Key Takeaways

- 01Form 1099-NEC is used to report payments of $600 or more to independent contractors

- 02Businesses must file 1099 forms by January 31st of the year following payment

- 03Independent contractors are responsible for paying their own taxes and quarterly estimated payments

- 04Properly classifying workers as contractors vs employees is crucial to avoid IRS penalties

- 05Keep accurate records of all contractor payments and their tax identification numbers

Are you an independent contractor who needs to know more about the 1099 form? Understanding this form is essential for independent contractors, as it helps them keep track of their income, federal income tax, and other financial information.

Continue reading and learn more in this comprehensive guide to the independent contractor 1099 form.

Table of Content

- Who is an Independent Contractor?

- What is an Independent Contractor 1099 Form?

- Why is the Independent Contractor 1099 Form Needed?

- How to File an Independent Contractor 1099 Form?

- When to File an Independent Contractor 1099 Form?

- Who Must File an Independent Contractor 1099-MISC Form?

- Where Does The Independent Contractor 1099 Form Come From?

- How to Prepare the Independent Contractor 1099 Form?

- What is a Self-Employed Individual's Social Security Number?

- FAQs

- Conclusion

Who is an Independent Contractor?

Finding out who qualifies as a true independent contractor is crucial. The Internal Revenue Service (IRS) gives clear criteria for identifying an independent contractor as an employee.

As an employer, you should use these guidelines to determine who qualifies as an independent contractor for purposes of filing a Form 1099. The following questions must be answered to identify an independent contractor:

- How an employee does his or her job in terms of behavioral control?

- Do you have a say in how much money is spent on the employee's project? When a task needs to be completed, who is responsible for providing the necessary resources? And do you get to say which costs get paid back?

- Do you have a formal agreement outlining your working conditions? What, if any, insurance, paid time off, or retirement benefits does the employee have access to?

What is an Independent Contractor 1099 Form?

Self-employed people and those who perform contract work for others must use IRS Form 1099 to report income and other details. More than twenty distinct 1099 forms are in use today. Formerly known as the 1099-MISC, the 1099-NEC is now the standard form for reporting payments to independent contractors.

There are other uses for Forms 1099 than reporting compensation to independent contractors. Prizes, state tax refunds, and interest payments are all other ways that freelancers might bring in cash. Form 1099-MISC is used to record income from these sources.

Since form 1099-NEC is the most common type of 1099 that an independent contractor may encounter, that is what this article will cover in depth.

Why is the Independent Contractor 1099 Form Needed?

As an independent contractor, you may be required to file a 1099 form with the IRS. The 1099 form is used to report income that is not subject to withholding tax. This includes income from freelancing, consulting, or other self-employment activities.

Establishes Clear Agreements

The first section of the form is devoted to establishing the necessity of the form. In summary, the form establishes an agreement between you and the hiring party that specifies each party's obligations and expectations. This helps prevent future misunderstandings and disputes.

Collects Essential Information

The form also serves as a way for the hiring party to collect important information about you, such as your contact information and Social Security number. This information is necessary to process payments and comply with tax laws.

Provides Legal Protection

Lastly, the form protects both you and the hiring party by clearly defining the terms of your working relationship. This can be especially helpful if there are ever any disagreements or issues that need to be resolved.

Why do we need a 1099-NEC form?

On IRS Form 1099-NEC, your clients or customers will report payments made to you as a freelancer or independent contractor.

- It is typical to receive the form for payments in excess of $600.

- The IRS uses these documents to certify your status as an independent contractor, assess your taxable income, and determine your annual tax burden.

Although independent contractors are not responsible for submitting Forms 1099-NEC on behalf of their clients, it is important to follow up if you do not receive these forms from your customers to complete your tax returns.

It is important to keep in mind that as an independent contractor, you are responsible for making anticipated quarterly payments of income tax, even though the majority of 1099-NEC forms do not withhold taxes.

How to File an Independent Contractor 1099 Form?

If you're an independent contractor, you may be required to file a 1099 form. Here's what you need to know about how to file an Independent Contractor 1099 form.

To file a 1099 form, you will need the following information:

Once you have gathered all of the required information, you can file your 1099 form online or by mail. If you choose to file online, you will need to create an account with the IRS. State income tax filings by mail are simple - just print out the form and send it to the IRS.

If you earn $600 or more from a company in a year, that company is required to send you a 1099 form by January 31 of the following year. The 1099 form will show the total amount of money you earned from the company in the previous year.

You should receive your 1099 forms by early February. If you don't receive them by then, contact the companies that should have sent them to you.

When to File an Independent Contractor 1099 Form?

If you are a business owner, you will need to file a 1099 form to receive payments for your services. This form is used to report income that you have earned from working as an independent contractor.

Once you have your 1099 forms, it's time to file your federal payroll taxes. You'll need to use independent contractor tax form 1040 (the individual tax return) and Schedule C (the profit or loss from business) when filing your income taxes as an independent contractor.

Be sure to keep good records throughout! There are a few things that you will need to know to properly fill out the 1099 form.

- First, you will need to know your social security number or tax identification number.

- You will also need to know the name and address of the company that you worked for as an independent contractor.

- Finally, you will need to know the amount of money that you earned from working as an independent contractor and the quarterly estimated tax payments.

The 1099 form must be filed by January 31st of the year following the year in which you performed the work as an independent contractor. For example, if you worked as an independent contractor in 2023, you would need to file your 1099 form by January 31st, 2024.

Who Must File an Independent Contractor 1099-MISC Form?

The answer to this question depends on a few factors.

Type of Work Performed

If the work is considered 'nonemployee compensation,' then the payer is responsible for issuing a 1099-MISC form. This includes payments made to independent contractors, attorneys, and other professionals.

Payment Amount Threshold

If the total amount paid to the worker throughout the year is equal to or greater than $600, then the payer is required to provide a 1099-MISC form to the worker.

Special Cases

Finally, there are some special cases where a payer may be required to issue a 1099-MISC form even if the payments don't meet the thresholds mentioned above. For example, if rent is paid to a real estate professional who is not an employee of the property owner, then a 1099-MISC must be issued.

In general, it's best to err on the side of caution and issue a 1099-MISC form whenever payments are made to nonemployees for services rendered. This will help avoid any penalties or fines that may be assessed by the IRS.

Where Does The Independent Contractor 1099 Form Come From?

It is important for consultants to comprehend the origin of their 1099 form as well as the functions it serves. The 1099 form is an Internal Revenue Service (IRS) tax form that is used to report income that is not subject to withholding.

Form 1099-NEC must be filed for independent contractors or freelancers paid $600 or more. The IRS requires your organization to prepare and return this document to a non-employee independent contractor. The IRS requires contractors to file Form 1099-NEC for royalties over $10.

This means that the consultant will be responsible for paying their taxes on the income earned from consulting work. The 1099 form is typically sent out by the company or individual that the consultant worked for during the year.

The form will show the total amount of money paid to the consultant during the year, as well as any other relevant information about the income earned.

How to Prepare the Independent Contractor 1099 Form?

To prepare the form, start by clearly defining the project scope and deliverables. Then, determine the compensation you will offer for the services rendered. Be sure to include any deadlines or milestones in the agreement as well.

Once you've drafted the contract, have both parties sign and date it. Make sure to keep a copy for your records. Here are a few tips on how to get it done:

Gather All Necessary Information

This includes the name, address, and social security number or taxpayer identification number of each person or company you paid $600 or more during the year.

Fill Out the Form Completely

Be sure to include all required information, such as your business name and address, as well as your EIN (Employer Identification Number).

Make Copies for Your Records

Make copies of the form for your records and for each person or company you paid $600 or more to during the year.

Send Forms by Deadline

Send the forms out by January 31st of the year following the tax year in which the payments were made. For example, if you made payments in 2024, you would need to send out the forms by January 31st, 2025.

What is a Self-Employed Individual's Social Security Number?

It's safe to assume that you're self-employed if you're an independent contractor. It's up to you to pay your share of taxes and social security. For governmental services and taxation, you'll be identified by your SSN.

When you file your taxes, you will need to include your social security number on your tax return. You will also need to use your Social Security number when you apply for a business license or permit.

It is important to keep your social security number safe and secure. You should never give your social security number out to anyone unless you are sure that they need it and will use it appropriately.

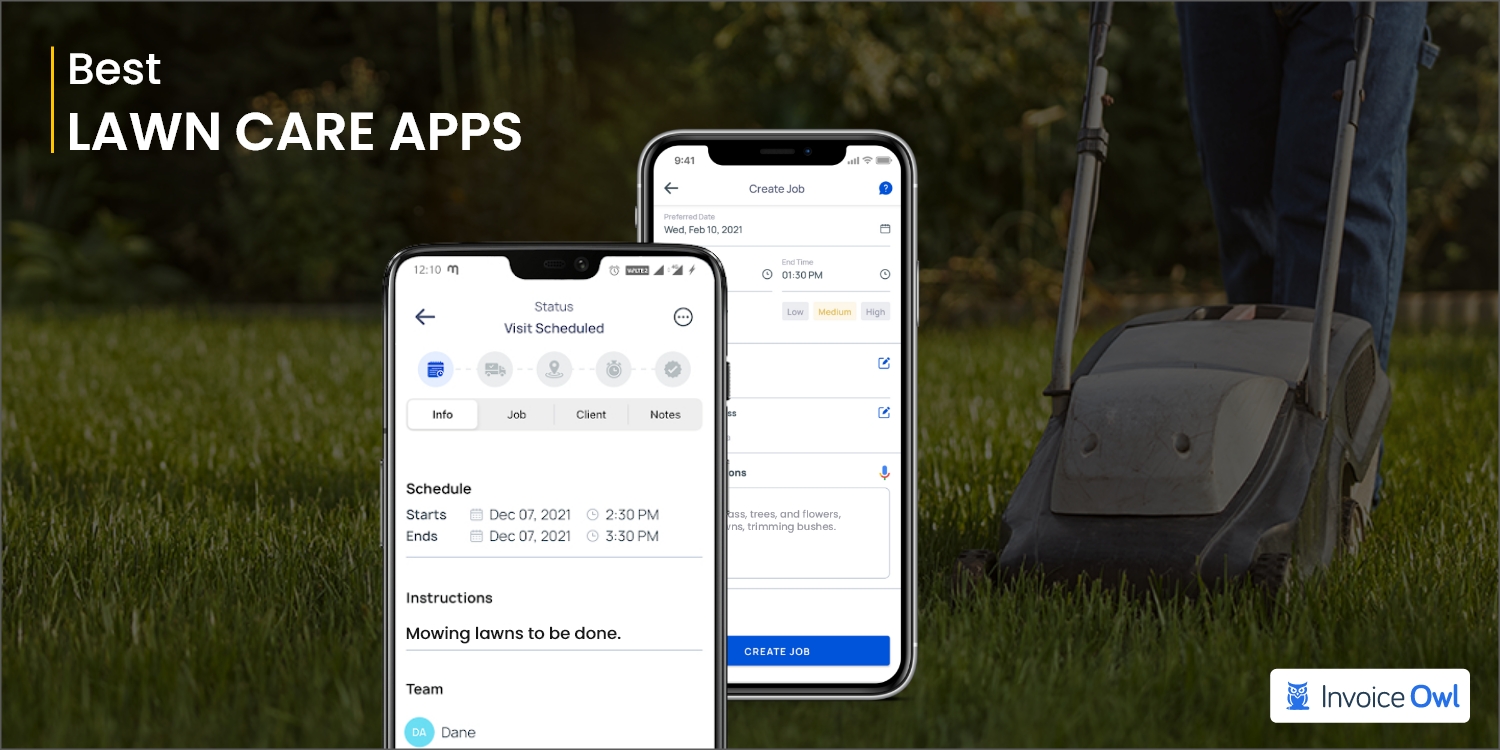

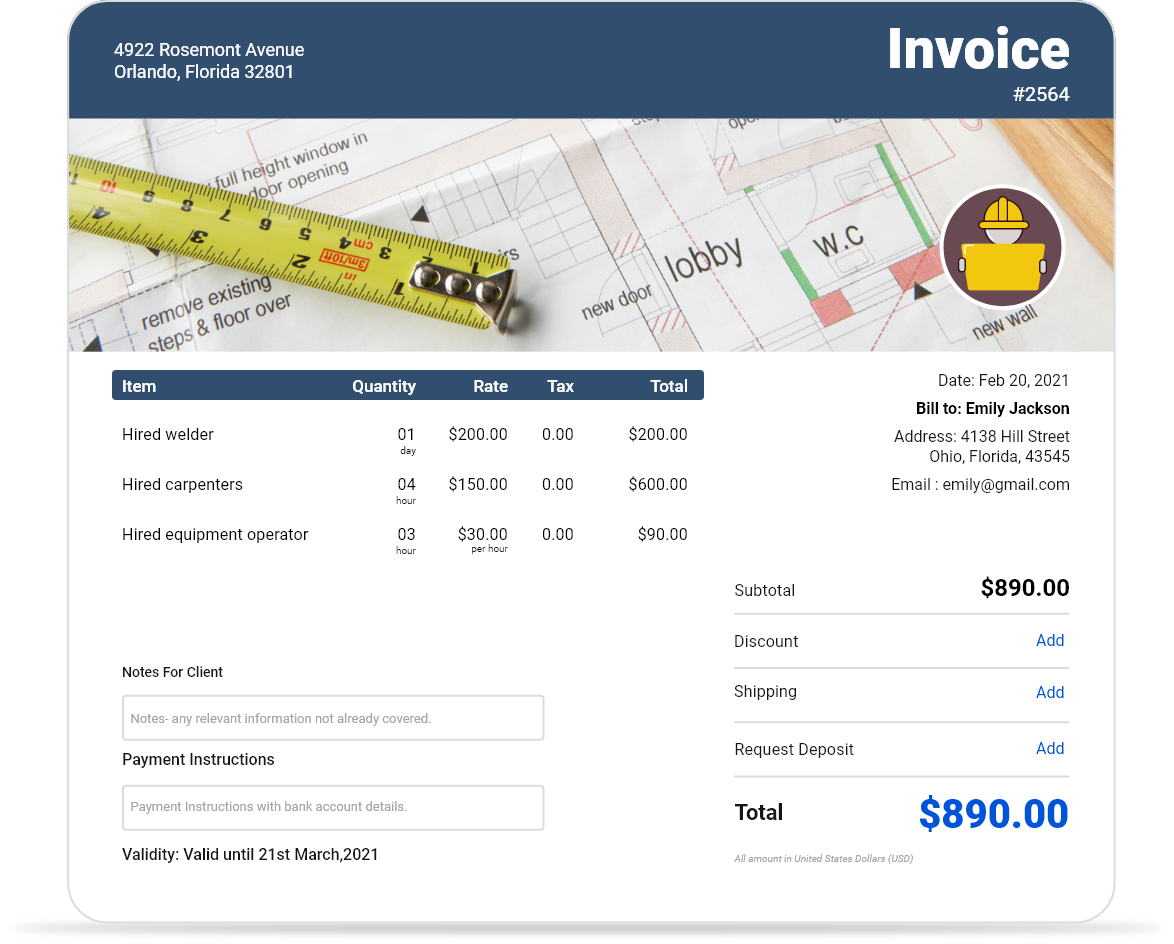

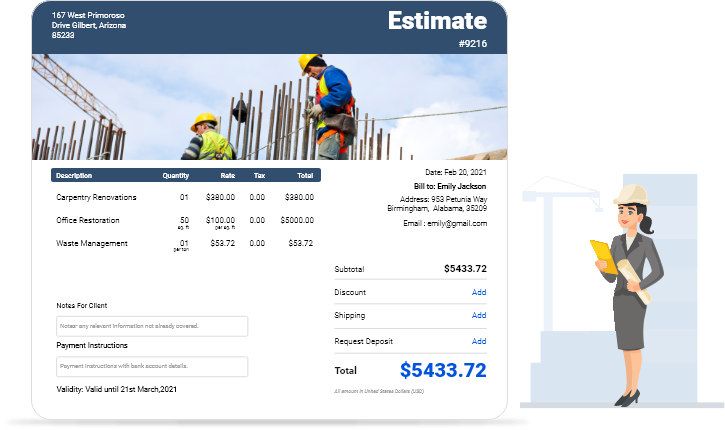

Save Hours of Time on Estimating and Invoicing

InvoiceOwl helps contractors and freelancers create professional estimates and invoices in minutes. Stop wasting time on manual paperwork and focus on growing your business.

Start Your FREE TrialFrequently Asked Questions

If you don't report payments to an independent contractor, the IRS may reclassify the worker as an employee. This could result in penalties and back taxes owed. The best way to avoid this issue is to make sure you correctly classify your workers and report all payments made to them.

You will need to file a 1099 form for every contractor to pay $600 or more during the year. This includes payments for services, rent, prizes and awards, other income payments, and medical and health care payments.

Employee Independent Contractor Forms must be updated annually by the IRS. However, we suggest updating forms more often, especially if staff interact with several clients. This keeps you informed about their work and tax situation.

Form 1099-NEC is specifically used for nonemployee compensation paid to independent contractors. Form 1099-MISC is used for other types of income such as prizes, state tax refunds, and interest payments. The 1099-NEC was reintroduced in 2020 to separate contractor payments from miscellaneous income.

Yes, you can file 1099 forms electronically through the IRS FIRE (Filing Information Returns Electronically) system. Electronic filing is required if you're filing 250 or more forms. For fewer forms, you can choose to file either electronically or by mail.

Conclusion

This information should have helped you gain a better grasp of the 1099 form and how it applies to independent contractors. Having an accurate 1099 can save you money in the long run and help ensure compliance with IRS regulations, so make sure that yours is up-to-date.

All independent contractors must be aware of their tax requirements; therefore, if you have any questions or concerns regarding your taxes, you should consult a knowledgeable accountant or tax expert.

If you're a contractor, you've likely dealt with the hassle of billing clients and keeping track of payments. This is where the software InvoiceOwl may help. With our user-friendly platform, you can generate professional estimates and invoices and have more financial control in one place.

Plus, InvoiceOwl offers competitive pricing plans to suit different budgets, so no matter what your needs are, InvoiceOwl has got you covered! This signifies the end of missing payments and late fines.