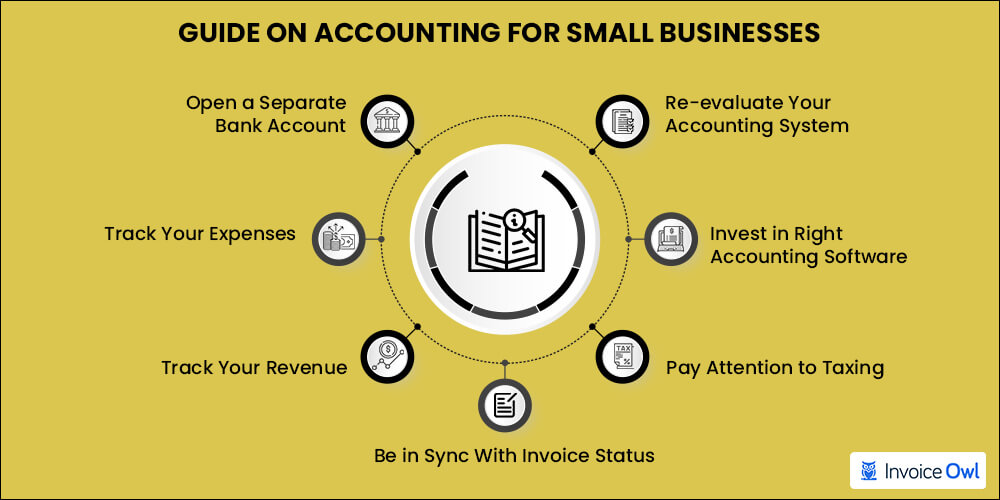

Key Takeaways

- 01Open a separate business bank account to keep personal and business finances distinct

- 02Track all expenses and revenue to maintain accurate financial records and avoid bankruptcy

- 03Stay synchronized with invoice status using automated invoicing software

- 04Pay attention to tax obligations and use accounting software to avoid penalties

- 05Re-evaluate your accounting system regularly to adapt to changing business needs

Accounting for a small business may sound simple but it's really not, right? Knowing your business expenses, revenues, profits, or losses accurately at your fingertips takes a lot of time, effort, and resources. Moreover, according to the "Small Business Report—Accounting," 60% of small business owners feel ill-educated about accounting.

Therefore, we have shared a complete guide on how to do accounting for a small business efficiently without hiring an accountant.

How to do Accounting for Small Businesses

Accounting for small businesses is complex work to do as most of the business owners have to do it themselves while managing all the other business tasks, such as marketing, sales, customer relation, and other essential business work.

So, let's start with the guide on accounting for small businesses that helps you save time and money.

Open a Separate Bank Account

The first thing after registering your business should be opening a separate account for the business revenues and expenses. A separate business bank account is necessary if you want to keep track of business financial transactions. However, keeping your personal and business bank accounts is one of the best practices because it helps you in multiple ways.

Track Your Expenses

The key to efficient accounting is tracking your expenses. Tracking your expenses has multiple advantages that help you make the right business decisions. First, keeping a watch on expenses in the financial statements lets you maintain good financial health and never let you go bankrupt. A business has many types of expenses to keep track of.

Track Your Revenue

As a small business owner, you have to track the expenses, but that is just one-half of business financial statements. Small business owners always have to keep an eye on the business income. After all, the budget for all the expenses depends on the revenue your business is making. Without tracking the revenue, it is easy to spend more than what you earned.

Be in Sync With Invoice Status

No matter whether you sell services or products, you need to issue invoices regularly. And just issuing is not all done. So stay updated with the status of all the invoices for an entire accounting process. But, managing multiple invoices manually would take much more than what you should spend.

Pay Attention to Taxing

Taxing is one of the most important accounting tasks. Failing to pay the sales tax can penalize business owners and, even worse, get businesses shut down. Thus, small-scale businesses should not forget to pay their sales tax at any cost.

Invest in Right Accounting Software

Managing all the accounting systems manually would take too much of your time. In addition, manual accounting leaves a door open for mistakes. Moreover, it would be too hectic and stressful. And you don't want to jeopardize your mental health over it. Right? So, invest in the best accounting software for your accounting method, and don't let your accounting system slow you down.

Re-evaluate Your Accounting System

A small business faces different challenges every day. And to conquer different challenges you need to adapt your methods and approaches. Thus, you need to re-evaluate your accounting system regularly. Small business owners appoint a certified public accountant to check and evaluate the entire accounting system and manage business finances.

Benefits of a Separate Business Bank Account

Having kept personal and business accounts distinct provides multiple advantages:

Types of Business Expenses to Track

A business has many types of expenses to keep track of. Understanding these categories helps you maintain accurate financial records:

Business operating expense

Businesses have to make many expenses just to run the office. Common expenses are electricity bills, water bills, property rent, and office supplies. Tracking these expenses lets you know the business's minimum monthly requirement of funds.

Taxes

Keeping a record of taxes paid previously allows your business to plan for the taxes next time. Moreover, it helps claim tax returns. And whenever you apply for any sort of loan, the bank needs your tax filing records, without which the loan would not be sectioned.

Without proper tax filing records, your business loan applications will be rejected. Keep meticulous records of all tax payments to ensure you can access financing when you need it.

Recreations

Who does not like to enjoy the day? And you should, but don't forget to record the expense. Tracking the expenses for recreations lets you hold your horses. It is easy to get carried away with a celebration every day if you don't keep track. And recreational accounting expenses help you manage the funds wisely.

Out of town travel

As a small business owner, you might need to travel out of town for business purposes. So, should you account for the travel expenses in your ledger or business ledger? Yes! You are right. Business travel expenses should be accounted for in business expenses.

Travel expenses include:

- Flight tickets

- Cabs

- Accommodation

- Meals

Gifts and vouchers

Gifting your clients is a gesture that helps build business-customer relations. Thus, these gifts should be recorded so that you don't go over the budget. Similarly, you need to keep track of the vouchers you give your employees as well. Moreover, knowing how to check and approve an invoice helps your business limit unnecessary expenses.

Tracking income and expenses helps you with creating a balance sheet as well. This gives you a comprehensive view of your business's financial health at any given time.

Stay Synchronized with Invoice Status

Thus, you can use the InvoiceOwl app. This invoicing app not just lets you create and send invoices and collect the accounts receivable but provides you with real-time notifications for the invoice status. With the InvoiceOwl app, you get notifications when a customer receives, opens, and pays the invoice. Tracking invoices never lets you misplace an invoice or forget to follow up on an unpaid invoice.

Why Choose the Right Accounting Software

Pick the accounting tool according to your cash flow, accounting cycle, and scale. We would suggest you choose an accounting tool that offers a double-entry accounting system.

Manual accounting leaves a door open for mistakes and would be too hectic and stressful. Investing in the best accounting software saves time, reduces errors, and protects your mental health while maintaining accurate financial records.

A small business faces different challenges every day. And to conquer different challenges you need to adapt your methods and approaches. This keeps your accounting efficient and protects you from any accounting failure. Okay! So, now you know it's not rocket science. Any accountant can easily do it with the right accounting software.

We hope you are ready to do the accounting yourself. Moreover, we have answered some of the most common questions of readers.

Create Professional Invoices Online Easily

InvoiceOwl is a feature-rich invoicing app that helps small businesses, freelancers and contractors to create invoices on-the-go and get paid quicker!

Start Your FREE TrialFrequently Asked Questions

Here are the steps to do bookkeeping for a small business efficiently:

- Open a business bank account

- Register every expense

- Record every income

- Save tax receipts

- Make employee pay-roll system

To do all these steps, you can use an Excel sheet or Google sheet. However, managing all the data on a sheet is quite complex and can lead to confusion. Thus, the best business accounting method is to use accounting software. It helps the business by saving your time and efforts to do bookkeeping accurately.

Yes, you can! Small business accounting is made quite easy with accounting software. If you pick the right accounting software for small businesses, you can do all the accounting by yourself without wasting much time. However, if you choose to do accounting manually, you might find it mundane and repetitive. Moreover, the chances of mistakes increase when accounting is done manually. Thus, the best option is to use accounting software.

Small-scale businesses keep track of finances by tracking every expense. And the most efficient way to do so is by creating an exclusive account for business transactions. If you want to automate the accounting for your business, use accounting software that helps you automate iterative accounting tasks.

The cost of hiring an accountant has a wide range. It depends on several different factors, such as business structure, scale, the scope of service, and the accountant's experience. However, according to an estimate made by the US Bureau of Labor Statistics, accountants make an average salary of $70,000 annually.

Be Accountable with your Small Business Accounting

Accounting for small businesses is necessary as most small-scale businesses are running on a tight budget. Therefore, picking the right bookkeeping system is the key to success. Without knowing your numbers, you can not expect your business to grow. Thus, we provided the steps to do accounting for a small business. If you want a smooth accounting process for your business, do not skip any of the following steps.

- Open a Separate Business Bank Account

- Track your Expenses

- Be in Sync With Invoice Status

- Pay Attention to Taxing

- Invest in Right Accounting Software

- Re-evaluate your Accounting System

Another accounting essential for any business is invoicing. If the invoices are what is stopping you from creating the best accounting system, download the InvoiceOwl app. It helps you with invoices and creates annual sales reports by clients, dates, and items. If you found this blog interesting, visit the InvoiceOwl blog section regularly for similar interesting discussions about accounting and invoicing.