Key Takeaways

- 01A remittance address is a specific address designated for receiving payments and invoices, separate from your general mailing address

- 02Using a remittance address reduces payment errors and prevents costly delays in business transactions

- 03Remittance addresses facilitate faster payment processing and improve fraud prevention

- 04ACH remittance allows businesses to accept electronic fund transfers for domestic transactions

- 05Clearly labeling invoices with 'Remit to:' ensures payments reach the correct destination

Have you ever sent a payment to a company, only to wonder if it's going to the right place? This is where the remittance address comes into the picture—a specific address, which is meant to receive payments, invoices, and transactions.

A remittance address is an important terminology for small businesses and solopreneurs to ensure payments are processed effortlessly. It is also one of the best ways for individuals to eliminate costly errors in international payments and domestic money transfers.

But have you ever wondered why the remittance address is so important for business?

To know that you will have to read our detailed blog on remittance address meaning, their importance, examples, and their role in business.

Table of Content

- What is a Remittance Address?

- Why Opt for a Remittance Address Instead of a Billing Address?

- What is the Importance of a Remittance Address?

- How Does a Remittance Address Look?

- What is ACH Remittance Address?

- What is a Remittance Bank Account Address?

- How to Find the Bank's Remittance Address?

- Why Should You Consider Having a Remit Address for Your Business?

- Role of a Remittance Address in Payment Management

- FAQs

What is a Remittance Address?

A remittance address is a distinct address used by an individual or a business to receive payments. Organizations generally use these addresses to receive payment overseas and invoices via mail. There is no such limit as to what address to use. Some individuals use their residential address, while others opt for a P.O. Box or an alternative location.

Therefore, small business owners must know the term, 'remit to address' or 'remit address' while transaction.

Several businesses use remittance bank addresses and payment processing centers to receive their payments. The address of these payment processing centers can be termed as a remittance address.

- Remittance address is helpful not just for sending and receiving payments, but also for organizing things perfectly

- Simplifies the process of receiving payments and invoices for businesses

Why Opt for a Remittance Address Instead of a Billing Address?

Remittance addresses are a great choice for organizations with larger transaction volumes. Additionally, they help in processing more payments effortlessly. Last but not least, it ensures that all the important invoices are safe among the general mail received by your business.

What is the Importance of a Remittance Address?

A remittance address eases the process of invoice tracking and managing them. Furthermore, it also has many other advantages, as listed below:

1. No payment errors

Mistakes in payment processing result in costly delays and damaged business relationships.

Offers clarity in situations where businesses have different mailing and payment addresses. This is mostly observed across law firms and government contractors in the U.S., often using separate remittance addresses to handle payment communications efficiently. This eliminates the risk of incorrect payments and ensures that the payments are sent to the correct location.

2. Facilitation of payment processing

With a specific remittance address, you can streamline your payment process by clarifying where invoices or payments are to sent.

This works great for businesses dealing with large transaction volumes or international clients, such as logistics firms or e-commerce retailers. It reduces the administrative burden and ensures quicker processing of funds.

3. Tax purposes

Accurate bookkeeping is quite important for ensuring tax compliance with U.S. regulations.

The address comes in handy to offer accurate payment records to simplify tax filings and audits. Additionally, it also makes sure that all the incoming payments are documented properly to ease the process of reconciling accounts and fulfilling tax obligations as per Internal Revenue Service (IRS) requirements.

4. Fraud prevention

By stating a clear remittance address, you can reduce the risk of unauthorized transactions or payments being intercepted.

A specific address provides an extra layer of security, which builds confidence and trust among both the sender and the recipient. For instance, a tech startup processing subscription payments can use a P.O. Box as its remittance address to protect sensitive payment details.

5. Easy tracking

With the help of a designated remittance address, you can track your payments effortlessly.

Additionally, it also eases the process of monitoring and verifying payments and ensuring all invoices are settled on time. Having such a level of transparency resolves any dispute seamlessly.

6. Prevent late payment

Miscommunication is one of the major causes of late payments. But, with a remittance address, you can eliminate this confusion and ensure timely payments.

This specifically helps service-based businesses like HVAC contractors or accounting firms to maintain their cash flow and avoid any potential late payment penalties.

How Does a Remittance Address Look?

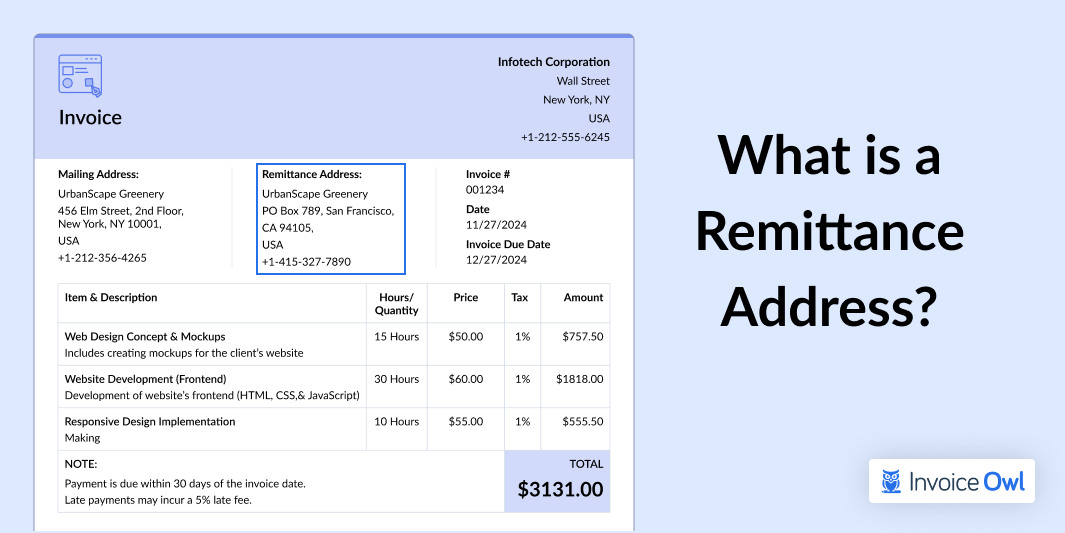

A remittance address seems quite similar to a regular mailing address. The only difference between the two is the prefix remit, which is important in the remittance before the address.

Ensure to label the address with the prefix - "Remit to:" to mention where the payment is to be sent. There are times when you might come across an international address, even in this case you need to use it like a normal mailing address in the recipient country.

Don't confuse the remittance address with the corporate mailing address of your business. Don't send the payments or invoices to the corporate address unless told to do so. Always look for the term "remit to:" address that should be listed on your invoice.

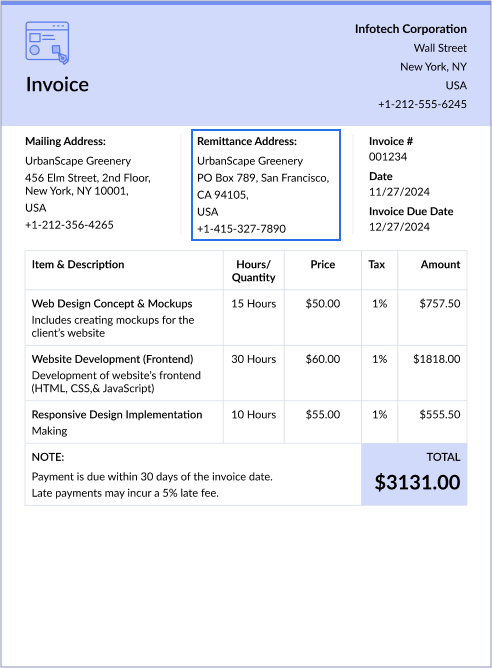

Remittance address example

Mailing Address vs Remittance Address

| Type | Address Details |

|---|---|

| Mailing Address | UrbanScape Greenery 456 Elm Street, 2nd Floor, New York, NY 10001, USA |

| Remittance Address | UrbanScape Greenery PO Box 789, San Francisco, CA 94105, USA |

As you can see, there are two different addresses above. Any invoice or payment should be sent to their remittance address in San Francisco. If you are working with clients using remittance address information, you can choose our professional template for invoices.

What is ACH Remittance Address?

ACH or Automated Clearing House is a particular format of Electronic Fund Transfer (EFT) network. It is generally used for transferring money all across the United States. There are two types of ACH transactions, direct deposits and direct payments.

Online payment with your bank account or depositing a paycheck directly is performed through an ACH network. This system is quite similar to paper checks, where a person or an institution's signature is important for authorizing the transaction. Several payment applications use the ACH network when payment transfers are locally or domestically done.

To facilitate an ACH transaction, you need to add the important information as follows:

With ACH transaction acceptance, you open doors for broader opportunities to grow your business, irrespective of its size. Additionally, it is also one of the easiest and most cost-effective ways for owners of firms or individuals to send money.

What is a Remittance Bank Account Address?

A remittance bank account address is the physical address related to the bank account used for receiving payments. It is generally meant for financial transactions while sending or receiving international money transfers to ensure the funding route is correct.

This address acts as a reference point for the bank with the recipient's account. It might be the location of the bank's branch where the account was opened or a centralized processing address for payments.

Adding a remittance bank account address is important for wire transfers, direct deposits, or cross-border payments to avoid delays and ensure accuracy. In several cases, a remittance address also complements other essential payment details like the account number, routing number, or SWIFT code to create a complete profile for seamless transaction processing.

How to Find the Bank's Remittance Address?

It is quite simple to find a remittance address. All you need to do is follow the steps mentioned below:

Review your bank statement

Generally, most organizations put out their remittance address on monthly addresses or account summaries.

Go through the bank's website

Most of the banks have their remittance address added in the section - "Contact Us" or "Help" on their official website. If required, you can also add a new remittance address while editing the bank details.

Call customer support

In case, you are not able to find the address on the online platform, contact the bank's customer service.

Look at payment instructions

If you have got the bill or an invoice from the bank, the remittance address will be included in the payment instructions.

Inquire at your local branch

Go and visit the bank's branch and ask the representative for the remittance address.

Why Should You Consider Having a Remit Address for Your Business?

If you are a small business owner, such as a local retail shop, or a service provider, like a cleaning company, with a general mailing address receiving a lot of invoices and payments, then you must consider having a specific remit address.

With this, you will be able to ensure everything is organized and also eliminate missing out on important payments.

If you receive payments and invoices via a remittance address, follow these steps:

- Initiate changing your existing billing forms, websites, business cards, and other important fields to reflect the address change

- Maintain that receiving address and keep checking it regularly

- When you have just changed the address, ensure to keep checking your old address as a client might accidentally send a payment there

Role of a Remittance Address in Payment Management

A remittance address plays an important role, particularly for U.S. businesses navigating high transaction volumes. With a clear distinction of where payment should be sent, it ensures accurate and timely payments for both businesses and individuals, respectively. In addition, sending the payment and invoice to the recipient's remittance address provides accuracy. It streamlines the overall scenario of processing payments and enhances financial organization for businesses handling multiple transactions.

Basically, it protects against potential fraud—a growing concern in today's digital landscape.

Whether the remittance address is different from your general mailing address or integrated into your online invoicing software, a clear remittance address streamlines payments and builds trust between payers and recipients.

With a proper understanding of the remittance address, you can implement it effectively to avoid any payment delays and optimize your payment management process.

Say Goodbye to Payment Confusion!

Add your remittance address effortlessly on every invoice with InvoiceOwl. Make it easy for clients to send payments without any confusion or delays.

Start Your FREE TrialFrequently Asked Questions on Remittance Address

The most important key terms in a remittance address are 'Remit to', 'remit address', and 'billing address'. The term remit is about telling the customer about the place for sending payments. The remit address refers to your organization and requests the preferred payment destination. Last but not least, the billing address is associated with the payment destination.

There are two types of remittances, inward remittance and outward remittance. The term inward remittance refers to getting funds acquired locally or from offshore locations or accounts. The term outward remittances refers to the transfer of funds to the recipient in the country or internationally.

The term remittances are about sending money across different countries, settling invocies, and fulfilling obligations. On the other hand, payment is all about transferring money from one party to another in exchange for goods and services.

As per U.S. regulations, the tax payment on remittance is dependent on the context. Suppose the remittances represent income, then it is taxable and must be reported to the IRS. Nevertheless, remittances given as gifts to friends or family are not taxable for the recipient. But, if the gift amount exceeds more than the annual exclusion limit of $17,000, then the sender might be subjected to pay gift tax.

A fulfillment address is generally used for delivery logistics to indicate where the goods or services are to be shipped. On the other hand, a remittance address is used in financial transactions where payments are sent for the settlement of invoices or bills.

A remittance advice address is the place where the recipient wishes to receive the remittance advice documents. Generally, this specific document comprises important payment details, like an invoice number or account information, to confirm and track the settlement of outstanding amounts.

A payment remittance email address is an email meant for sending payment proof or remittance advice. This mail address ensures that the payment details and confirmations are sent to the correct department or not.