Key Takeaways

- 01Sales orders track customer requests and manage inventory before delivery

- 02Invoices are payment requests sent after products or services are delivered

- 03Sales orders are generated early in the purchase process; invoices come at the end

- 04Both documents require different information and serve distinct accounting purposes

- 05Automation can streamline the management of both sales orders and invoices

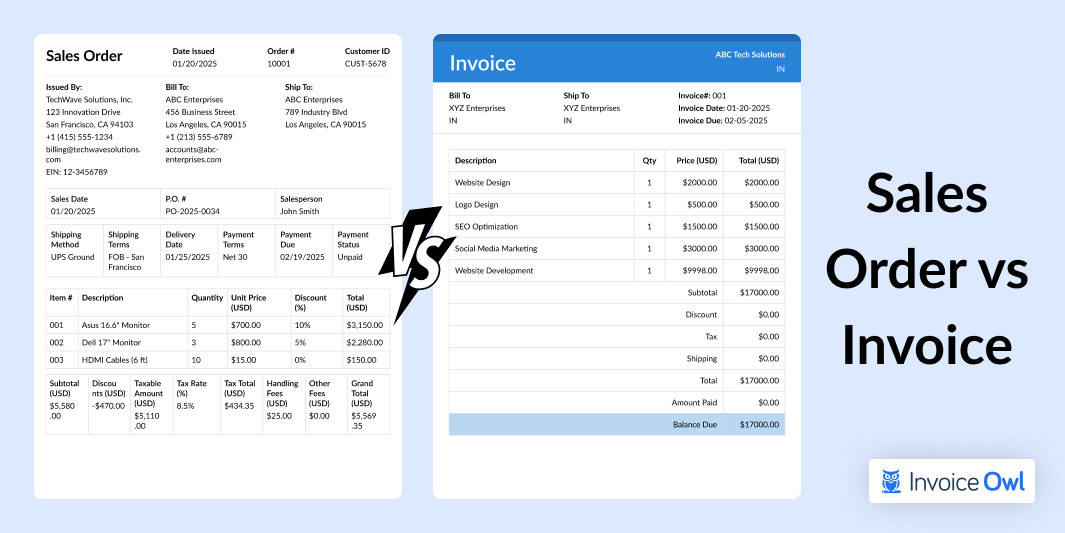

When it comes to accounting, both sales orders and invoices help businesses for the sales processes to progress seamlessly. Although customers use these terms interchangeably, there are unique differences that separate one from the other in terms of business transactions.

Have you ever thought about these financial terms—sales orders vs invoices while doing business? These are significant sections of the procurement process. Let us explore them in detail and what the key differences are between them.

Table of Content

- What is a Sales Order?

- What is an Invoice?

- Key Differences Between a Sales Order and an Invoice

- Compliance to Consider for Invoice and Sales Order Processing

- How to Effectively Manage Sales Orders and Invoices?

- Mastering Sales Orders and Invoices for Business Success

- FAQs

What is a Sales Order?

A sales order is a file that offers the details of an order and the guidelines for the transaction. It helps organizations save data about their customer and their requested order, referred to while the order is being prepared.

Furthermore, it also guarantees the delivery of the business's services requested. Once the product is delivered and picked up by the customer, this is now used as a receipt to check whether the right order was delivered to the customer.

After a sales order has been placed, the company needs to ensure that it has the adequate workforce or supplies to offer this service or not. If the business is capable of fulfilling its request, the person in charge sends a copy of the sales order to the customer for order confirmation. Another order copy is generated to trigger the process.

Key elements of a sales order

Let us take a look at the components that constitute the sales order.

Such elements are distinct from a sales invoice form. It is important to note that some of the items on this list may overlap with an invoice. However, not all of them, so try to know the fundamentals to keep your solopreneurship successful. Now that you understand the elements that make up a sales order, let us look at the types of sales orders.

Types of sales order

In standard business terms, there are four different types of sales orders.

Cash Sales

This type of sales order allows a customer to place, pick, and pay for an order. Just like the name, customers pay for orders through cash. Hence, the seller adds no accounts receivable for them. Replacing them, they add the order directly into the cash account. Although traditionally done in cash, in the U.S., businesses often process such transactions with credit cards, debit cards, or Apple Pay and PayPal.

Scheduling Agreement

A scheduling agreement is the type of sales order that specifies the delivery dates and goods quantities. The business accepts these deliveries as general deliveries. Such an order type is an external agreement that displays all the data as schedule lines. Industries such as manufacturing, automotive, and wholesale supply chains in the United States prefer establishing a scheduling agreement with their parts supplier for monthly deliveries.

Rush Sales Order

Once the order is placed as a rush sales order, the clients expect products quicker than general. Either the company delivers the goods, or the customers can pick them up themselves. Either way, the order is delivered to the client quicker than usual. The clients can defer their payment at a later date. The most fascinating example is Amazon, which utilizes rush orders through services like Amazon Prime Same-Day Delivery.

Third-Party Sales Order

This type of sales order does not deliver the products directly to the customer. Instead, a third-party vendor delivers them to the designated customer and generates the receipt. Majorly, American small and medium-sized businesses use services like Amazon FBA (Fulfillment by Amazon), Shopify Fulfillment, or FedEx Drop Shipping to manage third-party sales orders.

Purchase orders vs sales orders

There is a huge misconception that both purchase orders and sales orders are the same in the business world. However, there is a thin line of difference between the two.

A purchase order is a document sent by the company to its vendor requesting different goods and services. Furthermore, the vendor generates a sales order, sends it to the customer to confirm the request, and turns it into an invoice. Hence, the customer creates a purchase order, and the vendor turns it into a sales order in response to the purchase order. This is how sales order vs purchase order is differentiated.

Knowing about the sales order is just the half of the equation to follow. It is important to understand invoices too for mastering business transactions. For operating successfully in the U.S., businesses must know both the terms to scale and thrive.

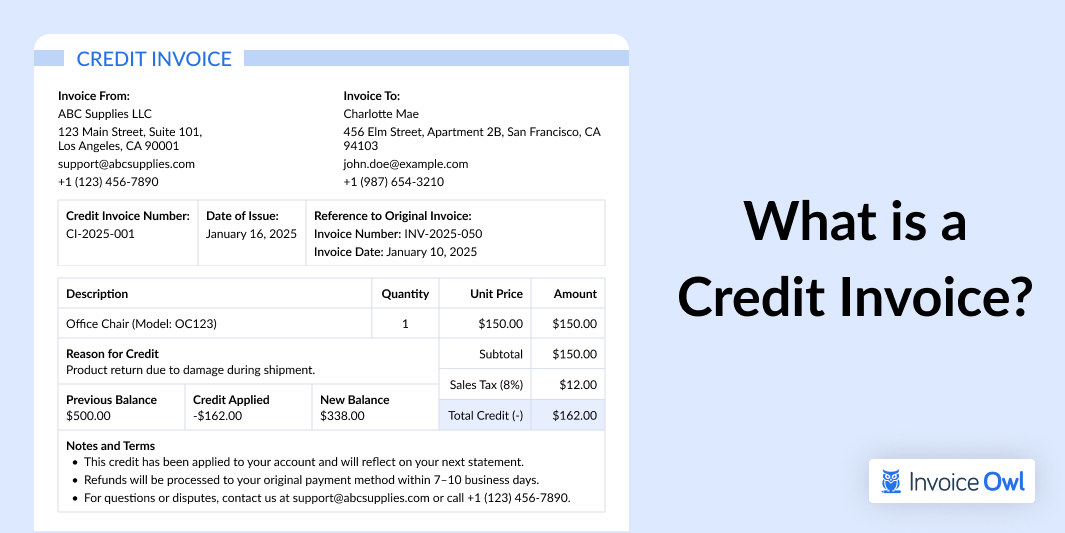

What is an Invoice?

An invoice is a document that notifies the customer that payment is due. This commercial record lets you know the costs required for certain services and goods. It is also called a 'bill' or a 'tab'. The invoice is sent to the customer once the product is delivered or the service is rendered.

The data stored in a sales invoice serves as a reference in case the seller finds errors in the billing.

Key elements of an invoice

Some of the major elements that make up an invoice include:

These elements constitute a complete commercial invoice that fills all the elements required to keep the payment of the designated services in check. Let us look at the different types of invoices involved in a business.

Types of invoices

Although there are multiple types of invoices in the business world, we will examine three of the most utilized ones. Here are the following:

1. Pro forma invoice

Unlike a traditional invoice, a pro forma invoice isn't a payment for a demanded document. It is similar to a pre-invoice. It offers a predictable cost of products once the order is delivered. It includes the same details as a final invoice. However, it only allows users to adjust or change any discrepancies in the billing amount before the final billing gets ready.

This invoice is commonly used in international trade. When the company outlines the expected costs for customs purposes and during large B2B transactions. It is used for clarity, which is essential to maintain before finalizing terms.

2. Interim invoice

Large project management can be complex to deal with at times. This is where interim invoices come in handy. These invoices split the total cost into smaller units of payments issued at multiple stages of the project. By dividing payments, businesses maintain their cash flow consistently, ensuring smooth project execution.

Widely used in industries such as construction, software solutions, and marketing agencies across the U.S. to manage varied and multiple project deliverables.

3. Final invoice

Once a product is sold, the final invoice comes into play. It contains all the details a customer needs, like the amount they are paying for the different items delivered to them. Additionally, it also includes information such as the different payment options and payment deadlines by staying transparent in the process.

E-commerce businesses, service providers, and wholesalers are a few of the sectors that are frequent users to prepare final invoices for transactions and provide complete clarity to customers.

Key Differences Between a Sales Order and an Invoice

Although both these elements are necessary for a business to flow smoothly, some businesses only utilize either of the two. Understanding the differences between the two helps all accounts payable transactions run seamlessly.

Let us take a look at some of these differences and determine their importance.

Sales Order vs Invoice Comparison

| Attribute | Sales Order | Invoices |

|---|---|---|

| Purpose | Track orders and manage inventory to fulfill the given orders | Serves as a receipt and monitors payment due in the accounts record |

| Timing | Generated early in the purchase process when the customer places an order | Generated at the end of the purchase process after delivering products/services |

| Role in Accounting | Utilized internally to manage required goods | Found in accounting as it is related to finances and payments |

| Action Required | Needs order fulfillment and helps plan future inventory needs | Requires payment from customers to track outstanding payments |

| Goods or Services | Only utilized for goods, service-based companies ignore sales order | Applicable for all business types for both goods and services |

| Document Date | Highlights when the order processing begins | Displays billing date and payment date after 30 days |

| Information | Shipping info, deposit, balance, and signatures | Tracking number, item descriptions, and payment gateways |

| Workflow | Generated once a quote is accepted | Generated once the sales order is completed |

Compliance to Consider for Invoice and Sales Order Processing

Since your business must be legal to exist, there are certain legal factors to consider when processing sales orders and invoices. Let us take a look at them.

Regulatory compliance in invoice factoring

While factoring an invoice, businesses must ensure the goods they are selling can be resold legally. Hence, the goods must comply with the safety standards in the USA. For example, goods like electronics must meet FCC regulations, and food products must comply with FDA guidelines.

E-Invoicing standards

Replacing traditional paper methods and going digital with invoice processing can improve the compliance standards of the business. Furthermore, it also enhances the functionality and payment processing rate, and needs to comply with the IRS guidelines too.

Digital validation laws

Turning digital for invoice processing implies that U.S. bodies like UETA and E-SIGN will overlook your transactions. These government bodies ensure that the online invoices sent to the customers hold the same value as their paper counterparts.

How to Effectively Manage Sales Orders and Invoices?

Regardless of the differences between the sales orders and invoices, one of the striking similarities is their management. With automated workflows, businesses can manage both sales orders and invoices conveniently. Let us view the main elements of the sales orders and invoices that can be automated below:

Tracking the Sales Order

Completing all the deliveries without much inconvenience is the key to maintaining strong customer relationships in a business. Delays can lead to unreliability. Hence, automation simplifies this process and keeps customers updated. Furthermore, it also offers real-time monitoring of the order status through the procurement cycle.

3-Way Matching

Matching invoices, purchase orders, and delivering goods is a time-consuming task if done manually. Hence, automation can save hours of time and effort, along with eliminating any risks of mistakes or fraud in the process. Automated workflows can also handle 2-way, 3-way, and 4-way matching with better precision.

Invoice Scanning

Just as in the step above, manually entering invoice details into the accounting system enhances the chances of errors and mismatches. This process can be automated through OCR (Optical Character Recognition), which will confirm accurate data, save time, and eliminate expensive errors.

Invoice Approval

Before payment, invoices require approval that includes different types of reviews based on the cost. Automation simplifies this process by ensuring precise verification and timely reviews. Advanced tools notify approvers about the pending tasks, speeding up the approval cycle.

Automated workflows can reduce invoice processing time by up to 80%, eliminate human errors, and provide real-time visibility into your sales and payment cycles.

Mastering Sales Orders and Invoices for Business Success

Since technology has taken automation to the next level, it is easy to manage sales orders and invoices conveniently. Now that both sales orders and invoices are clear to you, executing payment processing must be simpler than before. It is for you to decide if you want to use one or the other or both.

For businesses that prioritize efficiency, InvoiceOwl simplifies your operations. It is a free invoice generator app that provides templates with custom information details that need to be entered. Besides this, it also provides templates for estimates and quotes along with a purchase order generator to streamline the business process.

Streamline Your Sales Orders and Invoices Today

Stop juggling between sales orders and invoices manually. InvoiceOwl automates your entire workflow, from order tracking to payment collection.

Start Your FREE TrialFrequently Asked Questions

An invoice requests a payment, whereas a sales receipt is utilized as proof that the necessary payment has been made. It confirms that the customer received the purchased goods or services along with the agreed compensation.

An invoice is a payment request however, an order acknowledgement is written proof that the order has been accepted. Once the order has been received, the customer is expected to pay for the goods/services rendered and hence can expect to receive a bill.

Yes, a sales order can be legally binding once the seller accepts it. It demonstrates a signing agreement between the buyer and the seller, highlighting the purchase terms, and containing the products or services, pricing, and delivery details.

Once the sales order has been created, the customer can receive an order confirmation with the agreed conditions. Furthermore, the order moves to fulfillment where goods are prepared for shipping. Once the order is fulfilled, the seller creates an invoice requesting payment from the buyer.