Key Takeaways

- 0149% of small business owners face overdue payment issues that hurt their cash flow

- 02Send payment reminders at strategic times: 3 days before, on due date, 3 days after, 1 week after, and final notice

- 03Professional payment reminder templates save time while maintaining client relationships

- 04Always include specific invoice details, payment methods, and clear next steps in reminders

- 05Polite but firm language is essential for effective payment collection without damaging relationships

According to a recent survey by pymnts.com, 49% of small business owners suffer from overdue payments. The good news is that there is a quick fix: payment email reminder templates. The only problem while writing a reminder email is you don't have to be pushy and harsh, plus you have to maintain professionalism and be polite.

To help you increase your collections without stress, we've prepared editable email templates for payment reminders. Our templates are professional-looking, simple to use, and adaptable, so you may change them to meet your particular business needs. With our editable email templates, say goodbye to late payments and hello to a healthier cash flow.

5 Types of Payment Reminder Emails: Which Email to Send When?

Getting timely payments could be a once-in-a-blue-moon situation, but chasing payments becomes routine. And every time, you could not simply send just a friendly reminder; you must have strictly communicated with your customers.

Keep reading this section to know what those different email templates are and when you should send them.

First Payment Reminder Email (3 Days Before the Due Date)

This is the initial payment reminder mail. Basically, a first interaction with your customer for the upcoming payment of contracting jobs. In this scenario, as a business owner, your reminder message for outstanding payment should have polite and professional language. The objective of this email is to get paid on time before it becomes an overdue invoice.

On-due Date Payment Reminder Email

Just like the first template, you have to be polite and professional on the payment due date. This reminder serves as a gentle nudge that the payment deadline has arrived.

Overdue Payment Reminder Email (3 Days Post Due Date)

Third payment reminders will be the late payment reminder emails, where payment has been delayed or crossed the due date. In these overdue payment reminders, you will see a polite and firm tone with the goal of encouraging a customer to pay as soon as possible.

Final Payment Reminder Email (1 Week After the Due Date)

Even after reminding the overdue payment, if you still haven't received payment, then this time, you have to be firm yet polite when drafting the next mail. It is a late payment reminder email. The message tone used for reminding the email should indicate urgency, which will result in the customers paying the invoice immediately.

Past Due Payment Reminder Email

Past due email reminders are sent when immediate actions are required. It is the final notice where you notify your customers about the consequences they may face if failed to pay an unpaid invoice on time. The tone should be firm and professional, mentioning invoice amount and payment options.

First Payment Reminder Email (3 Days Before the Due Date)

This is the initial payment reminder mail. Basically, a first interaction with your customer for the upcoming payment of contracting jobs. In this scenario, as a business owner, your reminder message for outstanding payment should have polite and professional language. The objective of this email is to get paid on time before it becomes an overdue invoice.

Subject: Friendly Reminder for Outstanding Payment

Dear [Client Name],

Just a reminder that your first payment is due on [Due Date].

Let us know if there are any issues or if we can assist in any way.

Thank you

[Your Name]

On-due Date Payment Reminder Email

Just like the first template, you have to be polite and professional on the payment due date.

Subject: Last Day to Pay [Invoice Number]

Hi [Client Name],

I hope this email finds you well. I wanted to bring to your attention that the payment for Invoice [Invoice Number] is due on [Due Date]. The total amount due is [Amount].

You can make the payment easily and securely through our online payment portal or via [Payment Method].

If you have any questions or need any assistance, please don't hesitate to reach out to me. I would be happy to help.

Thank you for your prompt attention to this matter. I look forward to receiving your payment soon.

Best regards,

[Your Name]

Overdue Payment Reminder Email (3 Days Post Due Date)

Third payment reminders will be the late payment reminder emails, where payment has been delayed or crossed the due date. In these overdue payment reminders, you will see a polite and firm tone with the goal of encouraging a customer to pay as soon as possible.

Subject: Outstanding Payment for [Invoice Number]

Dear [Client Name],

We noticed that your payment of [Amount] is now overdue.

Could you please let us know when should we expect to receive payment or resolve any issues that need to be addressed?

Thank you for your prompt attention to this matter.

Warm regards,

[Your Name]

Final Payment Reminder Email (1 Week After the Due Date)

Even after reminding the overdue payment, if you still haven't received payment, then this time, you have to be firm yet polite when drafting the next mail. It is a late payment reminder email. The message tone used for reminding the email should indicate urgency, which will result in the customers paying the invoice immediately.

Subject: Avoid Late Payment Fees for [Invoice Number]

Dear [Client Name],

This is a final reminder that your remaining balance of [Amount] is due on [Due Date].

Please let us know if there are any issues or if we can assist in any way.

Thank you for your prompt attention to this matter.

Best regards,

[Your Name]

Past Due Payment Reminder Email

Past due email reminders are sent when immediate actions are required. It is the final notice where you notify your customers about the consequences they may face if failed to pay an unpaid invoice on time. The tone should be firm and professional, mentioning invoice amount and payment options.

Subject: Past Due Payment Alert: Your Balance is Overdue

Hi [Client Name],

I hope this email finds you well. I wanted to follow up on the late payment for Invoice [Invoice Number] in the amount of [Amount]. Our records indicate that this payment is now [Number] days overdue.

I understand that sometimes payments may be delayed, but I wanted to remind you that prompt payment is essential to maintaining a healthy business relationship. As a friendly reminder, our payment terms are [Payment Terms].

If you have already made the payment, please accept my apologies for the inconvenience and disregard this email. If not, I would be grateful if you could take the necessary steps to make the payment as soon as possible. You can do so by [Payment Method].

Please don't hesitate to contact me if you need any assistance or have any questions. I am here to help in any way I can.

Thank you for your prompt attention to this matter.

Best regards,

[Your Name]

5 Benefits of Payment Reminder Templates

Benefit #1: Time-saving templates

Using customizable payment reminding email templates, allows you to send reminders without having to start from scratch each time. To match the needs of your contracting business, you can easily make minor alterations to pre-written templates, which will save you time and eliminate your tension.

Benefit #2: Elevates professionalism

Customizable reminder templates for missed payments contribute to your professionalism. You can make sure that your reminders are well-organized, understandable, and professional by using a pre-written template, which will assist in creating a favorable impression of your company.

Benefit #3: Increases efficiency of reminders

Customizable emails can help to increase the persuasiveness of your reminders. You have a better chance of succeeding if your email is precise, appropriate, and organized.

Benefit #4: Increases brand identity

Emails that can be customized aid in increasing brand consistency. Utilizing a prewritten payment reminder email template will help you make sure that your reminders adhere to the tone, style, and messaging of your brand, enhancing your company's reputation and increasing client recognition.

The main benefits of using editable reminder templates are those listed above. You may improve the efficiency of your company overall and improve your chances of receiving payments on time by sending payment emails.

Now that you know how advantageous it is to use reminder templates for overdue payments, let's also know a few effective tips to implement when creating late payment reminder emails.

Set days and customized email templates through InvoiceOwl to send your customer who didn't pay on time. Automation saves hours of manual follow-up work while ensuring no payment slips through the cracks.

6 Payment Reminder Email Best Practices

Do you feel frustrated when your sent payment reminder goes unnoticed?

We've got your back!

With these best practices for writing efficient payment reminder emails that get results, it's time to step up your strategy.

1. Attention-worthy subject line

An email's subject line should be precise so that it instigates your customers to open your email and check. That's the main reason you must write a clear subject line that prompts your customers to see what's inside the reminder email.

Some examples of clear subject lines:

- Payment Reminder: Due Date Approaching

- [Client Name], Don't Miss Out on Payment Due Date

- Quick Payment Request: Invoice [Number]

- Payment Reminder: Your Balance is Overdue

- [Client Name], Act Now to Avoid Late Payment Fees on Invoice [Number]

2. Be polite & professional

When sending invoice reminders, your tone should be friendly and polite. You don't have to be aggressive or harsh, or rude when asking for payments on reminder emails. Always start with a warm welcome to maintain a good rapport with your customers.

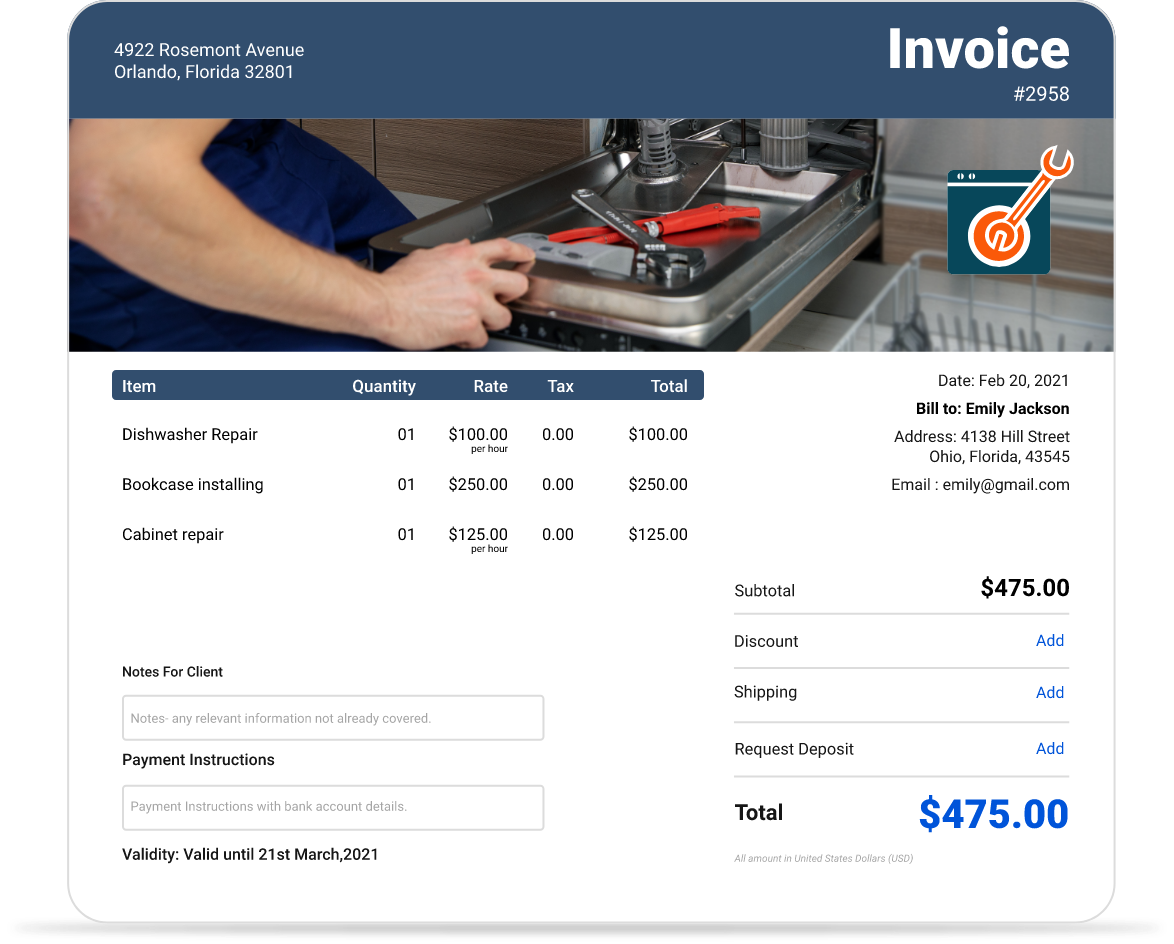

3. Add specific information

Payment reminder emails should not beat around the bush. You have to mention all the payment details that make your customer understand the overdue payment. Make sure you state the invoice number, invoice date, payment due date, payment terms, outstanding balance, late fees or penalties if any, accepted payment methods, bank account, and copy of the original invoice.

4. Add payment methods

Always make sure that you add all the available payment options in the payment reminder email. It will help your customers to directly click on the available link to get you paid faster.

5. Be clear with your next steps

Along with a friendly reminder email for timely payment, you must also be clear about your next steps. For instance, when are you sending a follow-up email, or what would be your next actions if your customer fails to clear the overdue invoice? The clear indications of the steps you are about to take enhance the likelihood of prompt payment.

6. Add a button to redirect customers

A call-to-action button should be added at the end of your email with the text "Pay Now" or "Avoid Late Fee."

With these best practices, you may encourage prompt payments from your clients. Now take a look at some template examples and situations so that you know which one to send and at what time.

Never Chase Payments Manually Again

Sign up for InvoiceOwl and automate your payment reminders with customizable templates. Set it once, and let the system handle follow-ups while you focus on growing your business.

Start Your FREE TrialFrequently Asked Questions

To streamline the current payment process, you must engage in routine follow-up reminders, phone calls, and in-person meetings to track down late payments. By using editable payment reminder templates, you would clear the outstanding invoices and receive payments more efficiently without starting from scratch each time.

Make sure your emails are personalized and polite and have a clear call to action to increase the effectiveness of your payment emails. A subject line should be personalized and actionable, a message that is clear and succinct, and the inclusion of payment information are all examples of best practices for writing efficient payment reminder emails.

It entirely depends on your clients' payment behavior. There are different ideal times to send payment reminder emails. The most efficient timing for sending such reminders is generally a few days before the due date, on the due date, 3 days after, and 1 week after. Sending past due payment emails is also advised if the payment is severely past due.

It is advised to follow up with a phone call or in-person meeting if your customer ignores your payment reminder emails. As a final resort for past-due payments, you can hire a collection agency to collect payment or consider legal action depending on the amount owed.

While chasing payments, it becomes difficult to maintain relationships with your clients. You have to be polite and firm in your wording when you are drafting reminders or messages. Using professional templates helps maintain consistency and professionalism while preserving the client relationship.

Conclusion

Late payments can be a serious trouble to your business's cash flow and operations. Chasing them could be an added headache. But with editable templates, late payment would be a thing of the past. These payment collection templates politely send kind reminders to customers, allowing them to take action. Eventually, it will benefit you in getting payments by using tailored subject lines and a friendly tone.

If you don't even want to indulge yourself in writing and sending "payment is due" reminders, you can subscribe to InvoiceOwl. It has automated payment reminders with which you can set the time, customize the message, and send it to your client. Besides, you can even relieve yourself from time-consuming tasks like estimating and invoicing. Explore InvoiceOwl now.