent contractor can be fired by the company they contract with. However, the company must have a valid reason for firing the contractor, such as failure to meet deadlines or poor quality of work.

A sole proprietor is considered self-employed because he or she does not employ anybody else. You are considered self-employed if you own and run your firm.

Employees have certain rights that independent contractors do not, such as the right to minimum wage and overtime pay, protections under anti-discrimination laws, and workers' compensation if they are injured on the job.

Conclusion

We hope this article has provided a good overview of the differences between sole proprietors and independent contractors. Both a sole proprietor and independent contractor are viable options for setting up your own business, although they come with different levels of responsibility and taxation.

It is important to understand the distinctions before you decide which option is best for you so that you can make an informed decision about how to set up your business. Regardless of what option you choose, we wish you success in achieving your entrepreneurial goals!

As an independent contractor or sole entrepreneur, it is essential to remain on top of bills to ensure prompt payment and to avoid leaving money on the table. However, invoice tracking can be time-consuming. InvoiceOwl, a web-based estimate & invoice application, streamlines invoice management and payment.