Key Takeaways

- 01Research the current market rate and use it as a benchmark while factoring in your experience and expertise

- 02Choose the right pricing model: hourly, fixed-project, performance-based, combined, or monthly retainer

- 03Calculate your hourly rate by doubling the median of your current earnings and market rate

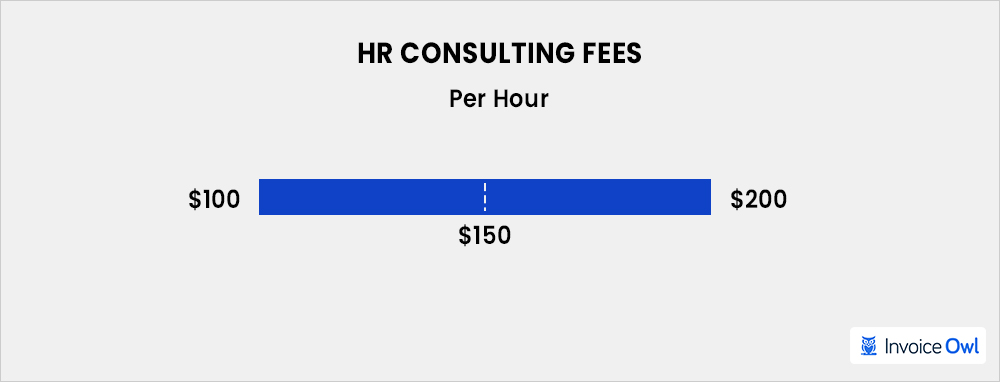

- 04Industry rates vary widely: marketing consultants charge $100-$375/hour while HR consultants charge $34-$42/hour

- 05Your pricing should balance the value you provide with what clients can reasonably afford to pay

One of the earliest challenges many consultants face is how to price their consulting services. And before you launch your business, it's a good idea to learn how to estimate consulting fees. One way to play safe when estimating your consulting fees is by researching the current average consulting rate. It's also important to note that your experience and track record would also determine the figure you settle for, even if you might be new in the consulting business. There is a lot to consider in terms of pricing when setting up consulting firms, and when done right, it'll undoubtedly be a rewarding experience for you and your clients.

Table of Content

- Factors to Consider When Determining Consulting Fees

- Common Consulting Fee Models

- How to Calculate Your Consulting Fees

- Average Consulting Rate for Various Industries

- FAQs

- Conclusion

Factors to Consider When Determining Consulting Fees

Let's consider some of the essential factors when setting up consulting fees and rates. Next, we'll strike a balance between what you believe your services are worth and what you think your clients can afford. Understanding what your clients can afford is crucial as a consultant as a comparatively lower rate may downplay your expertise. On the other hand, overpriced rates may deter potential clients. Here are some of the main factors to consider while determining your consultation fee:

How much is your time worth?

Time is money in any consulting business and there are two ways you can determine what your time is worth. The first is to divide your weekly pay by the total hours you work per week. The other way is to determine the value you place on your time and the minimum hourly payment you'd accept for a job similar to your current or previous job.

How many people are willing to pay for your time?

"The market rate" is an estimated wage range clients would be willing to pay for your services based on your skills and expertise. It is simply the average of what clients in certain industries currently pay for similar positions. For example, if HR consultants earn between $34 to $42 per hour, it's safe to say the standard market rate for this industry is $35, which is the median rate. This figure varies based on the client, expertise, and experience but can be a good benchmark when deciding how much to charge for consultations. You could double or triple your rate if you have appreciably more experience and expertise that can justify your rate in any niche. But if you're trying to win your first client, you may need to consider what's affordable for your prospects. Now that you've understood how market rates affect your consultancy fees let's look at some structures for consultant fees in any consulting business.

If you have significant experience and expertise that can justify your rate in any niche, you could double or triple the standard market rate. However, if you're trying to win your first client, you may need to consider what's affordable for your prospects to build your portfolio.

Common Consulting Fee Models

An hourly rate might not work for certain prospects, and a fixed rate might not be practicable in every situation. Here are a few other pricing methods that could apply to your consulting business:

An Hourly Rate

The hourly rate pricing model is a time-based arrangement where a consultant invoices clients by the number of billable hours they've worked. This is ideal for projects with unclear scope or when you're starting out.

A Fixed-Project Rate

A project-based pricing model is basically a flat rate you bill the client for the project described. This will be a better option if you do a lot of similar or repetitive work like logo designing or website designing. If you have become faster at what you do, you'll be losing a lot of revenue by charging hourly. Find the difference between flat rate vs hourly rate pricing model.

A Performance-Based Rate

This is also referred to as value-based pricing and is when your price is based on the promised outcome. Before you take this route, ensure you understand the client's goals and expectations and be comfortable meeting them in their expected timeframe. Also, consider how much the value you're adding is worth to your clients (in terms of an increase in revenue or a decrease in workload) in the long run to determine what they'll be willing to pay for your services.

A Combined Rate

There are instances where a client is willing to pay a fixed rate for certain, usually repetitive tasks and an hourly rate for other tasks. In these instances, ensure you are not earning less than your hourly rate by noting how long it takes to complete fixed rate tasks.

A Monthly Retainer Rate

A monthly retainer rate is one of the most successful for consultants at every level. You can charge an initial fee at the beginning of your relationship and a monthly retainer fee to cover ongoing work. This can be really cost-effective for your clients who may not be able to afford you full-time, and you can be assured of consistent income and wouldn't need to worry about how to pay your bills if you don't pull in the work to cover your bills.

The purpose of various consulting fee structures is to ensure you are rewarded fairly for the services you offer and that your clients feel comfortable paying for the value you'll be delivering. So, adjusting your pricing models accordingly and determining what pricing model works for each client is okay. Just make sure your clients are clear about the consulting fee before beginning any kind of work.

How to Calculate Your Consulting Fees

Depending on your consulting fee structure, here is how to charge your prospects.

How to estimate your hourly fee

The first step to calculating your hourly consulting rate is to find the median of what you currently earn compared to the current market rate. This means if you currently earn $65 per hour and the current market rate is $45 per hour, the median rate would be $55. Most consultants charge prospects at least twice the median hourly rate as a consultant but this may vary widely depending on the industry. So with the example above, your hourly wage should not be less than $110 since you obviously didn't take the risk of becoming a consultant just to earn the same wages. Besides, you're responsible for your health care and work tools. No doubt there may be others in the consulting business willing to accept a much lower hourly rate, but as long as you can deliver the experience and results clients want, you'll certainly justify your wages.

If you currently earn $65 per hour and the current market rate is $45 per hour:

- Median rate = $55

- Consultant rate = $55 × 2 = $110 per hour minimum

This accounts for the fact that as a consultant, you're responsible for your own healthcare, work tools, and other business expenses.

How to estimate your fixed-rate consulting fee

As we've seen, a fixed rate or project-based rate is more applicable when you've gained expertise in what you do, which means you spend less time completing projects. Since most clients have a budget for projects, it's a good idea to start by asking them their budget for the task in question. If you would normally charge $4,500 to build a custom website in three weeks, you should charge higher if a client wants it ready in one week. Also, your prices should be much higher if you're doing some HR Consulting for Walmart compared to offering the same services for a local supermarket. Also, realize that clients are flexible on their budget in most cases, so don't be afraid to negotiate when it falls below your expectations. The most important factors to consider when deciding how much to charge on a fixed project are:

- The project complexity, resources required, and duration of the project

- The conditions for project delivery

- The likelihood of a long-term relationship with the client

- The brand's influence on your portfolio

- The possibility of a retainership

How to estimate your performance-based project rates

Ideally, your project rate should be based on the Return on Investment (ROI) their work generates. Let's say you get hired to acquire five more clients each month worth $1,000 to your client, you'll be helping generate $5,000 in recurring monthly revenue, and you should get a percentage of the new revenue. And while the idea of getting paid a percentage of new business sounds wonderful, clients who go this route either don't have the money to pay you upfront or don't trust your ability to deliver on your promises. Either way, every business owner will opt for the best value for them, so ensure you can deliver as expected and track the ROI, and this route might just pay off. You may also want to include a quarterly review of your pricing structure and adjust it upwards if you win clients.

Clients who opt for performance-based pricing either don't have the money to pay upfront or don't fully trust your ability to deliver. Make sure you can deliver as expected and track the ROI properly. Include a quarterly review of your pricing structure to adjust it upwards as you prove your value.

How to estimate your monthly retainer for consulting services

First, determine what you want to earn yearly based on a figure you've previously made as an employee. So let's say you want to make $100,000 per year, calculate your running costs and add it to your salary expectations. If it costs you $30,000 on internet, electricity, telephone bill, transportation, and other expenses, you now have a total of $130,000. Next, estimate your profit margin as a percentage of your labor and running costs. For consulting businesses, the average profit margin ranges from 15-30 percent. So if your expected profit margin is 25 percent, multiply 25 percent (0.25) by $130,000, which should give you $32,500. This brings you to an annual salary of $162,500. If you work 7 hours a day, in 240 of the 260 working days in a year (taking emergencies and vacations into consideration), your billable hours would be 7 x 240 = 1,680 hours worked. This means you must charge your clients an hourly rate of $96 ($162,500/1,680) as your retainer fee and earn a monthly fee of $13,440.

Goal: Earn $100,000 per year

- Add running costs: $100,000 + $30,000 = $130,000

- Add profit margin (25%): $130,000 × 0.25 = $32,500

- Total annual target: $130,000 + $32,500 = $162,500

- Billable hours per year: 7 hours/day × 240 days = 1,680 hours

- Hourly rate needed: $162,500 ÷ 1,680 = $96/hour

- Monthly retainer: $13,440

Average Consulting Rate for Various Industries

Now that we have covered the most effective methods for estimating your rates for consulting projects, let's look at the average fees across industries.

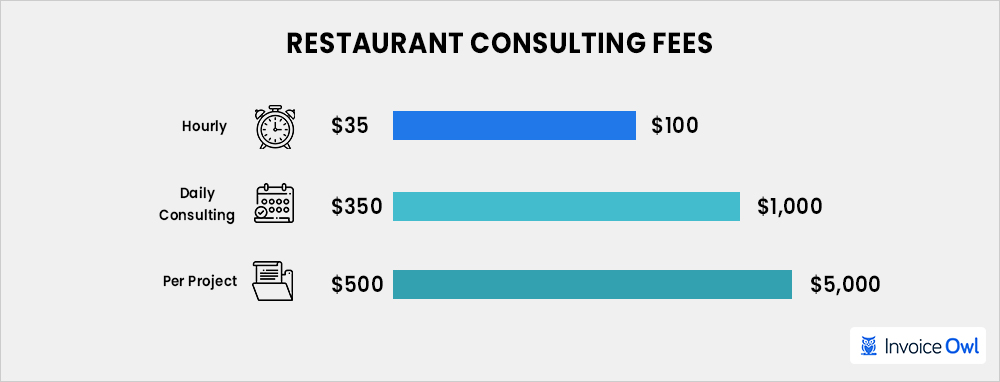

Restaurant Consulting Fees

According to FinanceOnline, "approximately 14 million people were working within the restaurant industry in 2015, and this number is expected to reach over 16 million by 2026." Since the demand for restaurant consulting is relatively high, the average rates would also be high.

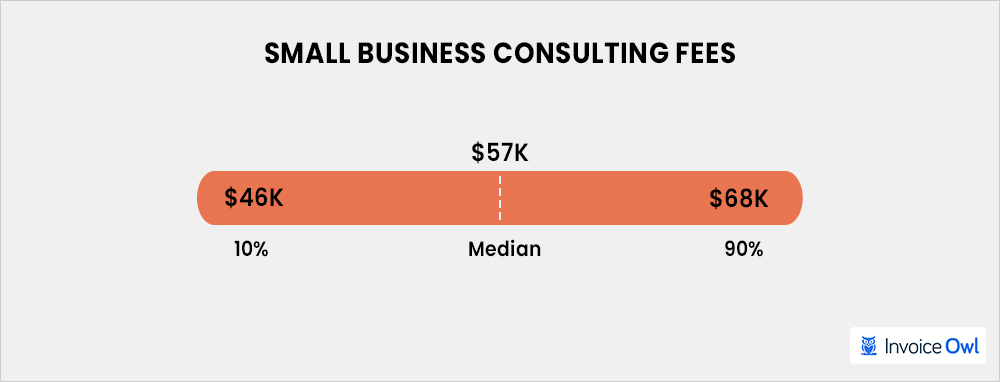

Small Business Consulting Fees

Most small business owners would love to grow their business. As a result, they eagerly work with a business consultant who specializes in growing start-up businesses and identifying market opportunities. As small business consulting is also in demand, the pricing range will also be higher. Here's an estimate for small business consulting rates as per PayScale.

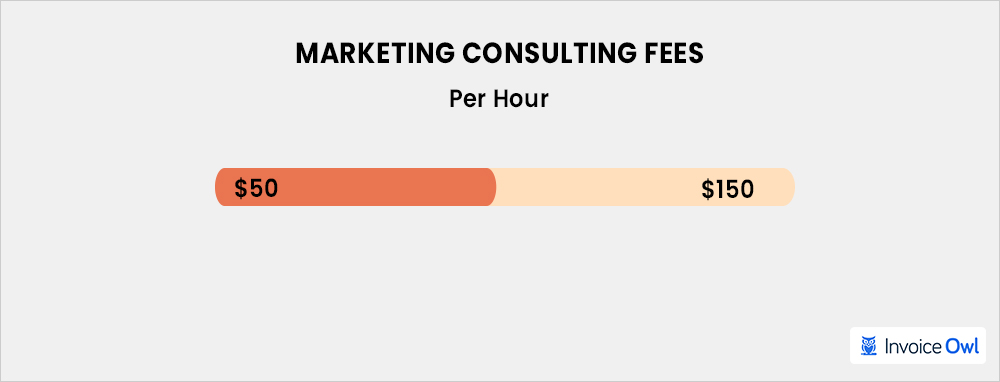

Marketing Consulting Fees

As a marketing consultant, your rate is primarily determined by your experience and measurable past success. Here's a marketing consulting fee estimate by Jason Falls.

HR Consulting Fees

HR consultancy is considered a highly specialized field, and it pays much higher as an independent consultant. As per a ProMatcher cost report, here's the cost to hire human resource consultants and advisors.

Conclusion

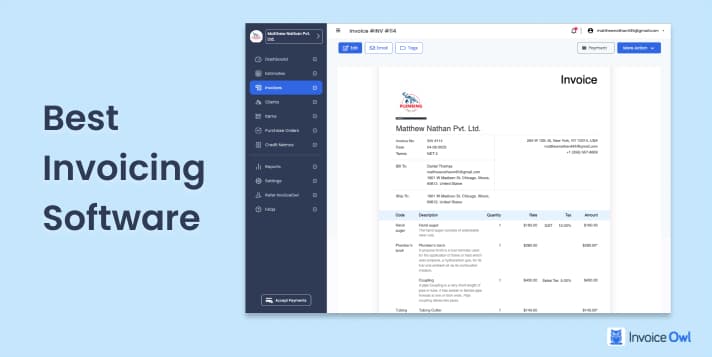

Just like everything else in business, setting your rates should be flexible. You are free to increase your rate if you are gaining new clients than you can handle or lower your rates if you're not getting any interest or prospects feel it's way above their budget. Once you've bagged a client, you need to ensure that you are paid promptly, which is why it's always a good idea to use a reliable invoicing solution to automate your invoices and payment reminders. This way, you can focus on the value you're offering and ensure you get paid promptly.

Create Invoices for Your Consulting Business Today

Trusted by over 145,000 businesses, InvoiceOwl is the best small business invoicing app on the market with easily customizable templates and simple workflows.

Start Your FREE TrialFrequently Asked Questions

To calculate consulting fees, you need to do some research to find out the current industry rate. Use the current market rate as a benchmark to calculate your rates while considering your experience and expertise. Ultimately, your rate depends on the mutual understanding between you and your client.

A consulting fee is what a consultant charges for their services either as a freelance or a full-time consultant. Basically, it is what consultants are willing to accept in payment for the advice or services they render.

As a consultant, it is completely up to you to decide how much you'd be willing to accept for your services. As long as you're offering value, clients would be willing to consider your offer, especially if you have a glistering portfolio.

Hourly rates charge clients based on time worked, ideal for undefined scope projects. Project-based rates are flat fees for specific deliverables, better for repetitive work where you've become more efficient.

Monthly retainers work best when you have ongoing work with a client. You charge an initial fee plus a monthly retainer, providing consistent income for you and cost-effective services for clients who can't afford full-time help.

![Construction Invoice Factoring [All-in-One Guide]](/images/2022/06/construction-invoice-factoring.jpg)